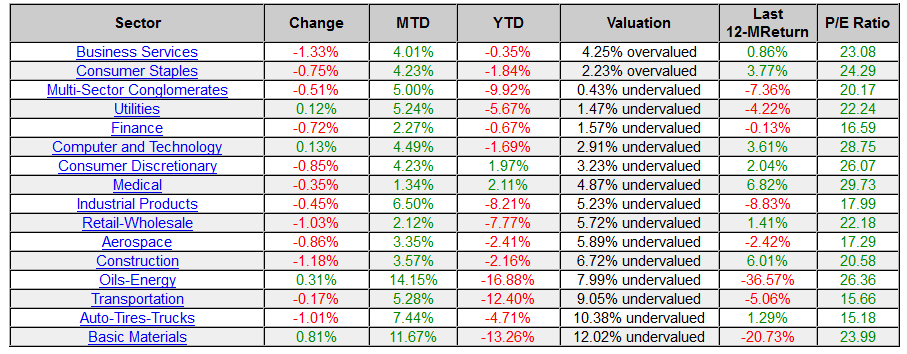

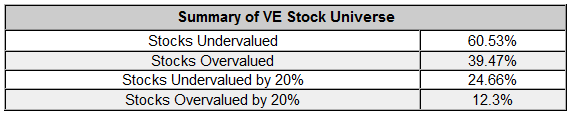

VALUATION WATCH: Overvalued stocks now make up 39.47% of our stocks assigned a valuation and 12.3% of those equities are calculated to be overvalued by 20% or more. Two sectors are calculated to be overvalued.

Big Boys

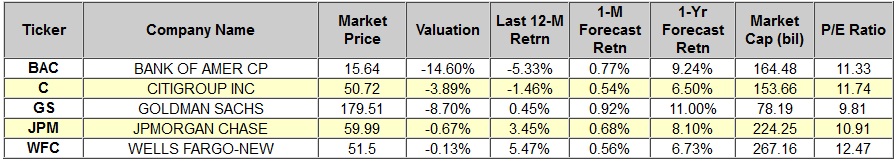

--Major Banks Reporting Earnings Compared

Earnings season is in full swing this week and we now have data from several of the big players on Wall St.

Today, Goldman Sachs (N:GS) reported disappointing results and a miss thanks to losses from their bond-trading unit. Volatility over the past months really hit their bottom line and their quarterly profits declined by 36%. The miss was only $0.01/share, but it was still a miss.

Goldman was stymied by issues related to the global economy such as declining commodities prices. As today's Wall Street Journal notes, Goldman is more dependent on trading income than other competitors, and thus difficulty there tends to hit their bottom line harder. Clearly, the days of complete quarters with "undefeated" trading days we used to see in the aftermath of the financial crisis are long gone.

The firm's rivals have done much better this week, with Wells Fargo (N:WFC), Bank of America (N:BAC), Citigroup (N:C), Morgan Stanley (N:MS) and JP Morgan Chase (N:JPM) all beating analysts estimates for Q3 2015. So, in the financial sector -- at least--we see some succor for the bulls.

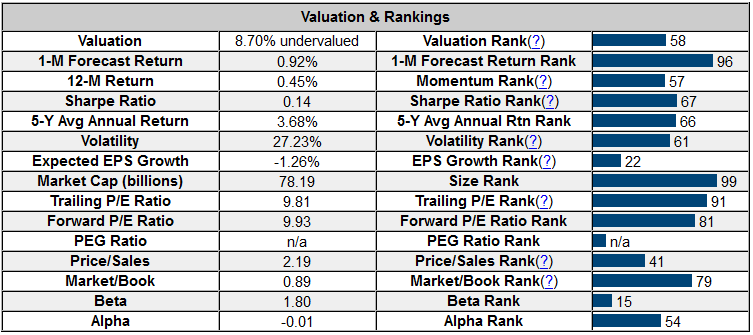

Below, we present the latest data on the major big banks that have reported earnings so far. First some key metrics compared, then the more extensive data from our systems on the leading institution -- Goldman Sachs.

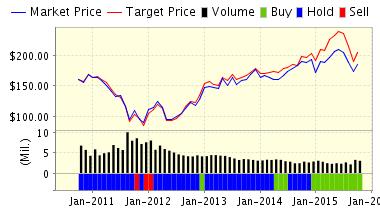

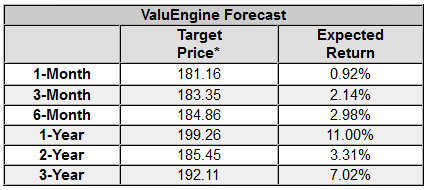

Below is today's data on Goldman Sachs:

Goldman Sachs is a global investment banking and securities firm, providing a full range of investing, advisory and financing services worldwide to a substantial and diversified client base, which includes corporations, financial institutions, governments, and high net worth individuals.

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on GOLDMAN SACHS for 2015-10-14. Based on the information we have gathered and our resulting research, we feel that GOLDMAN SACHS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

ValuEngine Market Overview

ValuEngine Sector Overview