The past few weeks have been exceedingly kind to the precious metal as it has rallied strongly in response to slipping chances of a rate hike from the US FOMC. Subsequently, it was no surprise when the tide again turned bullish for the metal, as Janet Yellen prepared to do the dance of defeat in light of the need to maintain the current monetary regime. However, storm clouds are brewing for the precious metal which makes the current long play a risky game of Russian roulette.

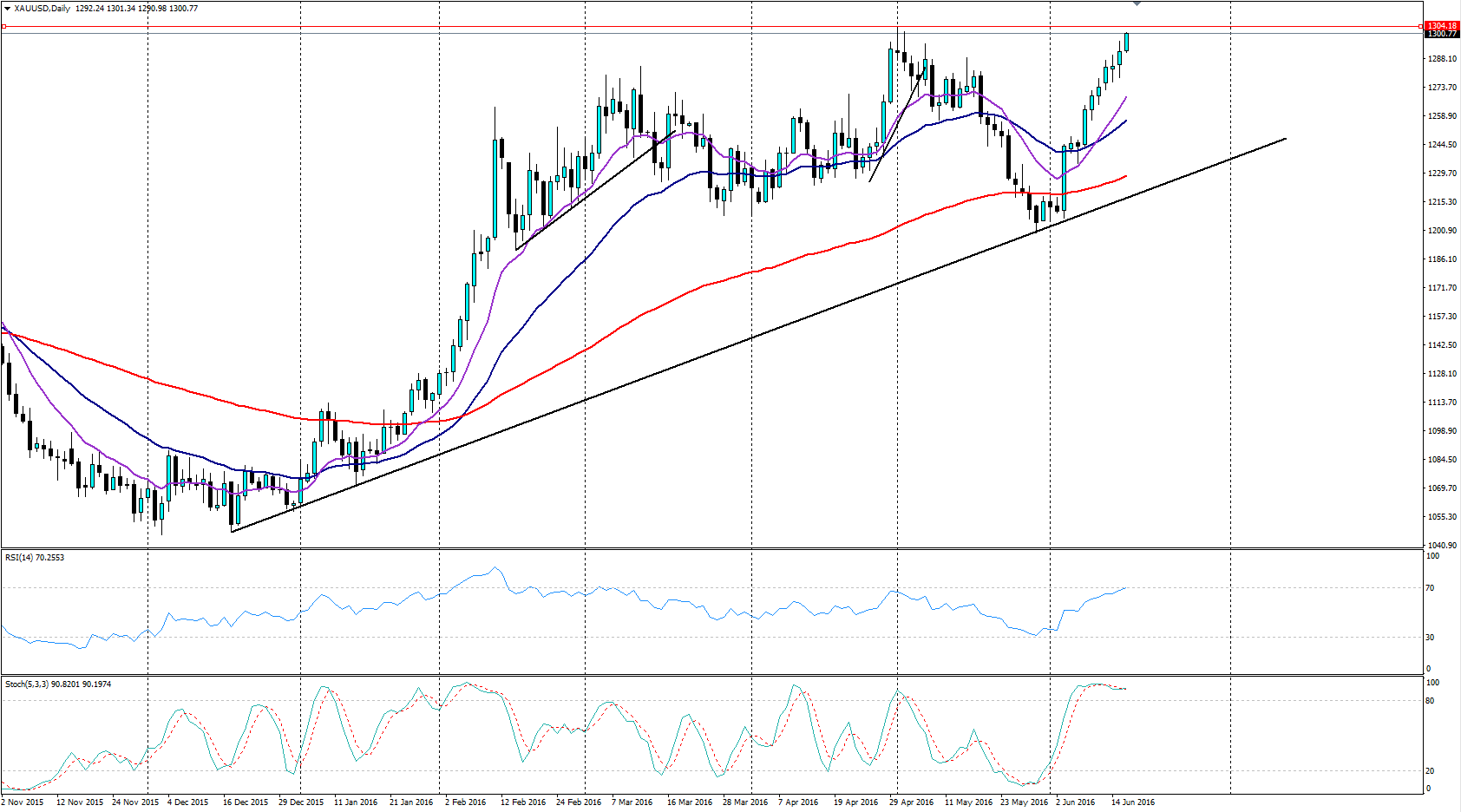

A quick perusal of gold’s chart demonstrates the meteoric rise that the metal has experienced of late. In fact, the current bullish leg has taken the metal from a low of $1204.96 to price action’s current level, just above the $1300 handle. However, despite the strong rally, and price’s position above the 100-day moving average, some concerning signs of a reversal are apparent.

In fact, a cursory review of the RSI Oscillator shows the indicator having just entered over-bought territory on the daily time frame. In addition, the Stochastic Oscillator is also in reversal territory and has started to trend lower, diverging from price action. Subsequently, there is a growing impetus for a sharp corrective pullback in light of the overbought status.

Further adding to the bearish case is the fact that the commodity is directly facing a fairly important reversal and resistance zone around the $1303.56 an ounce mark. This is an area that has been a historical turning point for the metal and could very well influence proceedings over the next few sessions. Subsequently, a failure to close above this key level is likely to predispose the metal to an orderly retreat.

On the fundamentals front, keep a close watch on the looming BREXIT referendum as the metal is likely to be volatile in the lead up to this event and any exit could see the precious metal soar. Given that the polls are currently within the margin of error, any vote could be an exceedingly close run affair and lead to an ongoing “fear” trade.

Ultimately, there are plenty of factors that are currently impacting both the physical and paper demand for the metal. However, it currently appears that a confluence of factors is pointing to a pullback towards the $1276-$1263 level. Subsequently, watch for the retracement in the coming session and keep your stops tightly placed above the current highs.