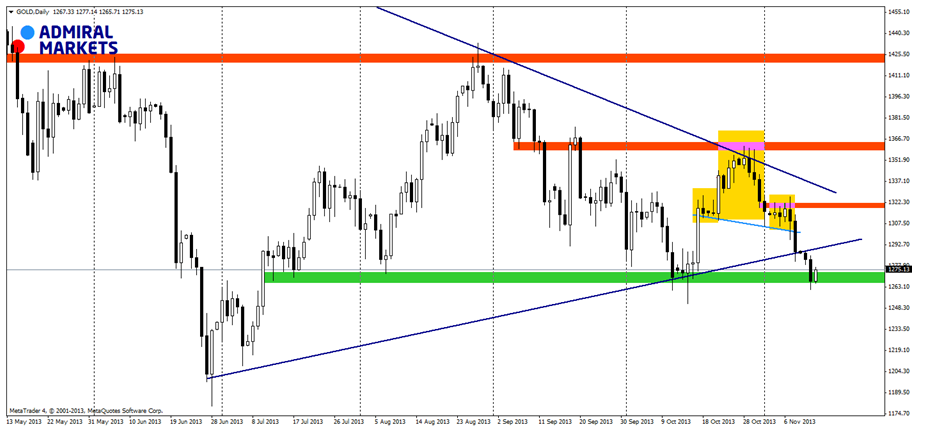

Gold is now paying the price for the weakness in the end of October when buyers failed to break the Upper Line of the triangle, being that it is at the same time the long-term bearish trendline. Retracement was shaped as a Head and Shoulder formation (yellow areas). Currently, sellers are close to fulfilling the minimum target of this formation. What is more important, the price broke the lower line of the triangle which is a very bad sign for buyers in the long-term. This fact triggers a sell signal with the potential movement to the levels from the end of June.

Wednesday starts with an upswing which is a natural reaction as price is at the 1,270 USD/oz. support and suffered four consecutive bearish days in a row. This upswing should not change much, unless it retraces the price back into the triangle. Chances for that are low and the base scenario promotes sellers.

Furthermore, we can see that the recent Head and Shoulders formation is a part (right shoulder) of the bigger H&S formation which has the 1,270 USD/oz. (green area) as neckline. Breaking the 1,270 USD/oz. can have a huge negative impact on the price of Gold, but currently, it is too early to say that this will definitely happen.