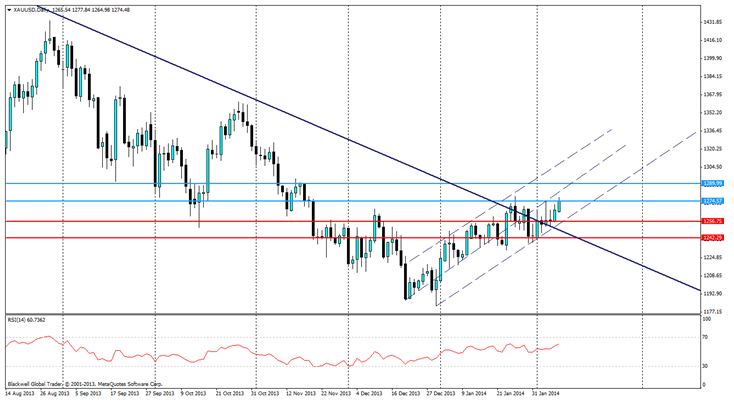

Over the last few months, I have routinely been against gold and the prospects of it turning bullish in the near term. But, now I certainly feel its time to draw my attention back to it yet again, especially as it starts to give off bullish signals and has clearly broken through its bearish trend line.

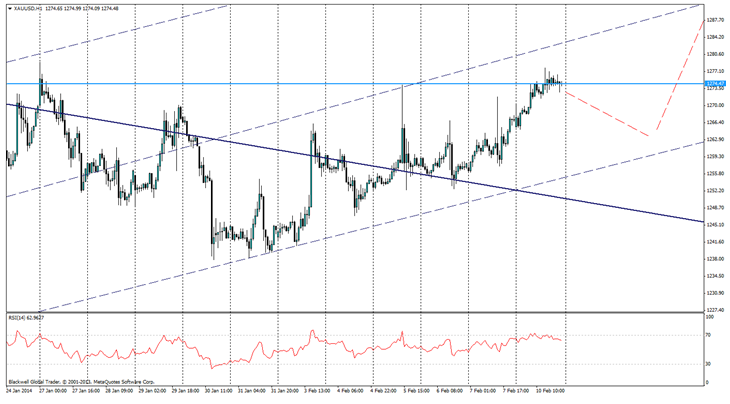

The upward momentum of gold has been hyped and talked up for some time, and finally that day has come – for some. Technically, looking at gold we can see the movements have been impressive to say the least, a clear bullish upward trend has formed on the daily and the H4 chart. Characterised by the usual higher highs and higher lows on the candles. The trend line has formed into a clear bullish channel. With a clear mid point that traders are using as dynamic resistance and support when trading upwards.

While the H4 chart shows the current market momentum for gold, the daily chart clearly shows the trend line break through, into a bullish run. Currently golds momentum has slowed on the H4 and daily chart, this is due to resistance at 1274.57, which will likely lead to gold pulling back – all be it briefly. The next level of resistance can be found at 1290.00, and could be tested by Yellen’s talk to the congressional committee. Especially if she talks down the state of the U.S economy, though it's not a good platform to start your tenure on.

Support levels can additionally be found at 1256.75 and at 1242.29. These are unlikely to be truly tested given they are outside the channel that has formed. Additionally, support is likely to be dynamic and on the trend line, or the 20 day moving average, which traders have used to push off when gold has moved lower as of late.

XAU/USD 3" title="XAU/USD 3" height="242" width="474">

XAU/USD 3" title="XAU/USD 3" height="242" width="474">

Despite the recent upward movements, likely movements in the coming hours could be a bit weak as gold looks to have hit resistance, and some level of profit taking may be a factor. The most likely scenario is a fall lower, followed by a bounce off either the trend line or current 20 day moving average. Helping to further momentum for the bullish run of gold that is currently in play.

In the unlikely event it still breaks upwards I would expect to see it, touch the current centre trend line and use that as resistance, however, if Yellen does talk down the state of the economy on a serious scale and we have a massive market overreaction we could see gold push its upper channel range. In that scenario catching it on the trend line and looking to short would be an optimal strategy, while also factoring in the second level of resistance I mentioned earlier.