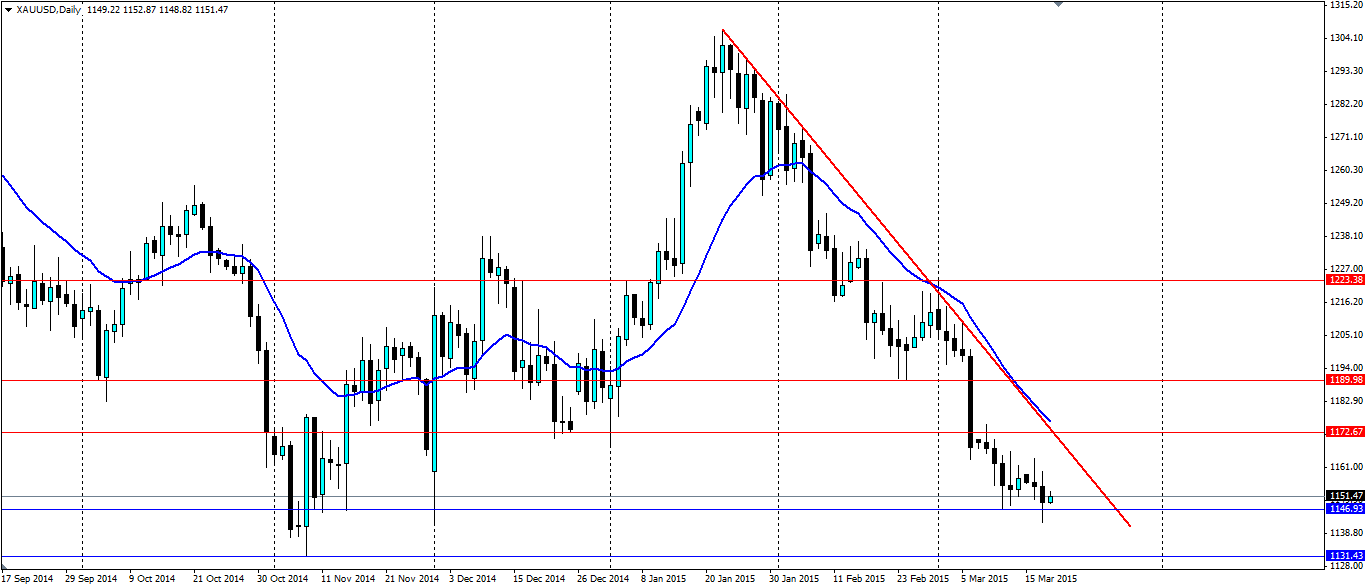

The gold market is looking to target the lows found back in November last year ahead of the FOMC meeting later today. With the prospect of interest rate rises by mid-year, these lows will be tested sooner or later depending on Yellen’s stance today.

(Source: Blackwell Trader)

The Federal Open Markets Committee is unlikely to change the current interest rate at the meeting later today, the market agrees on that much. But as for the timing of the first interest rate hike in almost seven years is still up for debate.

Judging by the bearish trend in the gold market it is fair to say the market is beginning to expect a rate rise in the months ahead. For this reason the low at $1,131.43 per ounce of gold found on Nov 7th, 2014 is likely to come under pressure in the medium term.

If Yellen does give some clarity about her intentions of when to raise interest rates, we will see the recent low come under immediate pressure. But will she? For some time now she has remained committed to raising rates by “mid-2015”, but that could mean anything really, and even then it’s no guarantee she will. But given the recent strong labor market, rising consumer sentiment, and strong GDP growth, it’s a possibility she may be less cryptic than “mid-2015”.

On the other hand there is inflation, or lack thereof. With low inflation, it would be difficult to justify a rise in rates since interest rates are the main tool to fight high inflation.

If Yellen remains “patient” in her outlook on rates and cites low inflation as the cause, then gold will likely put the bearish trend under pressure and look to breakout to the bullish side in the short term. In the longer term however, gold is likely to return to put pressure on the lows given the imminent interest rate rises.

Either way, watch for increased volatility in the gold markets later today thanks to the FOMC. The market will certainly scrutinize Yellen’s statement with a fine tooth comb and decide which side of the fence she is on. The lows are likely to be tested sooner or later, so it would pay to have a plan in place for how to play both scenarios.