Investing.com’s stocks of the week

Gold – Second Day of Heavy Losses and $2.3 Billion in Notional Selling

As we mentioned yesterday in our daily market commentary, the short term pressure was bearish with the pair forming an inside bar just above the key 1300 level. We talked about watching for a break below this level, and today the precious metal fell much lower, with an intra-day low of 1292.

We tweeted about the large mysterious seller dumping $2.3 Billion in notional volume, and what levels to watch short term.

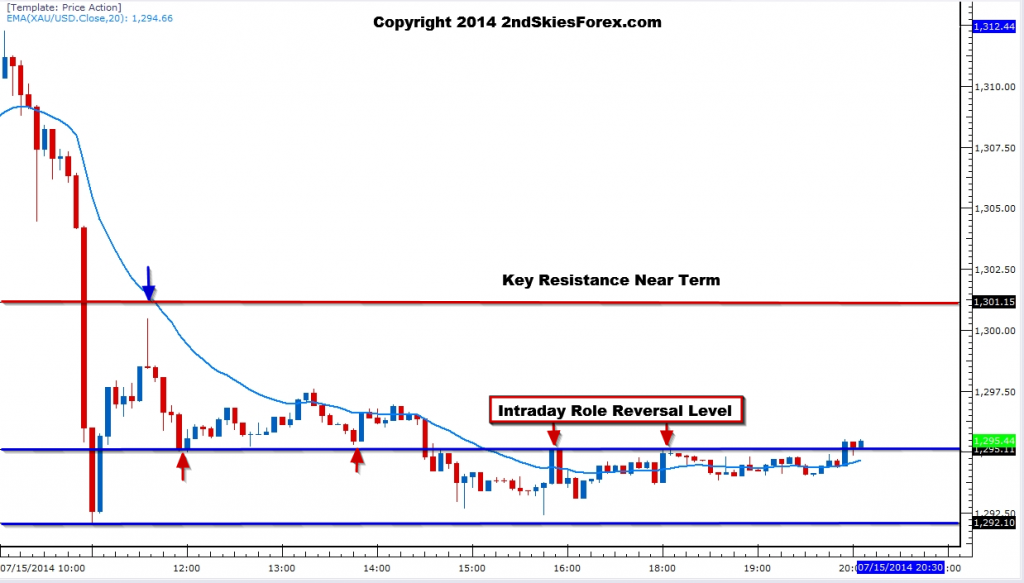

Looking at the 5m chart below, we can see the pair is still consolidating in a corrective price action phase towards its lows, which is an overall bearish sign. Short term, the PM has cleared the first resistance level in 1295, which held the shiny metal under water for over 5 hrs now. If the pair can regain 1297, then it will test the key 1300/1302 level which is likely to have some sellers waiting.

If this role reversal level sends the PM lower, or it breaks below the intraday low, then 1292 and 1285 will be the next downside tests, while breaking above this cleanly will put pressure on 1306 and 1312, potentially setting up a false break scenario.