- Gold prices are trending down due to a lack of safe-haven bids and a strong US Dollar.

- Upcoming US jobs data and interest rate decisions will significantly impact gold’s future performance.

- September is historically a challenging month for gold, which could further influence its trajectory.

In the early European session, gold prices (XAU/USD) continued their downward trend as the precious metal struggled to attract haven bids. Known for its challenges during September, gold faces a potentially rocky path, especially with high prices inviting profit-taking.

Additionally, looming rate cuts, which might already be factored into market expectations, could further influence gold’s trajectory. As we navigate this month, investors should remain vigilant of these trends in the precious metals market.

Recent Chinese data has reignited concerns about demand, putting pressure on the metals market. Despite expectations that recession fears would boost safe haven demand for precious metals, akin to the Japanese Yen, gold has struggled. This difficulty is compounded by the strength of the US Dollar, which continues to exert downward pressure on gold prices.

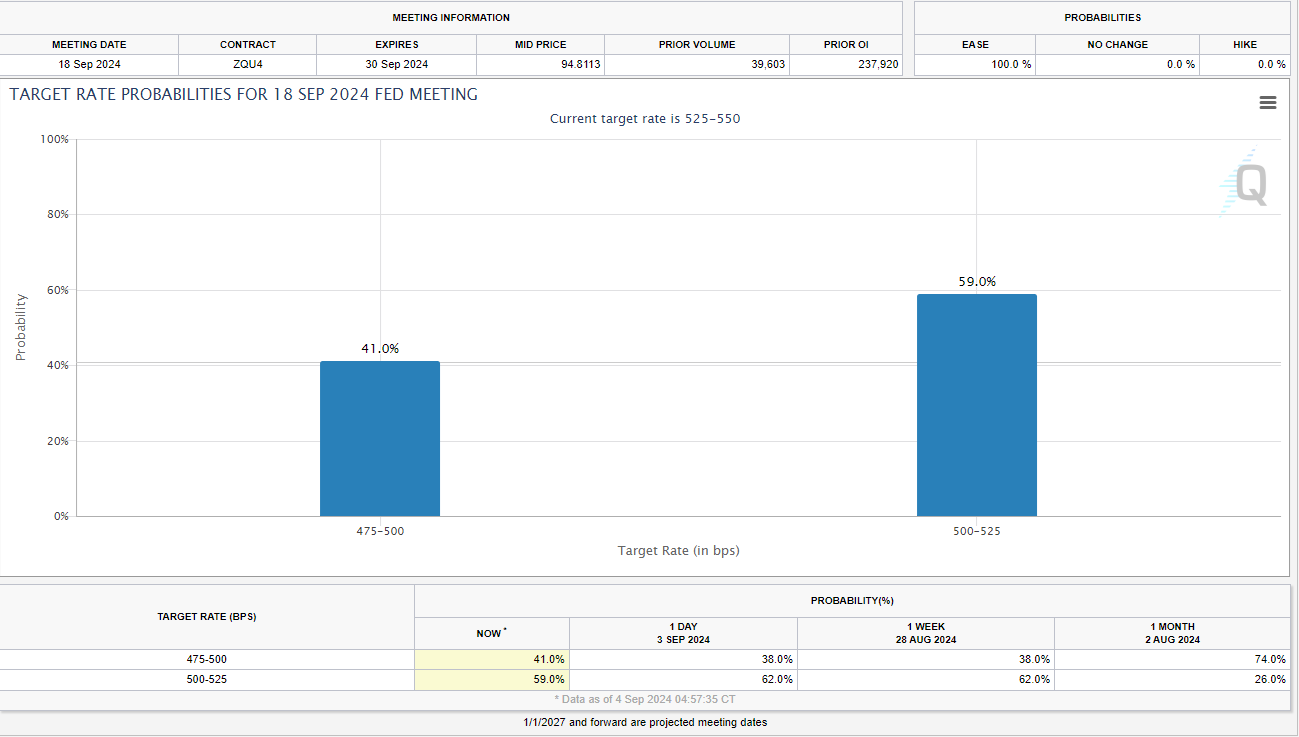

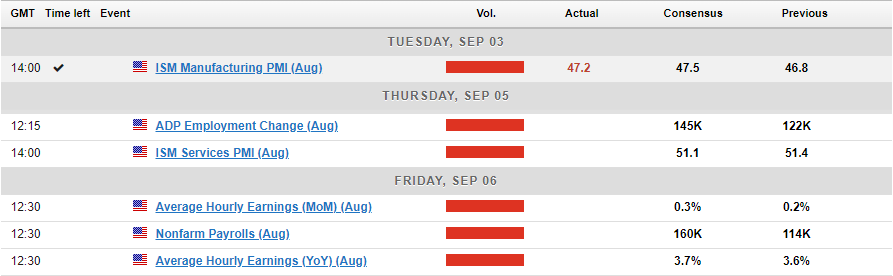

As markets brace for a potentially strong jobs report, ongoing recession concerns linger. Economists surveyed by Reuters predict that the US economy added 160,000 jobs in August, rebounding from July’s figure of 114,000. A solid report could ease recession fears and support a 25 basis point rate cut by the Federal Reserve on September 18.

Conversely, a weaker jobs report and rising unemployment could amplify recession worries, potentially boosting gold prices. However, any upside for gold might be limited, as much of the anticipated 25 basis point rate cut seems already priced in. This raises the question of whether the prospect of a 50 basis point cut could drive gold to new highs. As the jobs report date approaches, market expectations for a larger rate cut are gradually increasing, reflecting the shifting sentiment.

Source: CME FedWatch Tool

September has historically been a challenging month for gold, often coinciding with strength in the US Dollar, which could pressure gold prices in the medium term. Should the Federal Reserve implement a 25 basis point rate cut, we might see market participants engaging in the classic strategy of ‘buy the rumor, sell the fact’ during the Fed’s September meeting.

In the lead-up to Friday’s nonfarm payrolls (NFP) and jobs report, several other US economic indicators are poised to influence the dollar and recessionary concerns. Today, JOLTs job openings and US factory orders will be released, potentially offering further insights into the manufacturing sector after a disappointing PMI figure.

Thursday promises an even more impactful release with the ISM Services PMI, crucial for the US, which has largely transitioned to a service-oriented economy. This data is expected to set the stage for Friday’s much-anticipated jobs report, which will be closely watched by market participants.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, the four-hour gold chart presents some intriguing developments. It appears a double bottom pattern may have formed, suggesting potential upside movement. However, there’s an immediate challenge in the form of the 100-day moving average at 2495.85, which needs to be surpassed to confirm further gains.

Breaking above 2500.00 will be crucial, yet it must sustain these gains, especially with the upcoming jobs report, as any upward movement could trigger profit-taking and repositioning by traders.

Last week’s triangle pattern breakout, detailed in my previous gold analysis, has reached 2472, a previously identified target. This supports the possibility of an upward retracement, although the extent of this retracement remains uncertain.

On the downside, a decline would first need to breach the 2472 mark before the 200-day moving average and the psychological level of 2450 become pivotal points of focus.

GOLD (XAU/USD) Four-Hour (H4) Chart, August 23, 2024

Source: TradingView

Support

- 2472

- 2450

- 2432

Resistance

- 2495

- 2513

- 2531

Most Read: Brent Crude – Oil Slides on Renewed Demand Fears, Brent Back at $75 a Barrel