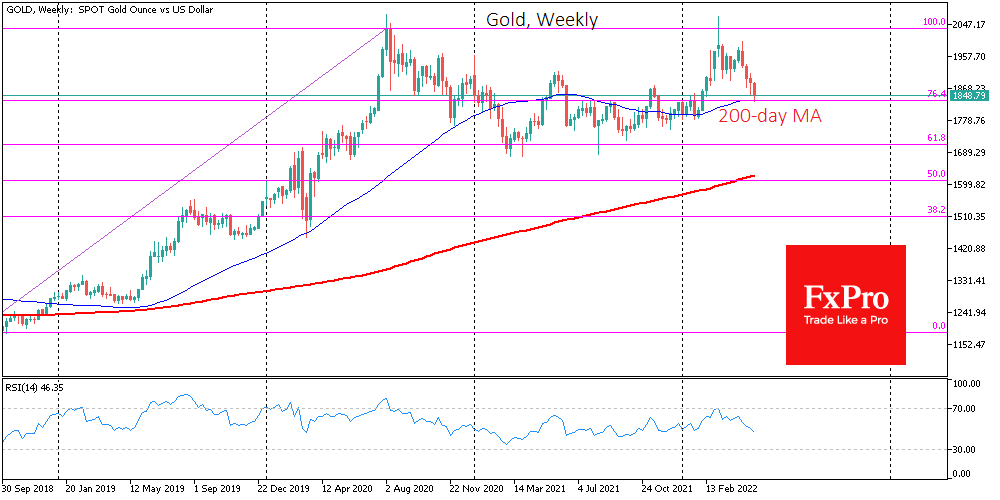

Gold dipped to $1832 on Wednesday morning, pulling back to a critical support line in the form of the 200-day moving average, losing more than 11% from the peak levels reached in early March.

Gold has been under systematic pressure for the past month and a half amid a rally in the dollar. In addition to this increase in the underlying price, gold has lost buyers amid a jump in US government bond yields.

However, it is too early to talk about a break in the uptrend in gold, but only a retreat into deep defenses ahead of essential data.

Most of the time, the correlation between inflation expectations and long-term bond yields governs the dynamics in gold. Weak real bond yields lead to a pull in the precious metal as investors look to protect the purchasing value of capital.

With high-interest rates and inflation control, investors prefer to earn yields in bonds by selling off gold. A significant event for the gold outlook is today’s US inflation release. The market reaction to this event could be decisive for gold in the coming days or weeks.

Consolidation below $1830 on the day would be an essential bearish signal that could rapidly decline towards $1800. Moreover, there would be an immediate question of double-top formation through 2020 and 2022 peaks as an early signal of a long-term downward trend with a potential of $1200.

If gold manages to develop a pullback from current levels, we could see a sharp increase in buying over the next few days, as we did in early February and late November. But unlike those episodes, this time, the bears might not wait for a quick reversal, and a further rally would be an important signal that gold continues to claw its way out of the prolonged correction.

In this case, the nearest stops might be the levels near $1900, and further, the market might quickly target a renewal of the historic highs above $2075 before the end of the year.