- Gold falls below $2,700 after double top

- Maintains neutrality within $2,540-$2,720

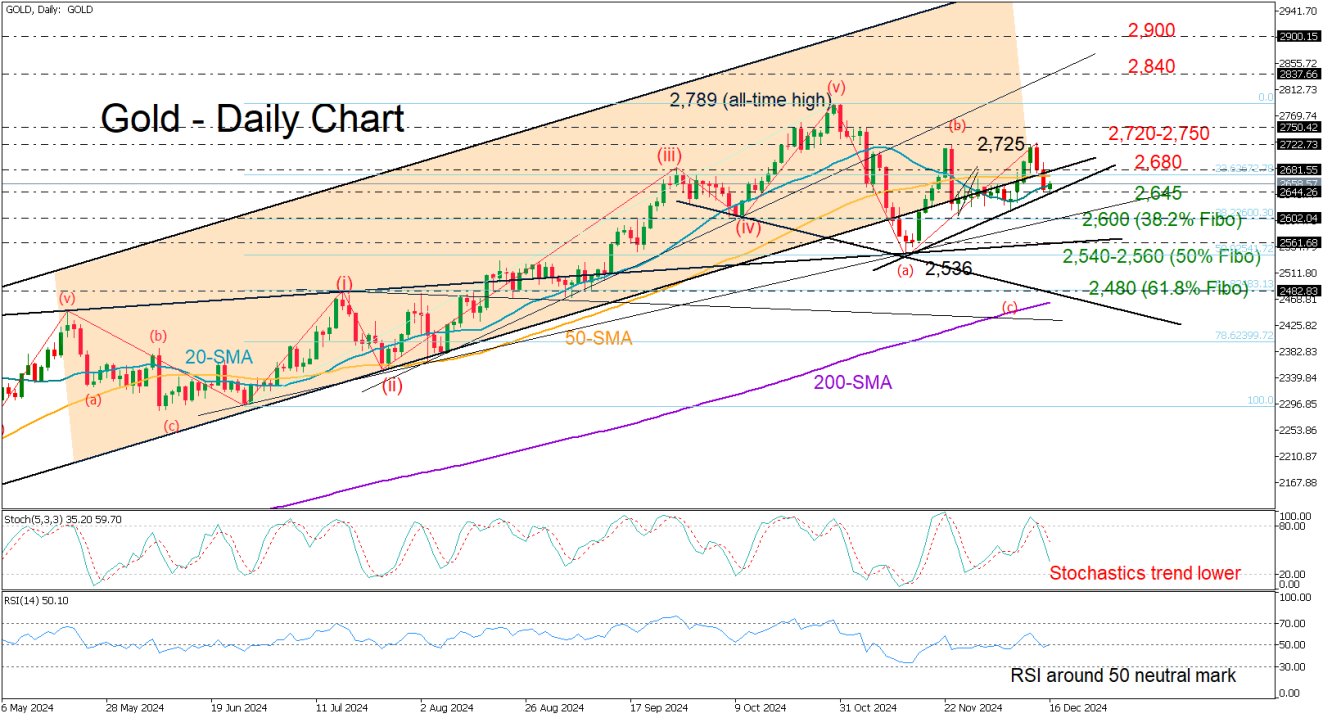

Gold came under renewed selling pressure after the bulls ran out of fuel marginally above the previous lower high of $2,721, unable to initiate a clear bullish reversal.

Volatility was low during Monday’s early European trading hours, with the price being squeezed between the 20-day simple moving average (SMA) at $2,655 and the short-term support trendline from November’s low near $2,643.

With the stochastic oscillator sloping downwards and the RSI struggling to move above 50, there is little optimism for a meaningful rally. A close below $2,645 could prompt fresh selling toward the $2,600 round-level, a break of which may further dampen market sentiment, causing a drop to $2,540-$2,560. Additional declines from there would put the price back in a bearish path in the short-term picture, shifting the focus to the $2,480 area.

For the bulls to keep buying interest alive, they should first reclaim the $2,680 area and then sustainably run above the $2,720 wall. If the $2,750 barrier gives the green light, the price may surpass its record high of $2,789 with scope to mark a new higher high, probably near $2,840.

In summary, the recent pullback in the precious metal kept the neutral market structure intact. This might be an opportunity for traders to exercise their patience. A move above $2,720-$2,750 or below $2,540 is required to provide the next direction in the market.