Gold fell sharply last week as a strong US Non-Farm Payroll result stoked speculation of a rate hike in December. The NFP result came in well above forecasts at 271k which caused gold to immediately come under selling pressure and close at $1089.21 an ounce. However, as the US labour market firms so does the chances of a rate hike, which could spell disaster for the precious metal.

Following the surprise NFP result, gold experienced some serious selling pressure as the precious metal formed a new three month low. This has been compounded with a virtual public relations blitz by the Federal Reserve members suggesting that the conditions are now ripe for an interest rate hike in December. It would appear that even the dovish members of the FOMC are now pointing to decisive action on rates. Subsequently, as we near December expect to see a risk-off approach to the metal along with the respective price falls.

Looking at the week ahead, gold is likely to remain under pressure as the US Unemployment Claims and Core Retail Sales figures fall due. Traders will be watching these indicators closely, in particular, for signs that the labour market has finally reached full employment. Also, watch out for the bevy of speeches due from FOMC members this week as they are likely to confirm a hawkish bias and add to gold’s mounting selling pressure.

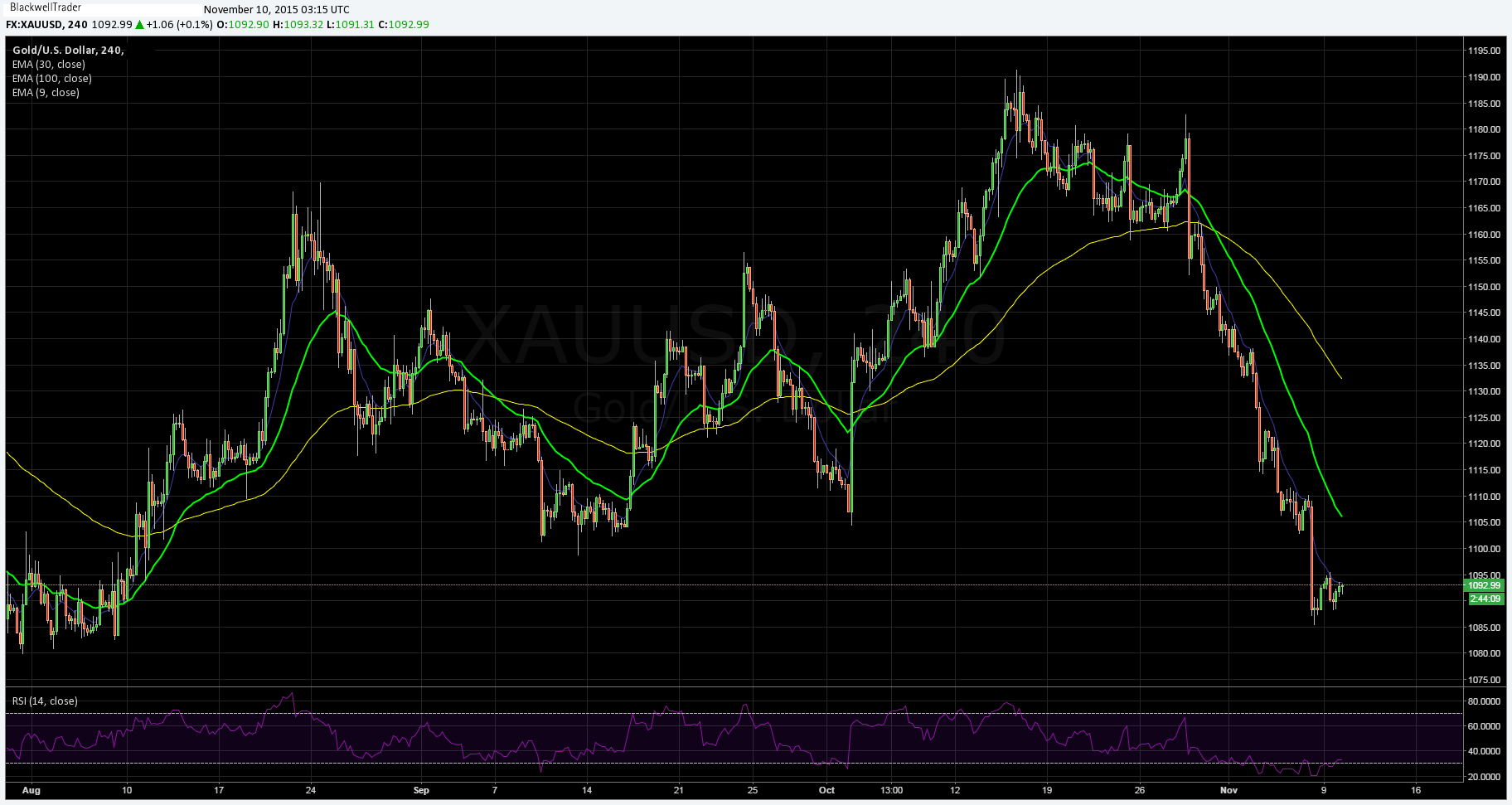

From a technical perspective, gold has fallen strongly back below the short term bullish trend line. The 12 and 30 EMA’s have also subsequently turned sour as they decline below the 100-Day moving average whilst the RSI oscillator continues to decline sharply, albeit within over-sold territory. Support is currently in place for the pair at $1082.17, and $1072.01. Resistance exists on the upside at $1114.00, $1156.83, and $1191.38.

Ultimately, gold’s fate remains inexorably linked to December’s FOMC meeting outcome. Subsequently, watch out for risk of a rate rise to be priced into the commodity as we move closer to December, because further falls are likely.