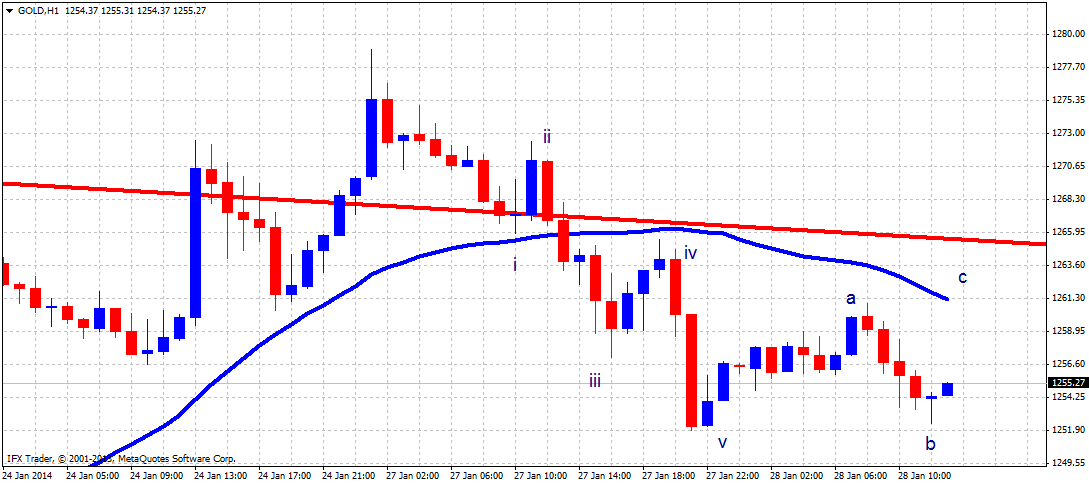

Gold prices as expected have reached the $1,270 area, which was our corrective target. The upward move from $1,180 is not impulsive as prices make an overlapping pattern. This makes us more confident when labeling the entire rise as a correction. Prices have managed for one day to move above the long-term downward sloping purple trend line but since yesterday, prices have reversed. Short-term support was broken and prices have completed 5 waves down from the recent high. If our bearish view is correct we should expect an upward three wave pull back near $1,263 and then a new wave down.

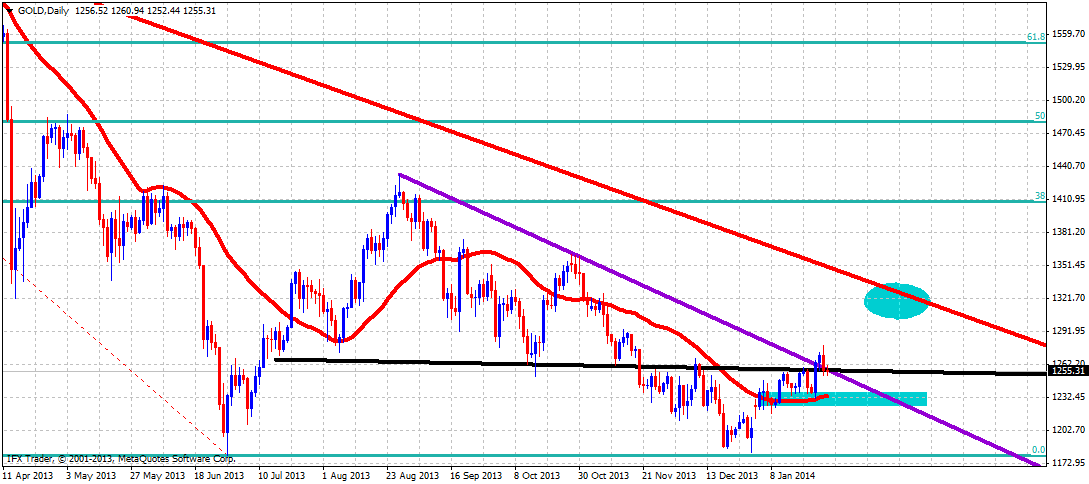

On the daily chart as shown below, Gold has turned again below the long-term downward sloping trend line. Important support level for bulls is the $1,230 area. If prices remain above that price level then chances to make a move towards $1,300 will have increased.

Prices are now testing the longer-term trend line that connect $1,433 and $1,360. If we see a clear break out above this resistance level of $1,270-80 then we should expect Gold to try to reach the next longer-term trend line at $1,320. If you want to see our trades in Gold in real-time through our exclusive twitter account for subscribers, become a member today. Thank you for taking the time to catch up on my thinking.