Our monthly analysis of gold-backed ETFs and similar products provides detailed information and insight on global trends of gold investment demand through ETFs.

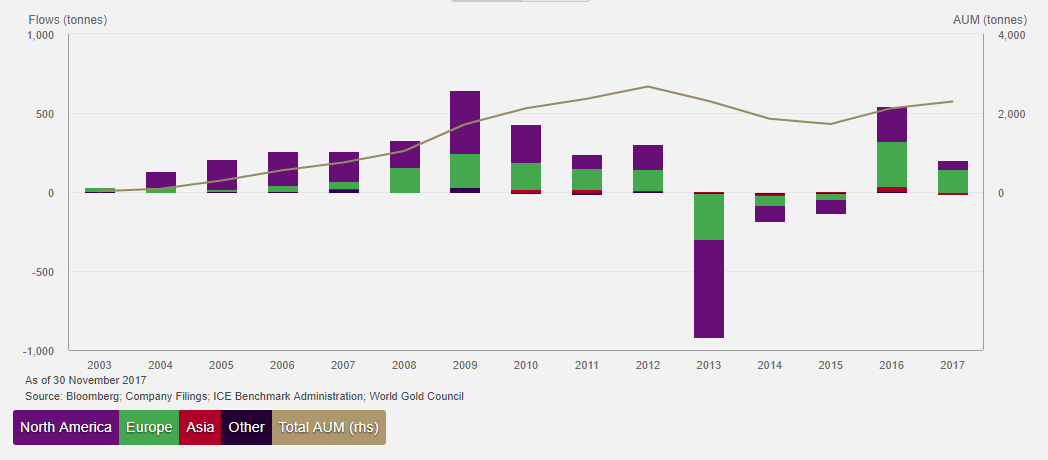

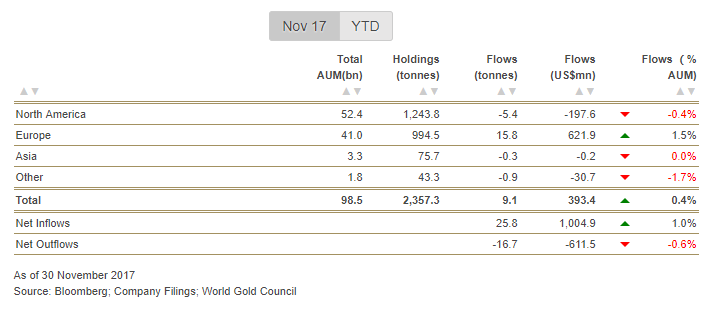

Regional fund flows

- Europe led inflows in November*, as investors added 15.8t (US$622mn, 1.5% AUM) of gold through funds listed in the region

- There were outflows for a second month in a row in North America of 5.4t (US$198mn, 0.38% AUM)

Individual fund flows

- iShares Physical Gold (LON:IGLN) ETC added 7.0t (US$292mn, 3.1% AUM)

- db Physical Gold Euro Hedged (DE:XAD1) added 5.3t (US$195mn, 14% AUM)

- UBS ETF CH-Gold CHF hedged added 4.2t (US$163mn, 19% AUM).

- db Physical Gold ETC EUR added 2.3t (US$95mn, 18% AUM).

- SPDR Gold Shares (NYSE:GLD) led outflows worldwide and in North America with 11.2t (US$451mn, 1.3% AUM) coming out of the fund

Year-to-date trends

- Global gold-backed ETFs collectively hold 2,357t, as funds added 198t of gold, equivalent to $8.5bn, so far, this year, which represents an increase of 8.3% of global AUM from December 2016.

- European funds continued to lead inflows and captured 75% of global inflows this year, adding 143t (US$5.7bn, 14% AUM) of gold to their holdings in 2017

- German-based ETFs account for 34% of global net inflows in 2017. Deutsche Boerse (DE:DB1Gn) Commodities Xetra-Gold (DE:4GLD) alone accumulated 53.3t (US$2.1bn) – a 49% increase year-to-date. However, these funds’ growth halted over the past two months