Talking Points

- FOMC Announcement in Focus Amid QE “Taper” Speculation

- Crude Oil Likely to Fall if Fed Opts to Scale Back Stimulus Effort

- Gold Technical Positioning Hints at a Possible Reversal Ahead

Commodity markets are likely to be singularly focused on today’s pivotal FOMC monetary policy announcement. On balance, the case for “tapering” the size of monthly QE asset purchases looks compelling:

- Fiscal drag fears – already on the decline since end of the government shutdown in mid-October – appear to have all but faded after Congress secured a two-year budget deal last week;

- US economic data has increasingly outperformed relative to market forecasts since the beginning of November (according to data compiled by Citigroup);

- Finally, near-term inflation expectations have started to perk up, with the 1-year breakeven rate (a measure of the price growth outlook priced into bond yields) surging in late November to the highest level since mid-April.

Still, a survey of economists polled by Bloomberg suggests the baseline consensus view still favors a “no change” outcome, with only about 1 out of every 3 respondents looking for some kind of cutback in stimulus. That means volatility is in the cards as investors jostle to readjust portfolios in the event that a reduction of QE does materialize.

An outright decline in the amount of monthly asset purchases stands to boost the US Dollar. This creates a de-facto headwind for commodities benchmarked against the greenback, including gold and crude oil. Precious metals would be likewise vulnerable to erosion of inflation-hedge demand. Meanwhile, the WTI contract may be pulled into a larger risk aversion selloff. A panic swept financial markets in the spring and summer when the idea of “tapering” first emerged; if fears of rising funding costs yield the same outcome this time, the spectrum of cycle-sensitive assets may decline in tandem.

A decision to withhold any changes to existing policy this time around that is coupled with taper-supportive cues in the Fed’s updated set of economic forecasts and/or Ben Bernanke’s press conference may yield similar (albeit probably less dramatic) results. The move may be likewise diminished if the Fed – fearing a repeat of the volatility burst in the first half of the year – opts to soften the blow to sentiment by coupling a smaller asset uptake with a lowering of its unemployment or inflation thresholds.

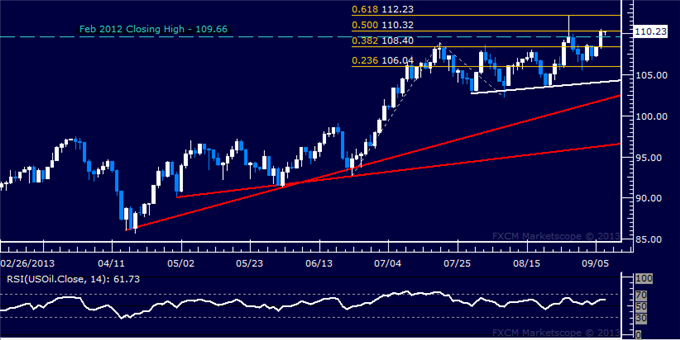

CRUDE OIL TECHNICAL ANALYSIS – Prices declined as expected after putting in a bearish Dark Cloud Cover candlestick pattern. Support is in the 95.36-74 area, marked by the 14.6% Fibonacci expansion and the November 6 high. A further push below that eyes 93.90, the 23.6% Fib. Resistance is at 98.74, the October 28 high.

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD TECHNICAL ANALYSIS – Prices may be carving out a bullish Head and Shoulders bottom chart formation. Confirmation requires a close above resistance in the 1260.84-68.84 area, marked by the October 11 low and the 38.2% Fib retracement. A break higher initially exposes the 1286.57, the 50% level. Near-term support is at 1211.44, the December 6 low.

Daily Chart - Created Using FXCM Marketscope 2.0

-- by Ilya Spivak, Currency Strategist for DailyFX.com