Goldcorp Inc. (NYSE:GG) has closed the earlier announced acquisition of all issued and outstanding shares of Exeter Resource Corporation, not already owned by the company, through a planned arrangement approved by the court.

Pursuant to this arrangement, Goldcorp acquired all issued and outstanding Exeter shares in exchange of 0.12 of a common share of Goldcorp for each Exeter common share, resulting in 100% ownership.

In regards to this arrangement, Goldcorp will issue a total of up to 1,896,145 Goldcorp shares to the former Exeter shareholders, who now own roughly 0.22% of the 865,034,962 Goldcorp shares issued and outstanding, on a non-diluted basis.

The Exeter Shares are now expected to be delisted from the Toronto Stock Exchange by Aug 8 and also from the Frankfurt Stock Exchange (Borse Frankfurt) and the NYSE-MKT.

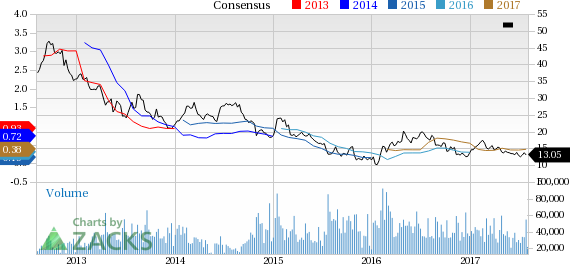

Goldcorp’s shares have lost 5.9% in last three months versus the 4.6% gain of its industry.

Goldcorp reported net earnings of $135 million or 16 cents per share for second-quarter 2017, against a net loss of $78 million or 9 cents per share a year ago. Barring one-time items, adjusted earnings for the quarter was 12 cents per share. The figure beat the Zacks Consensus Estimate of 10 cents.

Goldcorp generated revenues of $822 million in the quarter, missing the Zacks Consensus Estimate of $863 million.

Gold sales went up around 5.3% year over year to 649,000 ounces in the quarter and production rose 3.6% to 635,000 ounces.

Goldcorp expects gold production of 2.5 million ounces (+/- 5%) for 2017. The company has revised its outlook for AISC in 2017 to reflect the progress it has made on initiative to realize sustainable annual efficiencies of $250 million by mid-2018. AISC for 2017 has been projected at $825 per ounce (+/- 5%), down from $850 per ounce expected earlier.

Goldcorp currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the basic materials space are Akzo Nobel N.V. (OTC:AKZOY) , Versum Materials Inc. (NYSE:VSM) and Kronos Worldwide Inc (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Akzo Nobel has expected long-term earnings growth rate of 11.1%.

Versum Materials has expected long-term earnings growth rate of 11%.

Kronos has expected long-term earnings growth rate of 5%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Versum Materials Inc. (VSM): Free Stock Analysis Report

Goldcorp Inc. (GG): Free Stock Analysis Report

Original post

Zacks Investment Research