Gold slumped to a four week low in early New York trading, weighed by more weak Chinese data and worries that a Fed rate hike may come sooner than many were anticipating. The latter has weighed on U.S. Treasuries and underpinned the dollar.

HSBC/Markit flash manufacturing PMI for China slipped to 48.1 in March, below market expectations, versus 48.3 in February. This keeps the Chinese slowdown meme firmly in place, raising concerns about the overall health of the global economy. PMI numbers disappointed in Europe and the U.S. today as well.

U.S. Markit flash PMI retreated to 55.5 in March, down from 57.1 in February. Amid the ongoing focus on the labor market, it’s worth noting that the employment component fell to 53.9 in March, versus 54.1 in February. This is not, however, likely to alter the Fed’s taper trajectory.

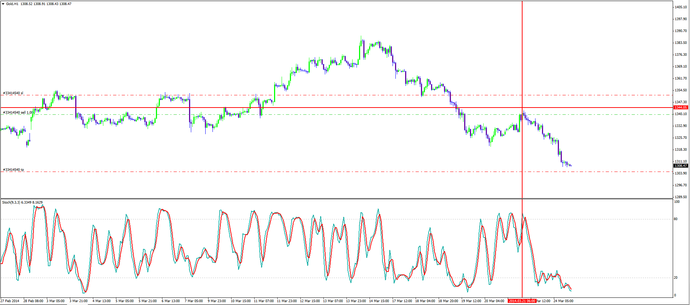

Technically gold has turned down from its resistance zone of 1344 level after a clear breakout from its major support level. Gold is trading at 1308 levels and our next major support zone is at the 1280 level. We can expect a strong correction from the 1280 support level.