Source: www.sharelynx.com

It is not often one looks at a yearly chart. Monthly charts are quite common. Time dimensions for charts normally range from monthly right down to tick charts. A tick chart is one that prints a bar at the close of any specified data interval. One of the great things about Nick Laird’s website, Gold Charts ‘R’Us www.sharelynx.com is that Nick’s website contains what may be the most comprehensive array of charts for gold, silver and other precious metals imaginable. This was the first time that I had seen yearly charts available. Not only are the yearly charts available in US$ but they are also available in an array of currencies including – Australian$, Cdn$, Swiss Francs, Chinese Yuan, Euros, British Pounds, Indian Rupees, Mexican Pesos, New Zealand$, Russian Rubles and the South African Rand.

Each currency chart tells its own story but the most followed currency is gold in US$ largely because gold is normally quoted in US$ as are all commodities. While currencies fluctuate against each other, the world is still measuring their own currency primarily against the US$. As the US$ rises and falls against other currencies those whose home currency is devaluing because of a rise in the value of the US$ discover that gold expressed in their home currency is outperforming gold in US$. This has been especially true since July 2014 when the US$ began a sharp rise against other currencies.

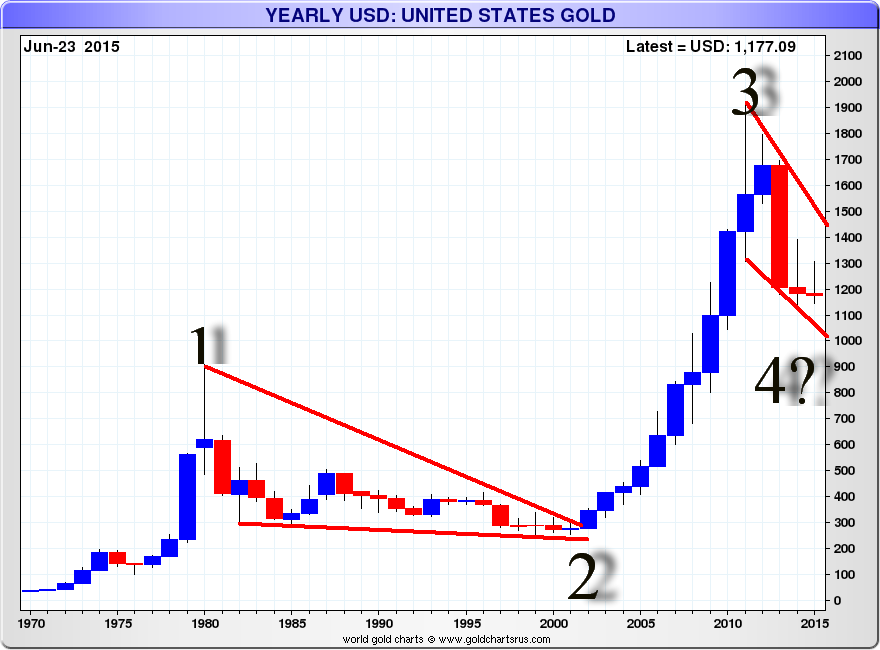

In looking at a yearly chart of gold, one gains a possible sense of gold’s longer-term performance that might not be spotted in daily, weekly or even monthly charts. What leaps out almost immediately is that gold appears to have completed three waves up from the time that gold started free trading following former US President Richard Nixon closing the gold window in August 1971 and setting gold to trade freely. The current down move may well be a fourth wave.

The closing of the gold window was a shock to the markets. It was the unilateral cancellation of the direct convertibility of the US$ into gold, a key measure of the Bretton Woods Agreement (1945). In effect, the US defaulted. The closing of the gold window did not end the Bretton Woods Agreement. That took another couple of years. In 1973, Bretton Woods was effectively dead to be replaced by one of freely trading fiat currencies. That system is still in effect today. Since then markets have become far more volatile as currencies, commodities, bonds and stock markets have had often-violent swings both up and down. As well the shift from a gold backed financial system to a US$ backed financial system was the beginning of a sharp rise in money and debt growth that continues today.

It is not my intention here to go into a lengthy description of Elliott wave analysis. There have been many books written on the subject. Elliott waves came from Ralph Nelson Elliott an accountant who wrote a series of articles back in the 1930’s that became to be the basis of what became known as Elliott wave analysis. Elliott wave analysis was popularized by Robert Prechter (www.elliottwave.com) in the 1970’s when he was working at Merrill Lynch. Prechter eventually wrote a book entitled the Elliott Wave Principle in conjunction with A.J. Frost. Since then Prechter and others have popularized wave theory. Still Elliott wave analysis remains a complex technical theory and while many may use it (mea culpa), few are considered experts.

The intention here is to keep it simple. At its simplest Elliott waves unfold to the upside in series of five waves and unfold in corrective or downside waves in a series of three waves. Keeping it at that level is why the yearly chart of gold appears to be quite bullish. Gold appears to have completed wave 1 up from 1971 at $35 to the peak in 1980 at $875. Wave 2 was the long complex corrective wave that unfolded from 1980 to 2001. Time here is not necessarily of the essence as while this is a yearly chart one could remove the time element and what one would see is a series of unfolding waves. Wave 3 up was the massive up move from the 2001 low of $255 to the peak in 2011 at $1,923. What has been unfolding since appears to be wave 4. This wave may not as yet be complete.

The theory of alteration as applied to Elliott wave analysis suggests that corrective waves should be different. In this case, wave 2 was a long complex primarily sideways correction. Based on that, one would expect wave 4 to unfold in a different manner. Thus far wave 4 appears to be unfolding as a sharp correction. This suggests that wave 4 appears may be satisfying the Elliott theory of alteration. If the theory holds, once wave 4 is complete gold should embark on wave 5 to the upside to complete the Elliott 5 wave advance.

The question naturally on everyone’s mind is when will wave 4 end and at what level. I have mentioned on numerous occasions Ray Merriman’s analysis (www.mmacycles.com) of cycles that suggests that gold has an 8.33-year cycle dating from the important gold low in 1976. Important lows were seen subsequently in February 1985, March 1993, April 2001 and October 2008. The next 8.33-year cycle is due in February 2017 +/- 17 months. That means this important low could be seen as early as late 2015 and as late as sometime in 2018.

The 8.33-year cycle subdivides normally into 3 cycles of 34 months each. From the last 8.33 year cycle in October 2008 an important low was seen in December 2011 and then again recently in November 2014. These may have satisfied the 34-month cycle. If the November 2014 low was a 34 month cycle low then the next one would be due in September 2017 +/- 6 months. In the interim gold should undergo a corrective upward phase from the possible 34-month cycle seen in November 2014. That corrective phase appears to be unfolding now and could take on the look of an ABC type Elliot flat. So far an A wave possibly completed in January 2015 and the market is still working on a B wave that has thus far remained above the November 2014 low of $1,130.

The C wave once it gets underway could take us up once again above $1,300. Only above $1,450 might it suggest that something larger was unfolding. Once that C wave is finished gold could start its long decline to its final low that could target down to test the 1980 high of $875. Once that low is seen then gold could start its 5thwave to the upside that could take us as high as $2,600 and possibly higher. In the interim gold has further work to do to complete might well be an Elliott wave 4. But once that wave is complete gold could well begin another powerful up phase to complete the Elliot five waves up from 1971.

It should be noted that completion of a possible 5 waves up could take a number of years. Elliott wave 1 lasted 9 years, Elliott wave 2 took 21 years, and, Elliott wave 3 took 10 years. The current possible Elliott wave 4 is in its 4thyear. Key could be making the 8.33-year cycle low, a low that still might be a year or two away. That could then be followed by an Elliott wave 5 that could take several years to complete based on previous history.

Copyright 2015 All rights reserved David Chapman

General Disclosures

The information and opinions contained in this report were prepared by Industrial Alliance Securities Inc. (‘IA Securities’). IA Securities is subsidiary of Industrial Alliance Insurance and Financial Services Inc. (‘Industrial Alliance’). Industrial Alliance is a TSX Exchange listed company and as such, IA Securities is an affiliate of Industrial Alliance. The opinions, estimates and projections contained in this report are those of IA Securities as of the date of this report and are subject to change without notice. IA Securities endeavours to ensure that the contents have been compiled or derived from sources that we believe to be reliable and contain information and opinions that are accurate and complete. However, IA Securities makes no representations or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to IA Securities that is not reflected in this report. This report is not to be construed as an offer or solicitation to buy or sell any security. The reader should not rely solely on this report in evaluating whether or not to buy or sell securities of the subject company.

Definitions

“Technical Strategist” means any partner, director, officer, employee or agent of IA Securities who is held out to the public as a strategist or whose responsibilities to IA Securities include the preparation of any written technical market report for distribution to clients or prospective clients of IA Securities which does not include a recommendation with respect to a security.

“Technical Market Report” means any written or electronic communication that IA Securities has distributed or will distribute to its clients or the general public, which contains an strategist’s comments concerning current market technical indicators.

Conflicts of Interest

The technical strategist and or associates who prepared this report are compensated based upon (among other factors) the overall profitability of IA Securities, which may include the profitability of investment banking and related services. In the normal course of its business, IA Securities may provide financial advisory services for issuers. IA Securities will include any further issuer related disclosures as needed.

Technical Strategists Certification

Each IA Securities technical strategist whose name appears on the front page of this technical market report hereby certifies that (i) the opinions expressed in the technical market report accurately reflect the technical strategist’s personal views about the marketplace and are the subject of this report and all strategies mentioned in this report that are covered by such technical strategist and (ii) no part of the technical strategist’s compensation was, is, or will be directly or indirectly, related to the specific views expressed by such technical strategies in this report.

Technical Strategists Trading

IA Securities permits technical strategists to own and trade in the securities and or the derivatives of the sectors discussed herein.

Dissemination of Reports

IA Securities uses its best efforts to disseminate its technical market reports to all clients who are entitled to receive the firm’s technical market reports, contemporaneously on a timely and effective basis in electronic form, via fax or mail. Selected technical market reports may also be posted on the IA Securities website and davidchapman.com.

For Canadian Residents:This report has been approved by IA Securities, which accepts responsibility for this report and its dissemination in Canada. Canadian clients wishing to effect transactions should do so through a qualified salesperson of IA Securities in their particular jurisdiction where their IA is licensed.

For US Residents: This report is not intended for distribution in the United States.

Intellectual Property Notice

The materials contained herein are protected by copyright, trademark and other forms of proprietary rights and are owned or controlled by IA Securities or the party credited as the provider of the information.

Regulatory

IA Securities is a member of the Canadian Investor Protection Fund (‘CIPF’) and the Investment Industry Regulatory Organization of Canada (‘IIROC’).

Copyright

All rights reserved. All material presented in this document may not be reproduced in whole or in part, or further published or distributed or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of IA Securities Inc.

June 25, 2015 Page 4