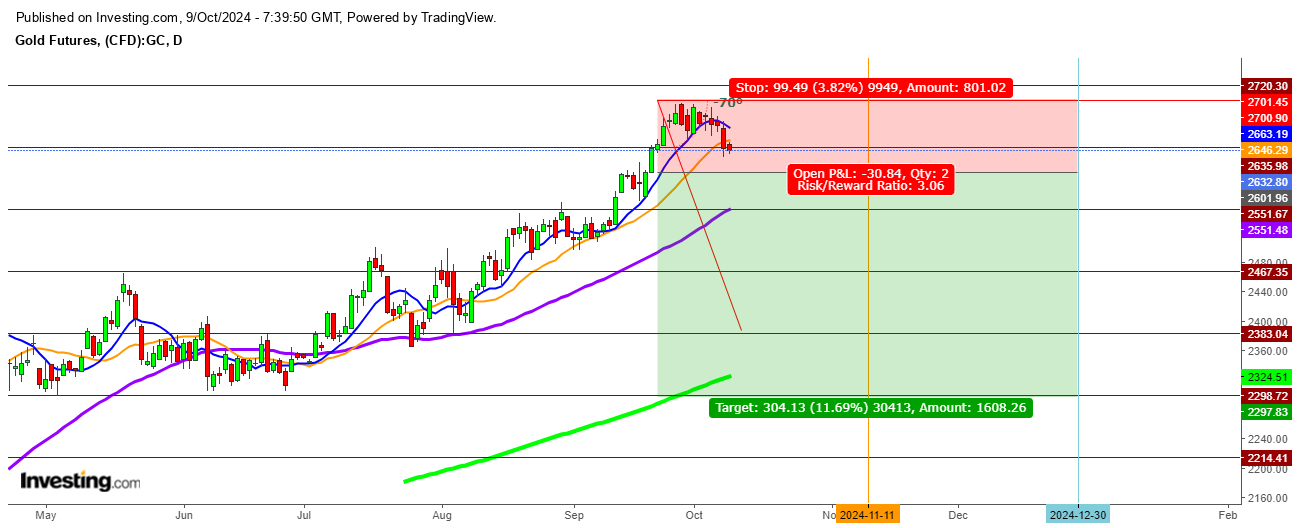

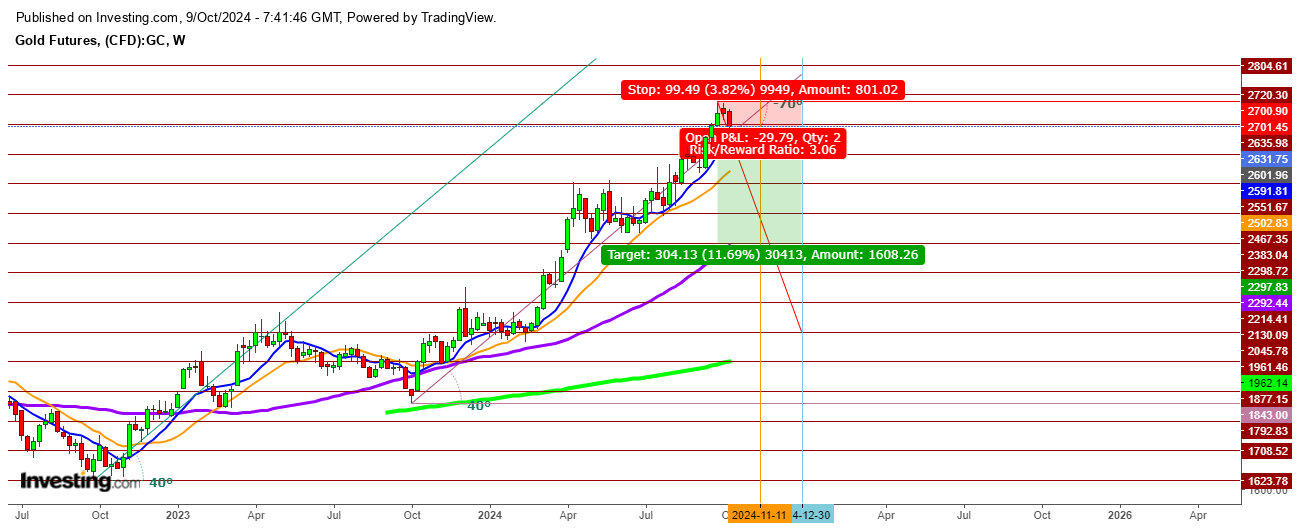

Upon reviewing the movements of gold futures since my last analysis on September 26, 2024, there's a noticeable price fatigue this week, potentially driving gold futures below the $2551 level by the close of this week.

The bullish sentiment surrounding potential interest rate cuts by the Federal Reserve in November has weakened, largely due to the strong dollar.

Another contributing factor is the shift of capital from gold to Bitcoin amid geopolitical uncertainties. Any positive steps toward global peace could push gold futures down to $2297 by year-end.

On analyzing the 1-hour chart, gold futures appear set for further decline after hitting stiff resistance at $2692 earlier this week. The 9 DMA, 18 DMA, and 50 DMA have all moved below the 200 DMA, signaling short-term exhaustion.

On the 4-hour chart, both the 9 DMA and 18 DMA have fallen beneath the 50 DMA, further confirming the ongoing fatigue amid volatile trading conditions for gold futures.

In the daily chart, gold futures are trading below the 18 DMA, with the 9 DMA tilting downward. This bearish tilt suggests that prices could slip below the 50 DMA, currently at $2551, by the week's end.

The weekly chart shows a bearish candle forming, reinforcing the downward trend. Gold futures may test critical support at the 50 DMA, now at $2292, possibly by November 11, 2024.

In conclusion, gold futures remain in a weak position, with ongoing pressure likely to persist.