Goldman Sachs (NYSE:GS) might achieve its $5 billion additional annual revenue target well before 2020, per its new Chief Financial Officer Stephen Scherr.

At a conference held by the Bank of America (NYSE:BAC), Scherr told that the company has generated $2.5 billion in revenues so far this year. A strategic update is likely to be provided in Spring 2019.

The company is conducting a “front to back” review of its operations in order to improve transparency. Also, it evaluates business adjacencies along with focus on growth.

Moreover, the company remains on track to drive performance of its segments in order to increase overall revenues. At its Investment Banking segment, the company plans to expand its product offering, grow client footprint and deepen relation with existing customers.

Further, in the Investment Management unit, performance growth is expected to be achieved by increasing coverage of ultra-high net worth clients and expansion across region. Also, at Investing & Lending, Goldman plans to build a consumer business over time by solving customer “pain points” and utilizing technology to deliver at scale.

Notably, technology remains a key point in Goldman’s strategic plan. It seeks to keep innovating products in line with client needs. Also, it aims to build scalable platforms to deliver operating leverage.

Over the past few years, Goldman has been undertaking several initiatives to become technically advanced. These include its online personal loan providing platform, Marcus, secure messaging service across the Wall Street through Symphony and the upcoming robo-advising service. These strategic moves are likely to bolster Goldman’s performance, over the long run.

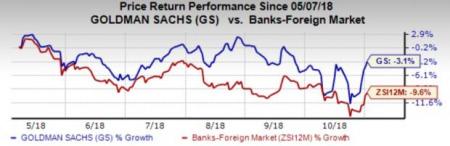

Shares of Goldman have lost 3.1% over the past six months compared with 9.6% decline witnessed by the industry it belongs to.

The stock currently carries a Zacks Rank #3 (Hold). You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked stocks from the same space are The Charles Schwab Corporation (NYSE:SCHW) , E*TRADE Financial Corporation (NASDAQ:ETFC) and TD Ameritrade Holding Corporation (NASDAQ:AMTD) , each carrying a Zacks Rank #2 (Buy).

Over the past 60 days, Charles Schwab has witnessed upward earnings estimate revision of nearly 1% for the current year. Its share price has increased 6.8% in the past year.

E*TRADE Financial’s Zacks Consensus Estimate for the current year has been revised 4% upward in the past 30 days. Its shares have gained 16.6% in the past 12 months.

Over the past 30 days, TD Ameritrade has witnessed upward earnings estimate revision of 1% for the current year. Its shares have gained 5.1% in the past year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

The Charles Schwab Corporation (SCHW): Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC): Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD): Free Stock Analysis Report

Original post

Zacks Investment Research