In my update from a week ago – see here – I wondered, “Should you buy (gold) now, or maybe later?”

I used the Elliott Wave Principle and Technical Analyse for the Exchange Traded Fund GLD (NYSE:GLD) to answer the question more objectively, and found:

“… it may be more advantageous to wait for the next pullback before entering GLD. As long as $179 holds, I expect higher prices.”

One week later, and here we are, GLD bottomed yesterday at $179.43, and those who said last week “buy now, gold is going to $2,500+!” based on Fear Of Missing Out (FOMO) had to sit through a 6-8% correction over the last few days already. That is not the proper way to trade and invest. Objective, time-tested analyses, and tools are the way to go. That does not mean losses can always be avoided. Not at all, as no technique is flawless, but the EWP and TA can help significantly in minimizing losses. And that is rule number one in trading as the upside will take care of itself.

Last week I wrote:

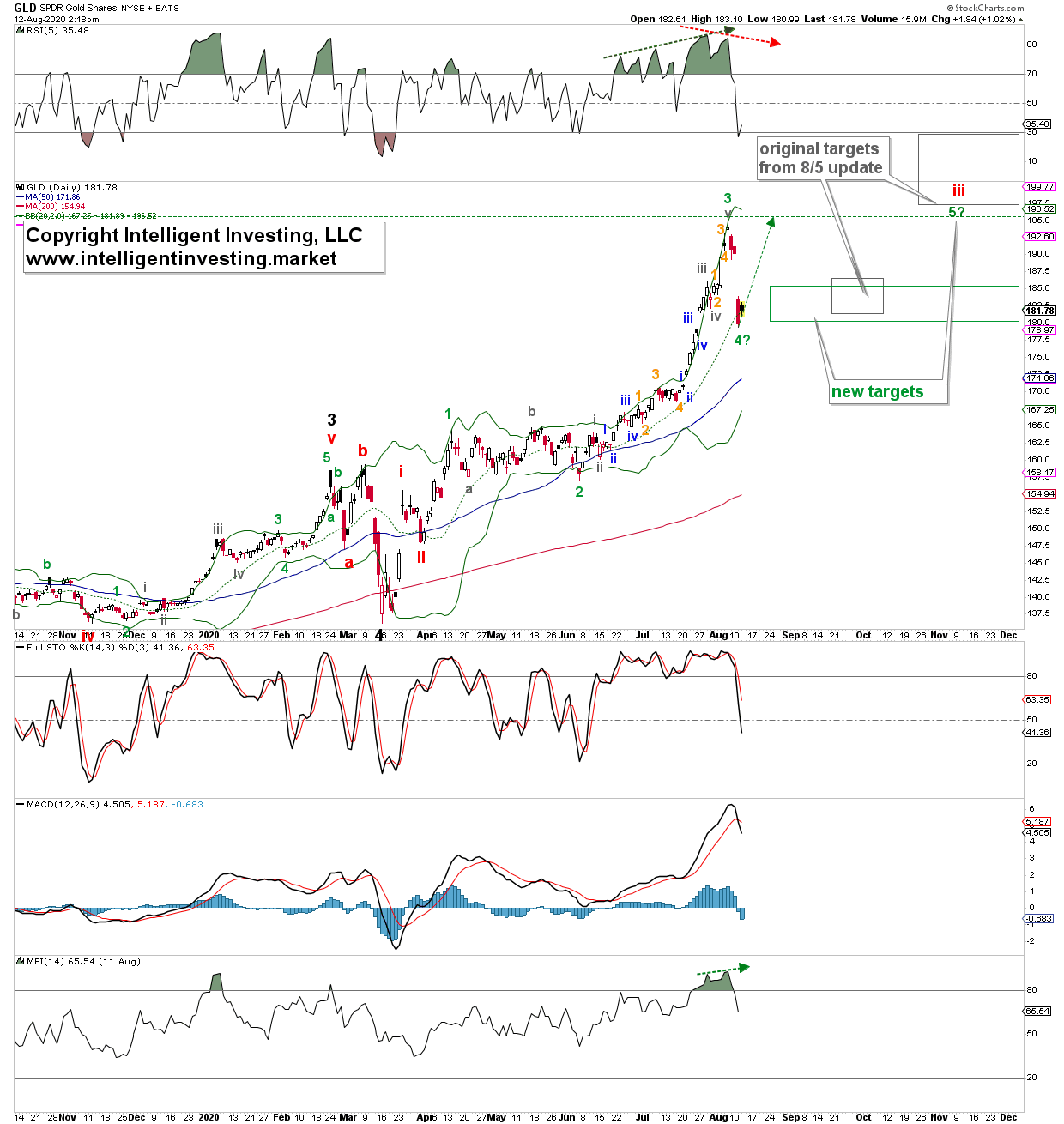

“Some negative divergences (red dotted arrows) are creeping in, foretelling us of a potential pullback before resuming higher considering the current strength. In EWP-terms, I would label the current advance as green wave-3, the pending pullback as wave-4, and then the next more significant rally as green wave-5.”

Well, the pullback indeed came and most likely surprised many. Not me. It was right on cue: clockwork. See figure 1 below.

Figure 1. GLD daily candlestick chart with EWP count.

Last week I also wrote:

“As long as the green wave-4 pullback holds the $179 level on a closing basis, I anticipate GLD to reach $197.50-213.00 for wave-5. This price target zone is rather large at this moment because I do not know yet how low wave-4 will go, and how much wave-5 will extend. The 5th waves are often between 0.618 to 1.000x the length of wave-1. Once that upper target zone is reached, it should complete red wave-iii. GLD should then experience another (larger) pullback, wave-iv, which will hold above the green wave-4 low at ideally around $185-188, before an even more significant 5th wave to new uptrend highs (think mid to high $200s) should take place.”

With the additional price action over the last few days at hand, I adjusted the green wave-4 and wave-5 price target zone for my premium members from the old (grey) ones to the new green ones. GLD bottomed right at the lower end of the wave-4 target zone, which is the 38.20% retrace of the entire green wave-3. Quite common for a 4th wave. Thus, as long as yesterday’s low holds, I expect wave-5 to be under way and target, ideally, just a little bit lower than I anticipated last week (because I now have additional price data at hand) at $195.50 for a wave-5 = wave-1 relationship. If the instrument moves below yesterday’s low then next support is at the $170-172 region, where the 50-day Simple Moving Average currently resides. That is an additional 6-7% loss, and not something I would like to sit through as it also means GLD is then going through a much larger correction then anticipated.

Hence, using the EWP, I now have a clear, well-defined path forward with clean, simple stops that – if hit – will only result in small losses (~2%). No guesses, no arbitrary 5 or 10% stops that the algos easily sniff out. If the stop does not get hit, then the upside is worth it: ~6-7%. Thus, there is a 1-to-3 risk/reward ratio currently. Not too bad.