We are back to ride the bulls as planned in our Aug 4th article, as a reversal candle, a hammer, closed on last week’s Thursday. The dismal NFP figure and failed expectation of the US unemployment rate last Friday only hampered the case of Feds rate hike in the near future.

NFP for August only added 151K jobs, below expectations of 185K jobs, though July’s figured was revised higher from 255K to 275K jobs. To make it worst, unemployment rate holds at 4.9%, failed to meet market expectation of 4.8% and average hourly earnings missed expectation as well.

The headline number wasn’t all that bad really, but is sure a fade to the labor market optimism for the past few months, hence to the potential September rate hike. Richmond Fed President Jeffrey Lacker was quick to respond during a prepared speech to two economist group in Richmond, saying that “the funds rate should be significantly higher than it is now”, making markets believe that though September maybe off the table, a hike during December holidays, like last year, is still probable.

Fed funds future a.k.a CME Fedwatch factored a 21% probability (down from 24% a day earlier) for a September hike and 41.1% (down from 42.1%) for a December hike.

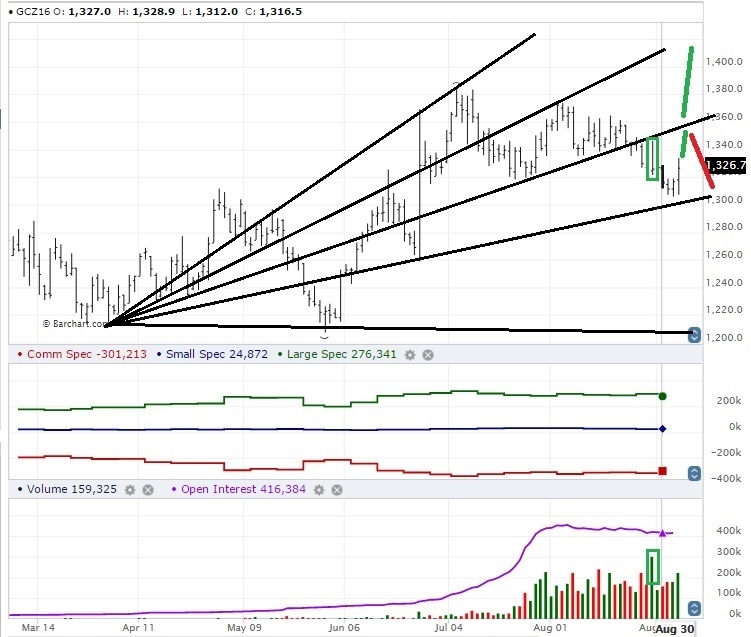

The recent CoT reports on gold futures showed that net long decreased to 276K contracts from 294K contracts a week earlier and 279K contracts when we published our last article on gold, which strongly indicates that many buyers are holding with only minor redemption.

On the sideline story, Deutsche Boerse (DE:DB1Gn) Commodities Xetra-Gold (DE:4GLD) - a gold ETF on the German Exchange - was reported failed to deliver on its prospectus of a physical delivery on demand. The debacle has Deutsche Bank (DE:DBKGn) as the ETF sponsor on fire as it doubt the credibility of the European bank as among the top 10 FX market players. If a bank as big as DB could not fulfill its obligation, what does that say about smaller institution?

Given current solvency issue of the financial institutions in Italy, this added spices in the market drama, would sure benefit the precious metal.

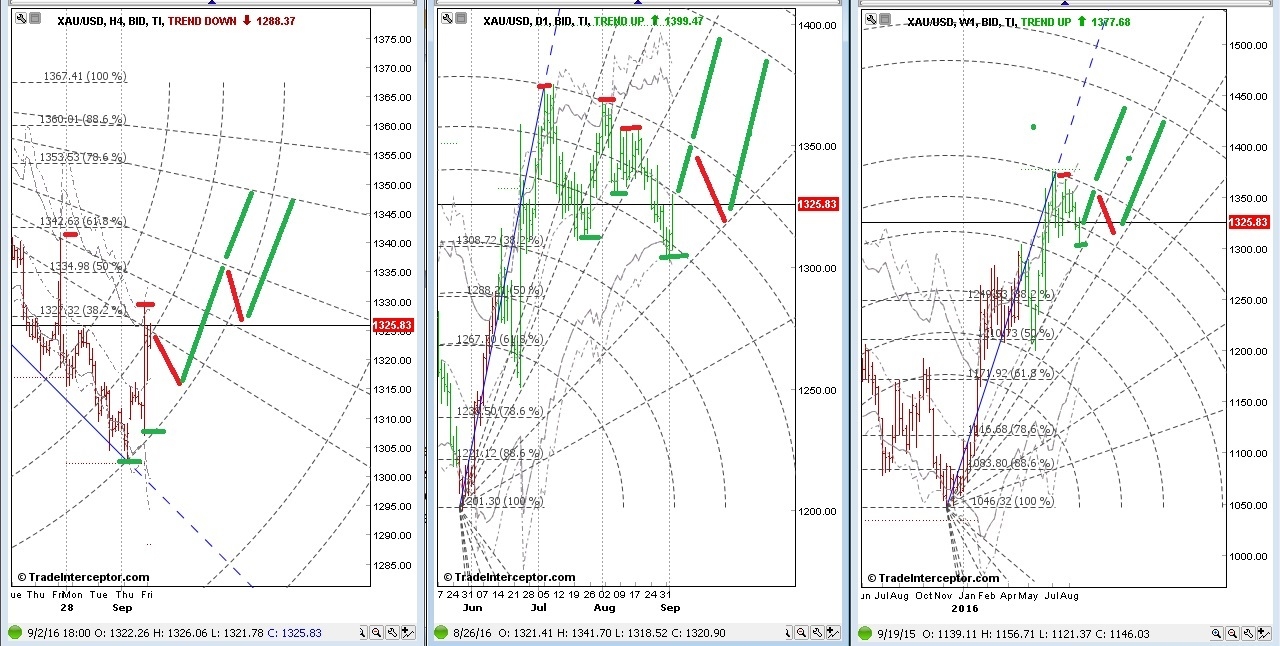

Halal Traders entered at market around $1,315/oz as our limit to buy at $1,300/oz was not triggered when no players was willing to offer at that price on our volume. Thus, this trade is invalidated if price closed below $1,300/oz on the daily and we target $1,350 level for the short term and $1,420 level in the medium term.

Please read our risk warning disclaimer.