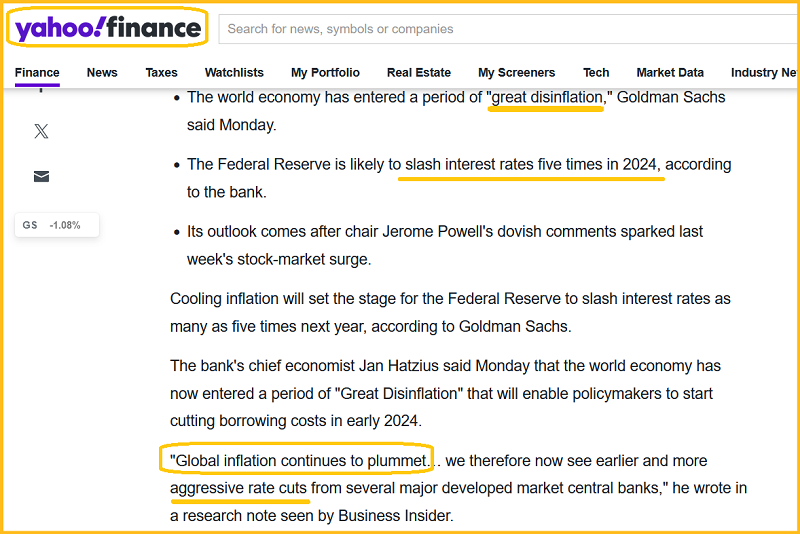

What lies ahead for investors of the world in 2024? Some insight into this key matter. Jan Hatzius is Goldman’s top economist and he is calling for five rate cuts in 2024.

Jan says the entire world economy is experiencing a “great disinflation” and he is sure that central banks will respond aggressively.

Is Jan correct? Jan is correct about oil. I’ve defined the $70 area as only a light buy zone because of the global economic slowdown.

The Panama drought has cut canal traffic in half and there’s now a bidding war for the few available open spots!

While “shipflation” soars because of the Panama drought, the 2021-2025 war cycle now features Suez Canal traffic suddenly slowing down dramatically.

The US government (already a debt, fiat, and war-oriented mess) will now borrow even more fiat and use it for long-term management of the Suez shipping traffic.

The long-term shipping cost ETF Breakwave Dry Bulk Shipping ETF (NYSE:BDRY) chart. A massive base pattern is in play.

A look at the daily chart. I urged investors to buy this ETF (BDRY) as it bottomed. Many did and are sporting fast 100% gains with more to come?

Clearly, the “great disinflation” heralded by economists like Jan is better described as the great disintegration. It’s arguably a disintegration of the bizarre “rules-based order” that is trumpeted by Western governments.

That itself is really a fiat, debt, and wars-based order. As it fails, it makes perfect sense that there are huge pockets of collapse (Jan’s disinflation) and equally huge pockets of inflation.

The somewhat pathetic-looking dollar index chart. While there will be minor rallies, the dollar looks like it’s entering a major bear market.

There are rumors that the US government wants to inject the “economy” (itself, the stock market, and banks) with another two trillion fiat dollars of debt. This insanity (against the background of rate cuts) could turn the dollar into flaming rice paper.

Here’s the bottom line: The global theme is not disinflation or inflation. It’s loss of control. The key weekly gold price chart. A broadening pattern (indicating loss of control) has been forming since 2020

And now there are indications that a major upside breakout is imminent. The target zone is $2400-$2500, and while US money managers will claim that rate cuts and pockets of disinflation prove the stock market is a roaring buy, my strongest suggestion for investors is to lock in fiat rates of 5% on CD’s and T-bills with some money and focus the rest on gold.

There are still two years to go in the 2021-2025 war cycle and at this point those two years look shaky at best.

What price should investors pay for the ultimate money that is gold? Basis this OUNZ ETF, the buy price is the Fed meeting low that occurred at about $19.11. That’s the equivalent of $1990 for nearby gold futures contracts and $1975 in the cash market.

Note the Stochastics oscillator at the bottom of that chart. There are only a few days of trading left before the Christmas break. Stochastics could become fully oversold by Christmas with no damage to the price.

The GDXJ “chart of the year”. There’s a spectacular inverse head and shoulders pattern in play.

Junior mine stock enthusiasts have reason to be positive as the “great disintegration” begins to drive money managers out of the general stock market and into the one sector that benefits from a bad economy and rate cuts which of course is gold and silver stocks.

The silver stocks ETF chart. An inverse H&S pattern is also in play.

A pre-Christmas lull in trading could see a second right shoulder form, but the positive action of the Stochastics oscillator suggests that won’t happen.

Instead, the most likely scenario is an upside breakout and surge to $32 or $33.

The GOAU ETF chart. There is also an inverse H&S pattern in play and a huge bull wedge breakout. The target is $21, and the good news is that it should be hit before the month of January is done!