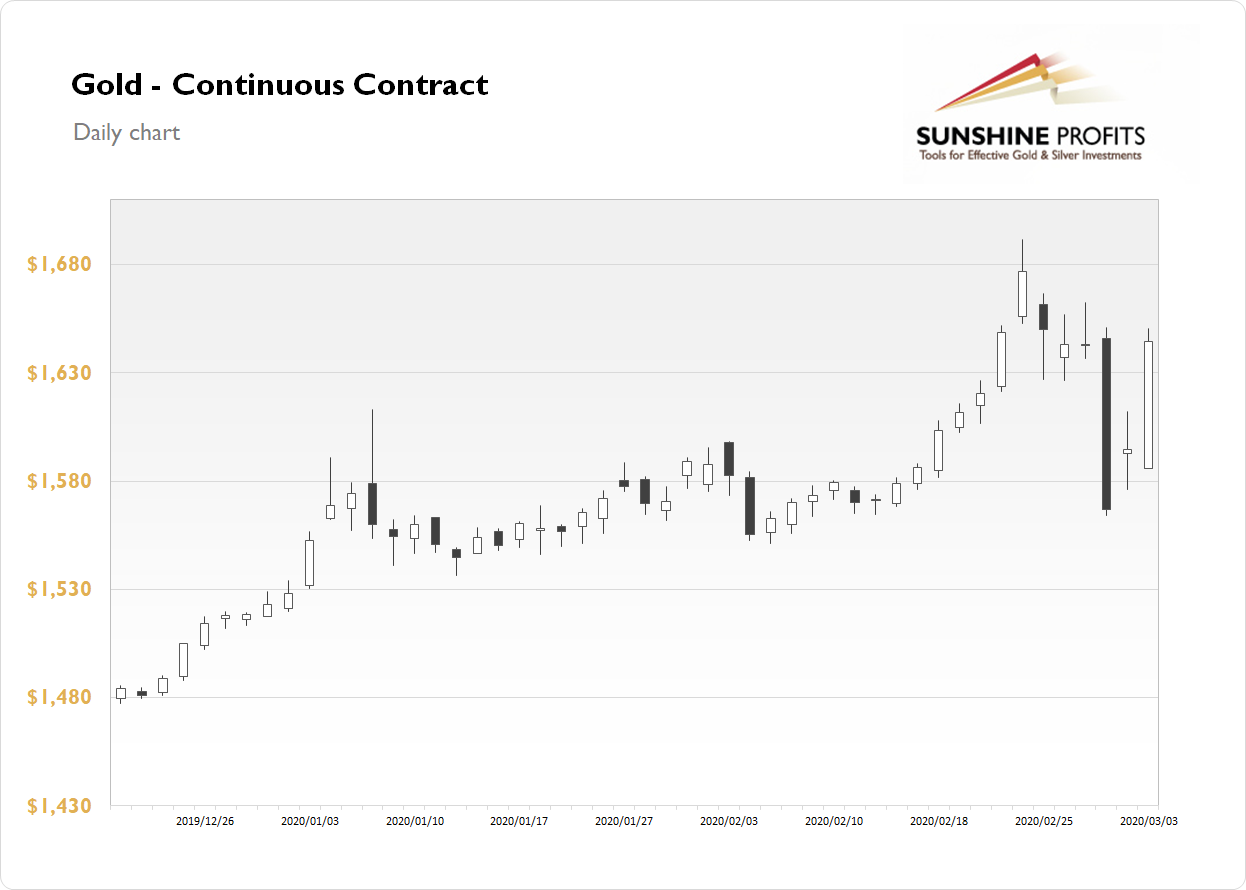

The gold futures contract gained 3.11% on Tuesday, as it retraced Friday’s sell-off after surprising Fed’s interest rate cut at 10:00 a.m. On Friday the price collapsed to $1,564.00 level, despite the ongoing coronavirus scare. The recent short-term volatility marked a topping pattern before that sell-off. Tuesday’s quick retrace may be suggesting that volatility will remain elevated. Investors were buying safe-haven asset amid coronavirus outbreak, economic slowdown fears recently. But then gold bounced off $1,700 mark and reversed its uptrend. On Friday the price reached local low of $1,560. Yesterday the market got back closer to $1,650 level.

Gold is gaining 0.4% this morning, as its price fluctuates along yesterday’s daily high. What about the other precious metals? Silver gained 2.68% yesterday. Today it gains 0.2%, as it retraces some more of Friday’s sell-off. However, it remains relatively much weaker than gold. Platinum gained 1.15% on Tuesday. It is trading close to local lows following Friday’s sell-off. Right now, the metal is 0.5% lower. Palladium lost 1.66% yesterday, as it extended its short-term downtrend. Today it is trading 0.8% lower.

The financial markets went full risk-off last week, as coronavirus fears dominated the news. Then we saw a quick Friday’s-Monday’s relief-rally. Yesterday’s Fed’s rate cut decision marked another short-term local high and the risk markets turned lower. However, investors’ sentiment is improving again this morning.

Tuesday’s Caixin Services PMI number release from China showed a very big virus impact on the Chinese economy, as it fell much below expectations (26.5 vs. 48). Today we will get the ADP Non-Farm Employment Change at 8:15 a.m. and the ISM Non-Manufacturing PMI at 10:00 a.m. There will also be the Bank of Canada Rate Statement along with the Overnight Rate release at 10:00 a.m. On Friday we will get the important U.S. monthly jobs data release. Take a look at our Monday’s Market News Report to find out more!

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.