Investing.com’s stocks of the week

Gold Is Not Just Another Metal:

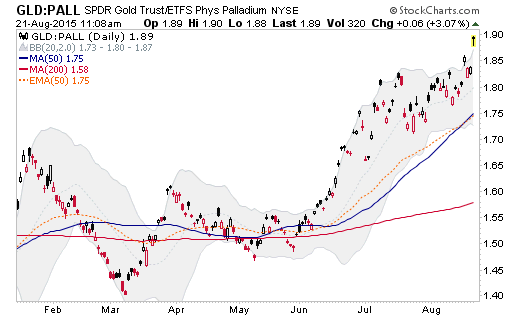

Gold is not palladium, a flipped over version of which (weekly (NYSE:PALL)-Gold) gave us a DOWN signal months ago.

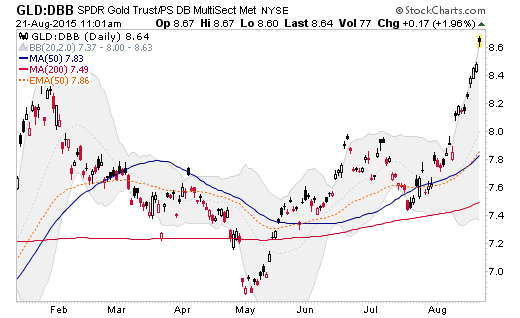

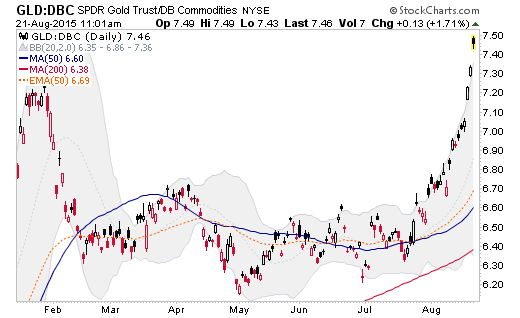

Gold is not just another commodity:

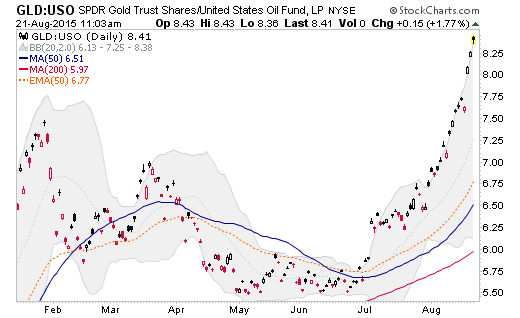

Gold is much different in its best investment environment from the things previously promoted to have been beneficial for oil:

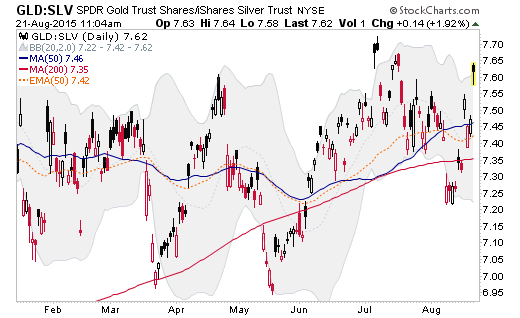

Silver is not gold either. But it’s much closer, which makes it a sensitive component of the metallic credit spread (Hat tip, Hoye) to economic, financial and monetary events:

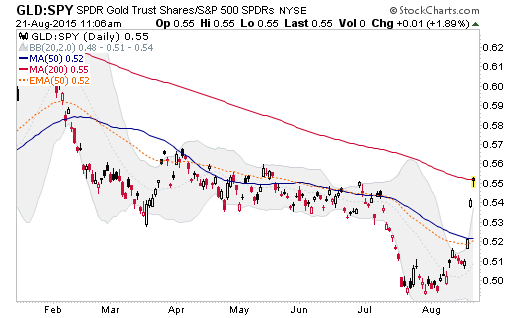

And of course Gold vs. US Stock market, making a move but still technically in a big picture downtrend:

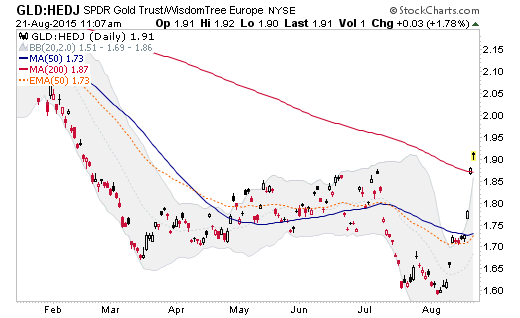

Gold vs. (NYSE:HEDJ):

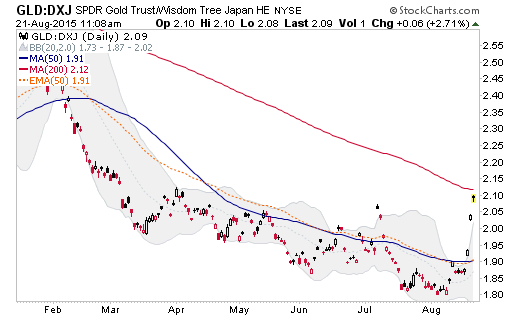

Gold vs. Yen-hedged Japan (NYSE:DXJ):

Gold is none of these things, because gold does not do anything other than sit there as a solid, pretty rock that irrational humans have alternately over obsessed upon and ignored for long stretches. That is what makes it a marker or barometer. Its very lack of utility and income distribution make it the anti-asset. In that resides its value when the levered up games start to unwind.

Other than that, I have no strong opinions on gold.