Gold and silver have been shifting down the charts over the last month, and it’s easy to see why, given the recent positive view of the United States' economy and the prospect of rising future interest rates.

On the charts, gold has continued to trend downward and there is a long term possibility of a trend line coming into play on the charts. But for the moment there are more pressing technicals to focus on in the form of moving averages and key levels that market players will be watching. Also the fundamental news out from the US will have some significant impact.

Retail sales due out tonight have always had a big impact on the USD, as the consumer sector has been driving home a large portion of the recovery, and for the most part has allowed markets to be somewhat bullish. Additionally, you also have unemployment claims which is always a big mover for gold, and so far the market keeps underestimating it and ending up with big moves lower as a result.

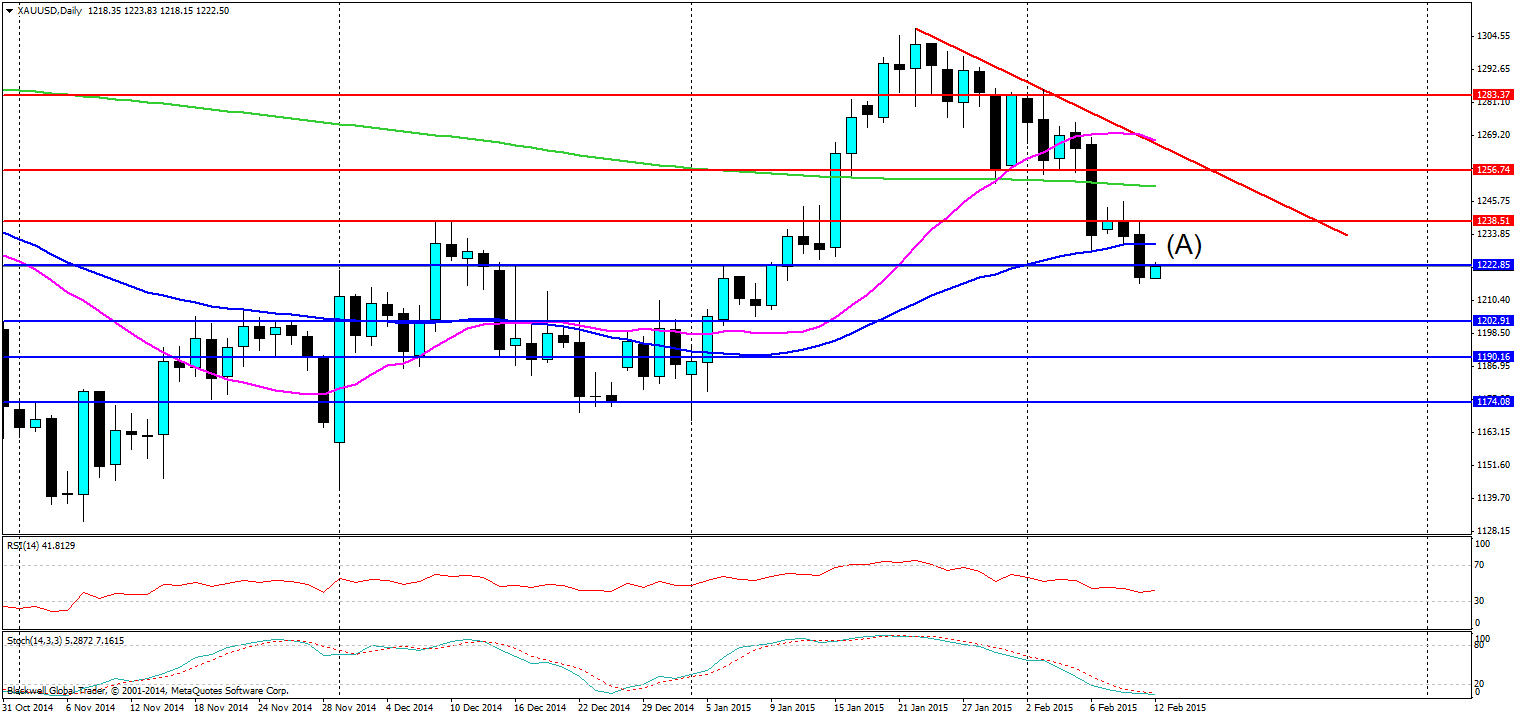

Either way, the charts are telling us that a failure to test the 1222.85 level at (A) is likely to lead to moves lower as it shows that there are buyers lacking who are willing to fight the current downturn in gold prices.

If we do see a break upward I would be very cautious of the 50 MA as it is very likely to act as dynamic resistance as it previously acting as dynamic support before it broke. Either way it’s worth taking note of this point and the 200 MA which in addition has acted as a level in the market.

Overall, gold has a good day ahead of it in trading and playing of these key levels will be vital for the majority of traders.