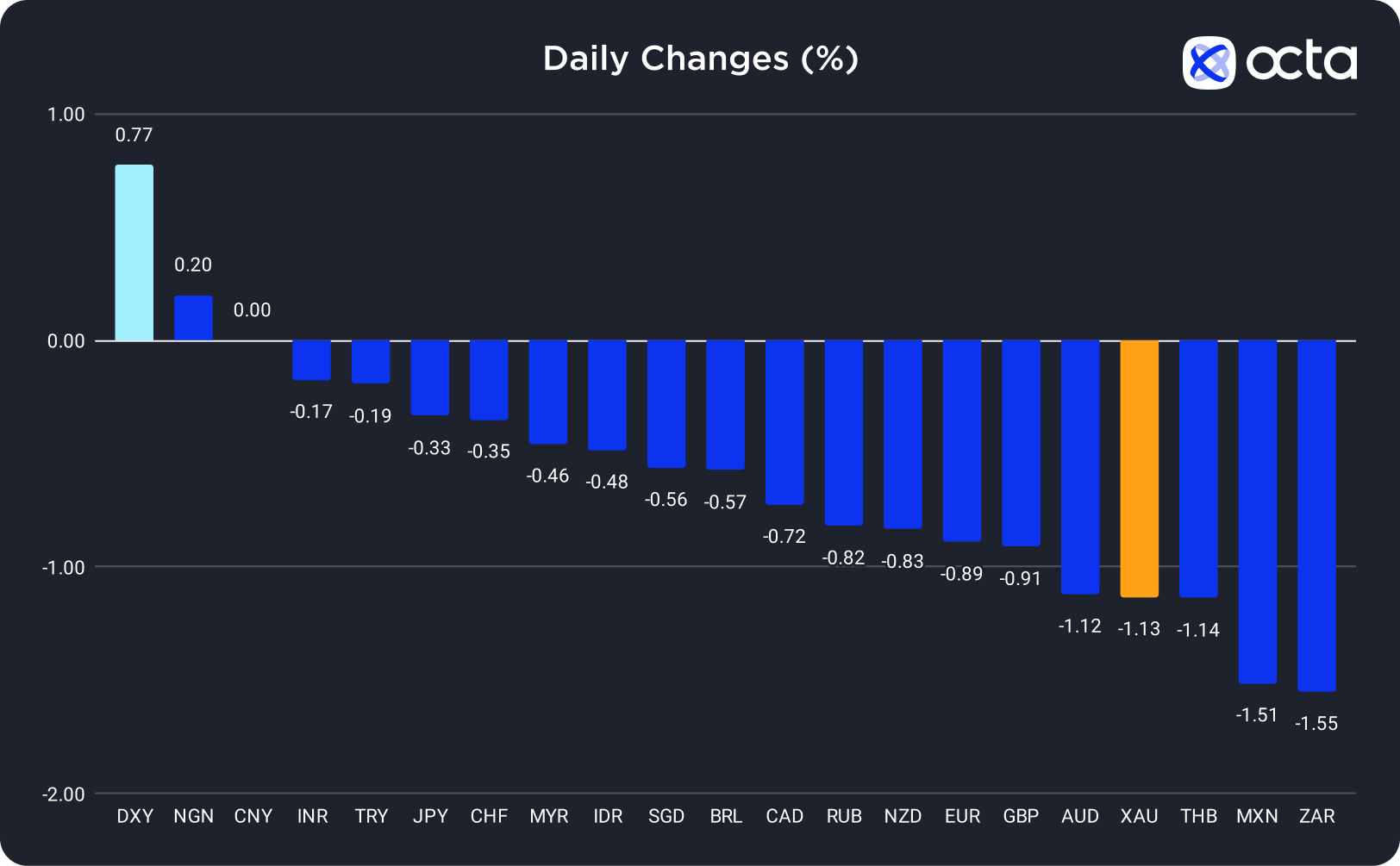

On Monday, the US Dollar (DXY) was the best-performing currency among the 20 global currencies we track, while the South African rand (ZAR) showed the weakest results. The Nigerian naira (NGN) was the leader among the emerging markets, while the Australian dollar (AUD) underperformed among majors.

Gold Remains Under Pressure as the US Dollar Sets a New Multi-Month High

Gold (XAU) continued falling on Monday for the sixth consecutive session after the U.S. Manufacturing Purchasing Managers Index (PMI) came out better than expected, further cementing the view that the Federal Reserve (Fed) would maintain its hawkish monetary policy.

Yesterday, the report published by the Institute of Supply Management showed that U.S. manufacturing contracted at the slowest pace in ten months. Later in the day, Michelle Bowman, the Fed official, expressed her readiness to back an additional rate hike in an upcoming session if the data indicates that inflation is not slowing. Solid macroeconomic reports coupled with the hawkish stance from the Fed bolstered the US dollar, which, in turn, exerted downward pressure on gold. Furthermore, the interim solution to prevent the U.S. government shutdown diminished the likelihood of investors seeking refuge in gold.

"There is a reckoning that interest rates are going to be higher for much longer, which has been the bearish element in the precious market. Gold prices could go below $1,800 in the near term," said Jim Wyckoff, senior analyst at Kitco Metals.

XAU/USD was declining during the Asian and early European sessions. Today, investors should focus on the release of the U.S. Job Openings report due at 2 p.m. UTC. Lower-than-expected figures will positively impact XAU/USD, potentially pushing the price above 1,830. However, the bearish trend in XAU/USD may continue if the figures come out better than expected.

"Spot gold may end its fall around $1,804 per ounce, as suggested by its wave pattern and a projection analysis," said Reuters analyst Wang Tao.

Australian Dollar Drops as RBA Shows No Willingness to Hike

The Australian dollar (AUD) lost 1.12% on Monday as the U.S. dollar surged higher due to better-than-expected macroeconomic reports from the U.S. and hawkish comments from the Federal Reserve (Fed) officials.

AUD/USD has dropped to an eleven-month low as the likelihood of another rate hike from the Fed in December almost reached 50%, according to the CME FedWatch tool, thus widening the bearish divergence between the U.S. and Australian monetary policy. Indeed, the Reserve Bank of Australia (RBA) held interest rates steady on Tuesday for the fourth month and expressed no urgency to hike. Although its post-meeting statement warned that further tightening might be needed, the details and outlook were uncertain.

"Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks," said Michele Bullock, the RBA Governor.

Thus, the interest rate differential (the yield gap) between the AUD and USD still favors the greenback.

AUD/USD was declining during the Asian and early European sessions. Today, investors should focus on the U.S. macroeconomic calendar, which features the Job Openings and Labor Turnover Survey release at 2 p.m. UTC. If the number of vacancies turns out to be significantly lower than the 8.8 million expected by the market, AUD/USD may reverse sharply, possibly towards 0.64000. Alternatively, a strong report may push the Aussie towards 0.62700.