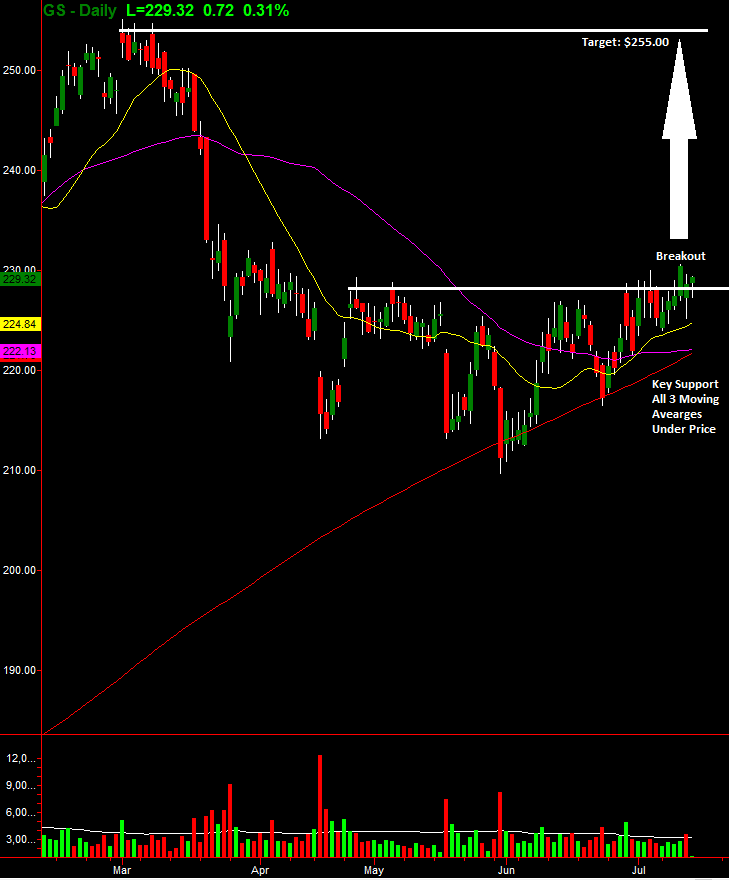

Shares of Goldman Sachs Group Inc (NYSE:GS) broke above key resistance and are likely headed to a double top high of $255.00. That would be a 10% upside move, expected in the coming weeks. The reasoning is simple. Interest rates have started to spike higher, good for any bank. In addition, volatility in the stock market is starting to inch back up, another key way Goldman Sachs makes money.

Lastly, the chart technical setup is beautifully bullish. Goldman Sachs has broken out above key resistance and is above all three major moving averages on the daily chart (20, 50, 200). This puts it in an exceptionally strong position to roar higher. I am bullish on Goldman Sachs Group.