Goldbugs are a serious crowd and rowdy at times. In fact I probably upset at least a dozen of them from the title alone. Let me dare to go further though. Gold has done nothing but move in a broad range for over 2 years. Teasing at the top and nail biting at the bottom, but a range. My charts suggest more downside which could actually break that range, and could even go lower.

Now that all the goldbugs are good and riled up let me shift focus just a little. In the short term the ratio of corn to gold is breaking out to the upside. All goldbugs should be selling there gold to buy the gold from the cornstalk.

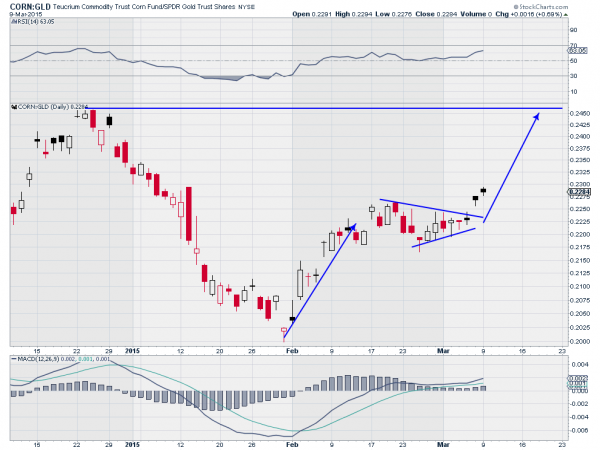

The chart above shows the technical reasons why. The ratio moved off of a low at 0.20 and continued to a consolidation around 0.225. This consolidation tightened into a symmetrical triangle and broke above that to the upside last week. Monday confirmed the breakout with a follow through candle higher. And the momentum indicators also support a continuation with the RSI bullish and rising and the MACD moving higher. This gives a target of a ratio of 0.245. Right where it was at the end of the year.

There are many ways to trade off of this information but the most straight forward would be to buy corn (NYSE:CORN) and sell gold (ARCA:GLD) roughly ion the ratio of 400 shares of Corn per 100 shares of gold.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.