In an inflationary environment, silver bullion and junior/intermediate gold stocks tend to outperform gold bullion and senior gold stocks.

That’s the daily gold chart. The price now is well below where it was at the November 2014 lows.

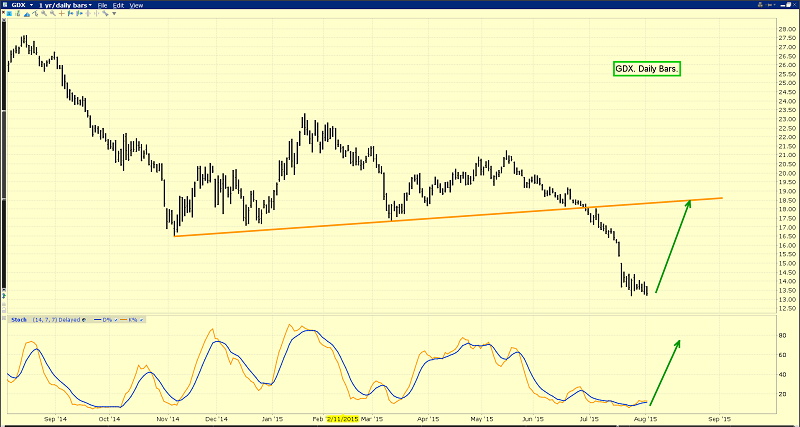

That’s the (NYSE:GDXX) daily chart. It’s also well below all its recent intermediate trend lows.

That’s the daily silver chart.

Rather than staging a technical “break down”, silver has essentially been trading sideways, and it has not traded significantly below than the November lows.

From the May highs, silver has drifted lower, whilst gold fell somewhat violently.

This difference in price action is typical when system risk fades, and inflation begins to dominate precious metals price discovery.

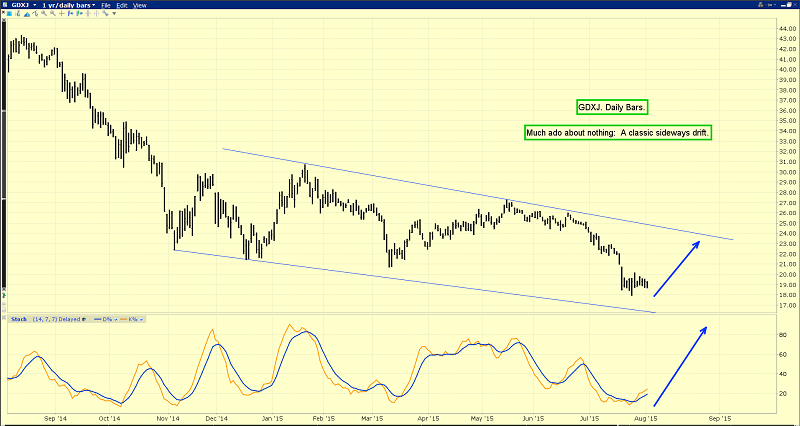

That’s the (ARCA:GDXJ) daily chart. While there is a downward bias in play, the price action really takes the form of a sideways drift.

Given the greater risk profiles of silver and GDXJ, (versus gold and GDX) it’s very positive to see them trading roughly sideways, while gold and most senior gold stocks tumble lower.

This price action suggests a concerning rise in inflation may be closer than most analysts think it is.

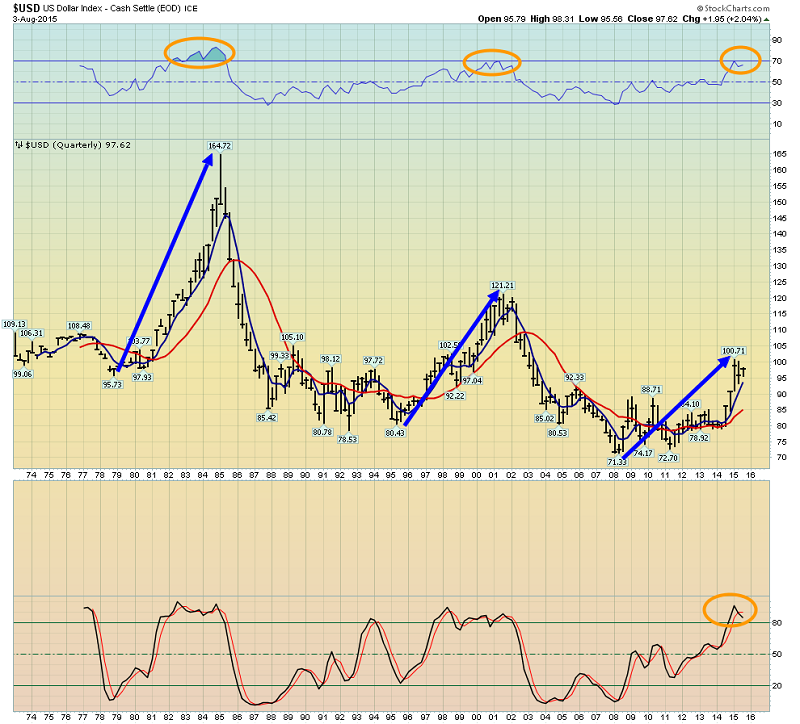

That’s the US dollar quarterly bars chart. The dollar has stalled at round number resistance of 100, and it’s technically overbought by a number of measures.

There are also a number of concerning macro issues facing America right now. The next debt ceiling vote probably takes place at the end of September. If the ceiling is raised without serious measures in place to reduce that debt, rating agencies could issue downgrades of US government debt.

It’s not a comfortable situation, and it’s certainly not one that I’m keen to invest in.

The September-October time frame is also “stock market crash season”. The worst US stock market crashes in history have occurred in the months of September and October.

This year is a particularly dangerous one, because a Fed rate hike could occur just as the debt ceiling is being hotly debated by US congress!

With these great fundamental dangers to America in place now, the idea that gold needs to be sold to avoid lower prices seems rather bizarre. Are analysts who are vehement about avoiding gold market drawdowns now… treating gold more as a gambling chip than an asset? Unfortunately, I think so.

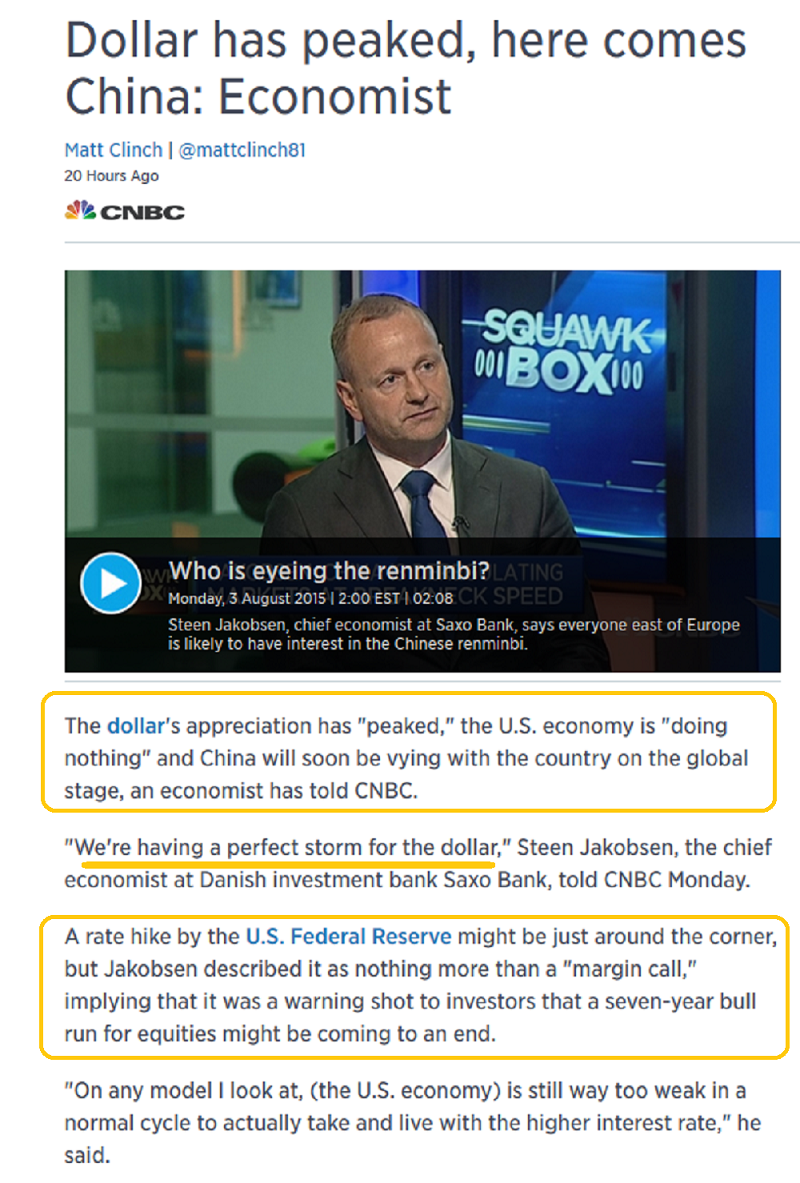

That’s a snapshot of Saxo Bank economist Steen Jakobsen being interviewed by CNBC. Obviously he has serious concerns about the US economy and about the dollar.

As the Chinese economy transitions from an exports focus to a domestic consumption focus,the need for a weak renminbi diminishes. The IMF is likely to accept the Chinese currency into its main reserve basket in October and that acceptance will probably create significant forex flows out of the dollar and into both Chinese stock markets and the renminbi.

In the longer term, Chinese real estate markets are more likely to suffer than the Chinese stock market. That’s where the biggest shadow banking loans are, and it’s likely to put a modest drag on Chinese GDP growth. It could also lead to a crash in other global real estate markets, particularly if the US debt ceiling debate gets out of hand.

Regardless, retail sales are showing double digit growth in China, whilst the US is in the seventh year of its business cycle, and fading.

That US cycle is old and reaching the point where it becomes inflationary, so it’s time to invest less in America and more in China, India and gold.

That’s the daily chart for (NYSE:INDA), the Indian stock market ETF. Like the US stock market, it’s gone essentially sideways in 2015 and it could crash if the US stock market crashes.

I’m more interested in what happens after a crash, and buying into that crash as it happens, than working maniacally to avoid it. In the case of America, if there’s a stock and bond market crash, I don’t really see much hope of a recovery after that, to meaningfully higher prices.

In contrast, in the case of China, India and gold, all market declines should be viewed as key price sales that will be followed by much higher prices. Let me repeat: Inflation tends to rise in the late stages of the business cycle, and the outperformance of silver and GDXJ versus gold and GDX speaks volumes about where the United States is now, in its business cycle. It speaks volumes about where the Western gold community should be focusing their biggest energies. Avoiding drawdowns is a game for gamblers and I have no interest in gambling (with anything other than gambling money).

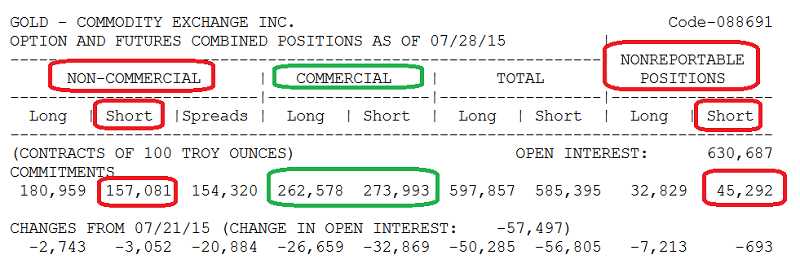

That’s the latest COT report, which I’ve highlighted. This key report clearly shows small investors and funds trying to avoid drawdowns by selling gold and shorting it into this decline. It shows banks almost reaching a net long position, much akin to their actions in the late 1970s. Accumulation with prudence now, is the modus operandi, of the professional gold investor!

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?