The price action of the SPDR Gold Shares (GLD) over the last several weeks has been a big concern in the national media and with individual investors' portfolios. Everyone has been quick to weigh in on their conspiracy theories, predictions and fundamental policies for owning the yellow metal. Some people own gold for its inflationary protection, some own it for its currency qualities, and others own it as a stalwart investment vehicle. However, I always focus on gold more from a technical perspective to take the emotion out of trading and view the investment landscape through a clear lens.

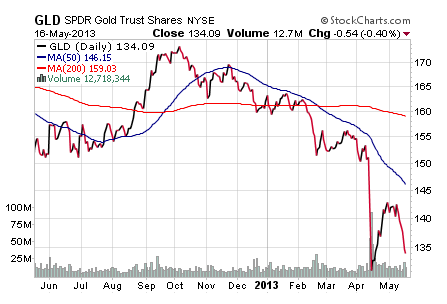

As I look at the chart of GLD over the last 12 months you can see that it peaked in October 2012 and has been on a slow trajectory downward ever since. The high to low over this time frame was -24.36%, which is a bear market in itself. The quick snapback recovery since the April 2013 lows was quickly tempered by a renewed downward slog and we are once again approaching these lows.

The question I would pose is: Will this latest move in GLD create a bullish double bottom from which a renewed up-trend will emerge or will gold pierce through that prior low and give the bears something to tear into?

That question will be answered in time, but my initial inclination is to watch for GLD to bounce off of the $130 area of support. A longer term 3-year chart shows that gold experienced a similar base in this area back in 2010-2011. The real key to watch will be the volume and price action that we experience as we approach these levels. The April low saw a tremendous spike in volume as investors shed their precious metal holdings and stop losses were hit along the way. If gold was to repeat that same spike down on huge volume then I would be very hesitant about its prospects for the remainder of the year.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold: Double Bottom Or Double Trouble?

Published 05/19/2013, 06:42 AM

Updated 05/14/2017, 06:45 AM

Gold: Double Bottom Or Double Trouble?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.