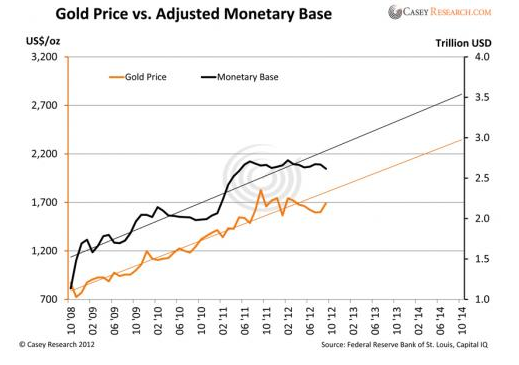

While many of us don’t like making price predictions, and certainly ones accompanied by a specific date, it’s hard to ignore the correlation between the U.S. monetary base and the price of gold.

That correlation says we’ll see $2,300 gold by January 2014.

The Monetary Base

There are plenty of long-term charts that show a connection between gold and various other forms of money (and credit). Most show that one outperforms until the other catches up. But let’s zero in on our current circumstances, namely the expansion of the U.S. monetary base since the financial crisis hit in 2008.

Here’s the performance of gold compared to the expansion of the monetary base since January 2008.

You can see the trends are very similar. In fact, the correlation coefficient is an incredible +0.94.

The Logic

Since the Fed has declared “QEternity,” it’s logical to conclude that this expansion of the monetary base will continue. If it grows at the same pace through January 2014, there is a high likelihood the gold price will reach $2,300 at that point. That’s roughly a 30% rise within 15 months.

And by year-end 2014, gold could easily be averaging $2,500 an ounce. That’s 41% above current prices.

Some may argue that there’s no law saying this correlation must continue. That’s true. And maybe the Fed doesn’t print till 2014. That’s possible.

But it’s not just the U.S. central bank that’s printing money:

- European Central Bank (ECB) President Mario Draghi has declared that it will buy unlimited quantities of European sovereign debt.

- Japan’s central bank is expanding its current purchase program by around 10 trillion yen ($126 billion) to 80 trillion yen.

- The Chinese, British, and Swiss are all adding to their balance sheets.

The largest economies of the world are all grossly devaluing their currencies. This will not be consequence-free. Gold and silver will be direct beneficiaries -- along with mining companies -- starting with rising prices.

There are other consequences -- good and bad -- of gold hitting $2,000 and not stopping. We think investors should be prepared for the following:

- Tight supply. As the price climbs and attracts more investors, getting your hands on bullion may become increasingly difficult. Delivery delays may become commonplace. Those who haven’t purchased a sufficient amount will have to wait in line, either figuratively or literally.

- Rising premiums. A natural consequence of tight supply is higher commissions. They won’t stay at current levels indefinitely. Premiums doubled and more in early 2009, and mark-ups for silver Eagles and Maple Leafs neared a whopping 100%.

- Swelling profits for the producers. If margins on gold production average $1,000 per ounce now, what will earnings be like when they average $1,500? At $2,000? Gold can rise much faster than operating costs, so this could happen. Imagine what this could do to dividend payouts, especially those tied to the gold price and/or earnings.

- Tipping point for a mania. There will be an inflection point where the masses enter this market. The average investor won’t want to be left behind. Will that happen when gold hits $2,000? $2,500?

The message from these likely outcomes is to continue accumulating gold -- or to start without delay. Waiting will have consequences of its own.

Bet On It

People say that there’s nothing certain in life except death and taxes. In my view, $2,300 gold is a close second.

Note: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.