A few months ago, Gold completed what, in time, will be viewed as the biggest Gold breakout in 50 years.

It does not get any bigger or more significant than a breakout from a 13-year cup and handle pattern. The implications are incredibly bullish over the next few years and the next decade.

Most have turned their attention to Silver, and rightfully so. When Gold breaks out and accelerates, Silver can move aggressively.

But Silver is 70% from its major breakout point. That will take time.

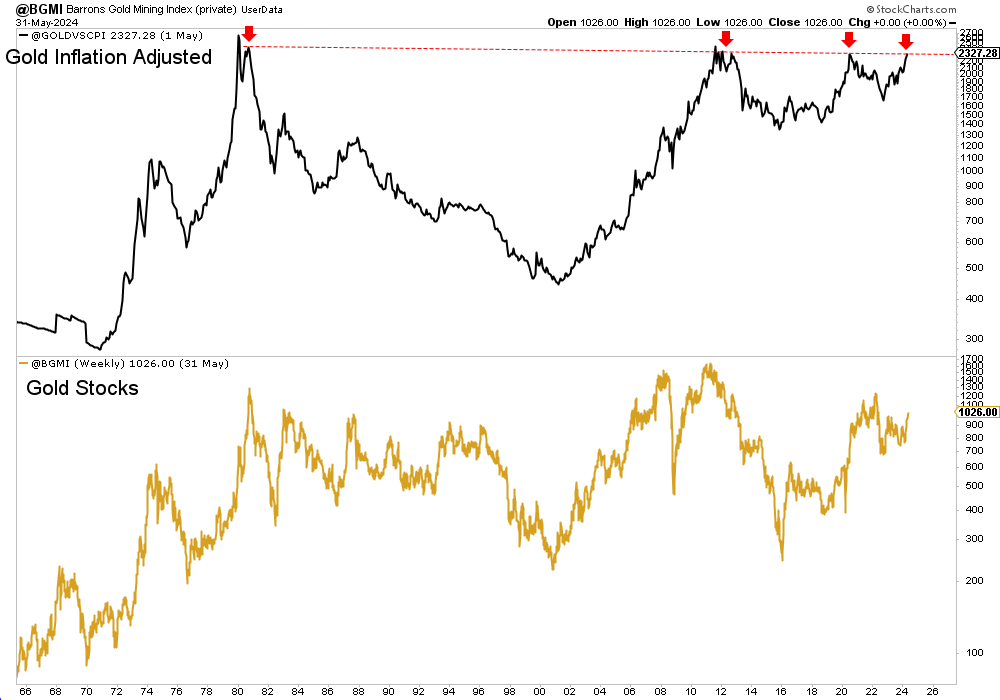

The next big breakout in Gold will be the inflation-adjusted gold price.

I was skeptical of its importance until recently.

The Inflation-Adjusted Gold price is important because it is an excellent indicator of gold miners’ performance. It correlates quite closely with their margins or profitability.

The Inflation-Adjusted Gold price closed May 2024 at a 12-year high and is fairly close to breaking out of a 45-year base. Note that the historical trajectory and shape of the Inflation-Adjusted Gold price is similar to that of Barron’s Gold Mining Index.

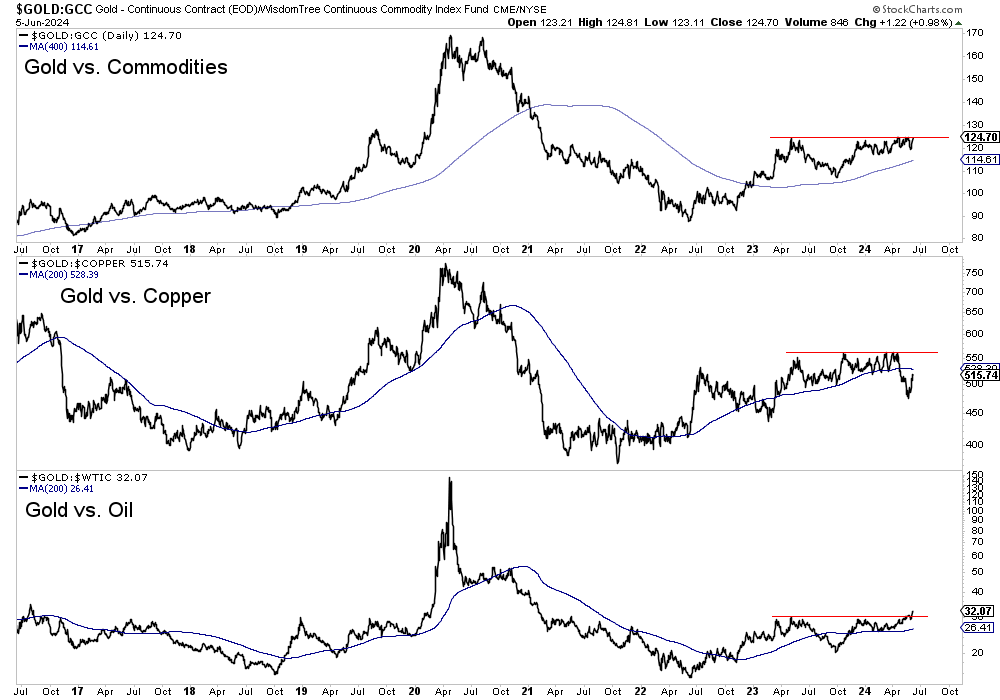

The breakout in the Inflation-Adjusted Gold price would likely transpire amid a slowing economy or outright economic downturn rather than a reflationary environment.

Economic weakness that leads to rising unemployment and lower stock prices, forcing the Fed to ease, is the best catalyst for Gold and gold miners. The Gold price in real terms and mining margins would explode higher.

Recent action indicates we are moving closer to that scenario.

Gold has broken out to a 3-year high against Oil and is very close to making the same breakout against an equal-weighted basket of Commodities. If Gold continues to regain its outperformance against copper, it will be an economic warning.

Recent weakness in precious metals is a welcome opportunity.

It may be one of your last chances to buy quality juniors at good value.

If the next leg up coincides with economic and stock market weakness, miners and juniors will launch higher due to huge gains in the real or inflation-adjusted Gold price.

It remains early in this new bull market, but the bargains and values won’t last.