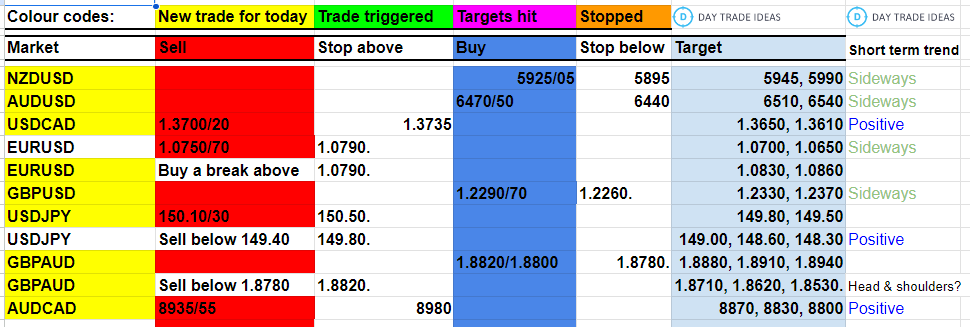

Today’s Trade Ideas

Gold XAU/USD shot higher to 2003 on the non-farm payroll release and then trickled back to 1988. We remain in a 2 week sideways consolidation. Some support at 1988/85 if you want to try to scalp 10 points with a 5-point risk.

Very minor support at what is probably the neckline to a short-term head and shoulders pattern on the 1-hour chart at 1976/75. A break below 1973 should be a sell signal if we hold below 1978 therefore and targets 1963/91, 1943/40, and even 1934/31 are possible eventually.

However, for today we should find strong support at 1965/61 so watch for a low for the day if you are scalping short-term levels and take a profit on a bounce to 1972/74.

If we continue higher perhaps we will find some resistance at the October high of 2007/2009. A break above 2010 should be the next buy signal.

Silver XAG/USD has been in a volatile sideways consolidation for so long now it seems pointless trying to swing trade when short-term scalping is the only strategy worth trying.

We are holding with the range set 3 weeks ago of 2235-2370.

WTI Crude December futures made a high for the day exactly at resistance at 8300/8350. If you tried a short here it worked perfectly hitting downside targets of 8190/60 & 8060/30. If we continue lower in the short-term bear trend look for a target of 7940/10 and then 7800/7760.

Resistance at the upper end of the 3-week range again at 8300/8350.