Gold continue to slide lower on this week open, heading closer towards the previous swing low back in April. Prices have been heavily depressed recently due to a myriad of technical (Channel rejection pattern) and fundamental reasons (renewed talks of tapering QE3 down by various Fed members), but all in all, the decline that we’ve seen is nothing new in the bigger scheme of things – where Gold prices have been on the decline ever since QE3 has been announced back in Sept 2012.

Weekly Chart XAU/USD_1" title="XAU/USD_1" width="580" height="403">

XAU/USD_1" title="XAU/USD_1" width="580" height="403">

With that in mind, it is interesting to note that price did trade lower after Fed’s Fisher, Plosser and Williams made their individual hawkish statements as price didn’t react favorably post QE3, suggesting that bears may be simply looking for reasons to sell, which make sense considering the heavy bear trend that we’re in currently.

Hourly Chart

Short-term chart has its own share of bearishness, with price breaking the previous descending Channel, while forming a wider larger channel of the same gradient in the process. Despite stochastic readings signalling a bull-cycle just a few hours ago, readings have failed to take flight with Stoch/Signal line both flattening and seeking lower pastures once more.

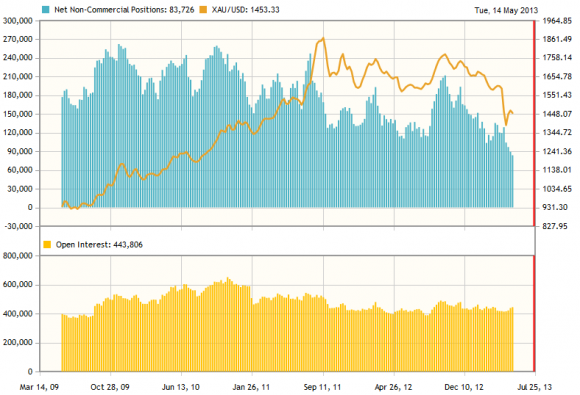

CFTC Commitment of Traders

Looking at US data, we can see a huge decline in Net-Commerical positions for bulls, which means the number of short holders are getting more and more. It is also important to note that Open Interest remain stable, instead of dipping, which means that current decline in Gold is supported by strong volume. This is not a flash sell-off, but a potential systemic change of demand/supply. We can all speculate why demand of Gold is falling – no US inflation risk, stocks recovery, US bond yields reversing etc, but the underlying empirically observation remains the same. With that in mind, it will be hard for Gold prices to climb back up easily – short-term reversals are still possible, but to expect Gold to suddenly fly back up above 1,500 back to 2012 levels will be highly unlikely to say the least.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold: Continuing Lower As More Traders Bet On Shorts

Published 05/20/2013, 05:06 AM

Updated 07/09/2023, 06:31 AM

Gold: Continuing Lower As More Traders Bet On Shorts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.