Gold prices started bearishly today, pushing from a high of 1,341 to a low of 1,328 during the first 4 hours of trade. This decrease is surprising as risk appetite was entirely bearish this morning following a series of disappointing economic number releases which drove Asian stocks deeply lower. Hence, we should have expected Gold which has "safe haven" status to climb up higher instead of trading lower. Looking at the sharp decline on Friday following a stronger than expected NFP print, there is no reason to believe that Gold's inverse correlation to bullish news is no longer in play. As such, the decline in Gold today should be regarded as bearish push in spite of bullish pressure - highlighting the strength of underlying bears right now.

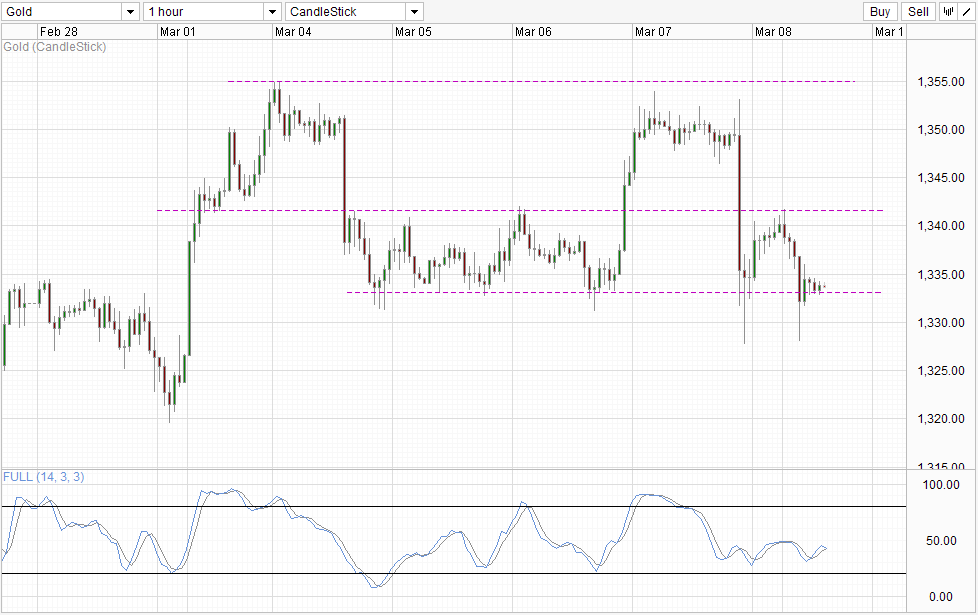

Hourly Chart

That being said, it should be noted that for all the supposed bearishness, prices remained mostly above the soft support level of 1,333. This morning's decline also failed to reach the lows made on Friday, suggesting that current bearishness isn't really that strong. However, as mentioned earlier, this bearish movement happened "in spite of" strong bullish factors, hence betting that prices rebounding off 1,330 back to 1,341+ resistance is considered risky. Furthermore, with a short-term bullish pullback due for risk appetite, we could potentially see stronger bearish movement coming out in the near future.

Daily Chart

Daily Chart suggest that we exercise caution not just on the bullish front, but on the bearish front as well. Looking at the bigger Rising Channel, it is obvious that prices have been straddling on the top end of the Channel, increasing likelihood of a pullback towards Channel Bottom. Stochastic readings agree with a fresh bearish cycle signal being made a couple of candles ago. However, we can also draw a smaller Channel that has been in play since mid Feb, with current price trading just around Channel Bottom. Stochastic curve has started to point up and has crossed Signal line, impairing the recently made bearish cycle signal. This doesn't invalidate bearish pressure but certainly traders should not automatically assume bearish pressure is at the forefront now.