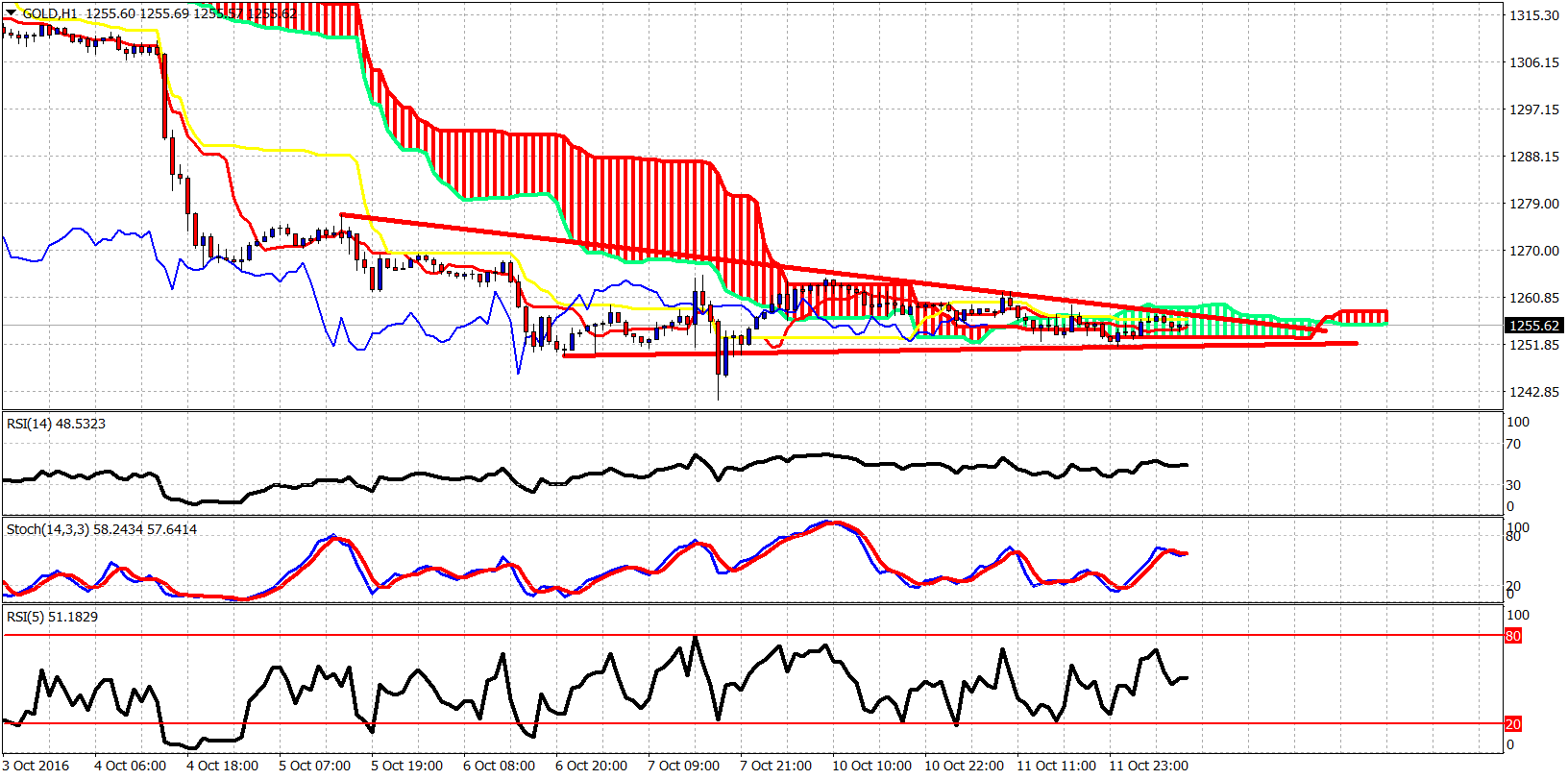

Gold is trading around $1,250, with important Fibonacci retracement on the rise from $1,045 to $1,375. I remain long-term bullish and have been warning that gold would be in danger of a deeper pull back if $1,300 was lost. Price is now at an important support level and a bounce towars $1,300 is expected.

Gold price is in a corrective phase and could very well bounce to $1,300 and then come back down to $1,200-$1,170 to complete the correction. Or it can start a new up-trend from current levels. We will focus on the form of the price action and if we see an impulsive rise we will have more chances of a longer-term upward reversal. The decline in gold is what I believe to be a wave 2 correction that will be followed by a strong upward move that will eventually break above the long-term downward sloping trend-line resistance that price got rejected at $1,375.

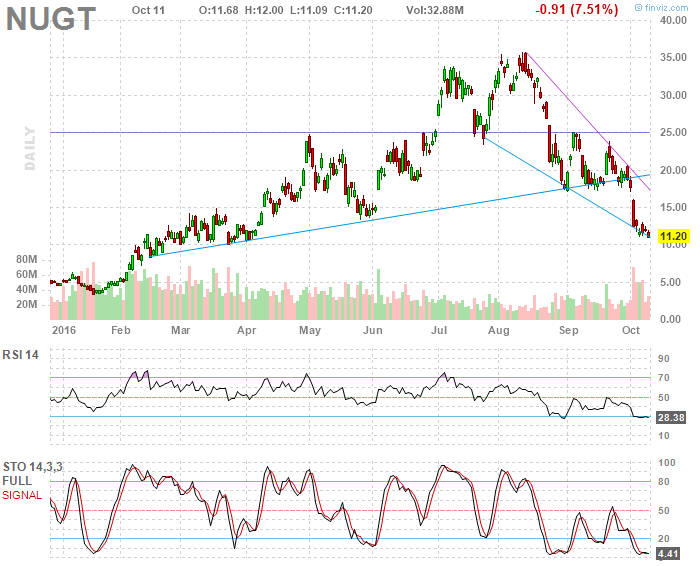

Price could eventually pull back toward the weekly Ichimoku cloud and the 61.8% Fibonacci retracement. This would be a gift for bulls. I’m already long NUGT and will be looking to add to this position.

With a downward sloping wedge pattern and oversold oscillators, price is now trading at the lower wedge boundary and expected to bounce strongly from current levels. A break out of the wedge will signal that the reversal has started.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.