Goldcorp Inc. (NYSE:GG) has entered into a $12.5 million cash deal with Tahoe Resources Inc. (NYSE:TAHO) to divest its 2% net smelter return (“NSR”) royalty related to production at the latter’s wholly-owned Bell Creek Mine. In addition, Goldcorp will relinquish its 30% interest in Whitney Joint Venture and will instead be entitled to 2% NSR royalty from the project.

Close to Goldcorp’s Hoyle Pond Mine, the Bell Creek mine is an underground mine and is fully owned by Tahoe and located about 20 km northeast of Timmins, Ontario. The Whitney JV encompasses approximately 8.9 square kilometre of highly prospective exploration property. The Hallnor, Broulan Reef, Bonwhit and Hugh Pam mines are located on this property.

The Whitney Project is located adjacent to the Bell Creek Mine. It is a joint venture between Goldcorp (30%) and Tahoe Resources (100%) with Tahoe as the operator. The Whitney JV transaction, wherein Goldcorp will sell its 30% holding and entitle 2% NSR royalty, is subject to execution of a definitive agreement and to the approval of Tahoe's Board of Directors.

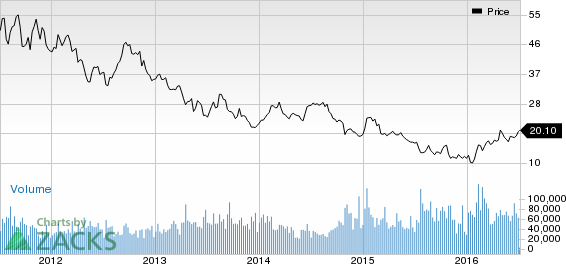

Goldcorp’s share price gained 0.6% on the news. In fact, the company touched a 52-week high of $20.38 yesterday. Goldcorp, along with other gold miners, Barrick Gold Corp. (NYSE:ABX) , Newmont Mining Corp. (NYSE:NEM) and Kinross Gold Corporation are currently trading at their 52-week highs, riding high on surging gold prices, which is reigning at 2-year highs.

Goldcorp reported a profit of $80 million or 10 cents per share for first-quarter 2016 versus a net loss of $87 million or 11 cents per share logged a year ago, aided by reduced costs. Adjusted earnings (excluding one-time items) for the quarter came in at 9 cents per share, beating the Zacks Consensus Estimate of 4 cents.

For 2016, Goldcorp reiterated its gold production guidance range of between 2.8 and 3.1 million ounces. However, the company anticipates that gold production during the second quarter will be hurt by planned lower-grade mining sequences in most mines and a 10-day mill shutdown for preventative maintenance at Penasquito.

The company expects AISC to be between $850 and $925 per ounce. Higher costs are expected in the second quarter compared to the first, mainly due to higher sustaining capital and lower gold production. The third and fourth quarters are expected to see AISC normalize vis-à-vis the second quarter as a result of higher gold production.

Growth capital for 2016 is expected to be roughly $100 million to advance the organic growth projects through their respective study phases.

NEWMONT MINING (NEM): Free Stock Analysis Report

BARRICK GOLD CP (ABX): Free Stock Analysis Report

GOLDCORP INC (GG): Free Stock Analysis Report

TAHOE RESOURCES (TAHO): Free Stock Analysis Report

Original post

Zacks Investment Research