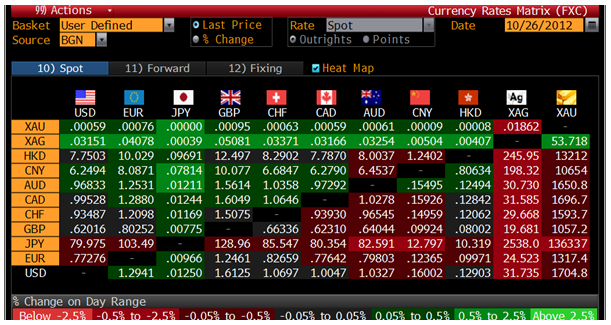

Today’s AM fix was USD 1,704.00, EUR 1,316.44, and GBP 1,057.01 per ounce.

Yesterday’s AM fix was USD 1,715.00, EUR 1,317.71, and GBP 1,063.24 per ounce.

Gold climbed $11.80 or 0.69% in New York yesterday and closed at $1,712.70. Silver surged to a high of $32.232 and finished with a gain of 1.36%. Gold edged down early Friday, on track for its third week of declines as the US dollar strengthened and momentum traders continued to exit positions or go short.

Gold edged down early Friday, on track for its third week of declines as the US dollar strengthened and momentum traders continued to exit positions or go short.

Investors and dealers await the US CFTC commitment of traders figures due at 1930 GMT, after last week's data showed hedge funds and other big speculators decreased their long positions in gold to their lowest since the end of August. This is bullish from a contrarian perspective and shows that much of the short term speculative froth has been removed from the market.

The US GDP figures are released later today and they are expected at 1.9%. A weaker than expected number would benefit safe haven gold.

Gold corrected in October as we anticipated and has fallen by 5.5% (in USD terms) from over $1,795.55/oz to a low of $1,699.65/oz It is too early to tell yet if the October correction is over. There would appear to be strong support at $1,700/oz and Asian physical demand is very robust down at these levels.

The physical bullion market was subdued in Asia overnight although there was some buying out of Japan. Trade was muted because of a public holiday in Indonesia, Malaysia and Singapore, but Reuters noted that dealers saw gold buying from Thailand.

Importantly, Chinese buying of gold, official and public, on dips is likely to be continuing.

Physical demand for gold bullion coins and bars in western markets remains subdued but smart money buyers continue to add to allocations. Gold and silver 1oz bullion coins from the Australian Lunar – 2013 Year of the Snake Coin Series are officially sold out at The Perth Mint. The sell out of the full mintages of 300,000 pure silver 1oz coins and 30,000 pure gold 1oz coins was achieved in just two months, ranking this release as one of the fastest selling behind the phenomenally successful Year of Dragon coins in 2012.

With gold having pierced slightly below $1,700/oz there is a risk that gold could fall to test the 200 and 100 day moving averages which are now at $1,663.30/oz and $1,664/oz respectively (see chart above).

A rise of over 1% today (from the current price of $1,705/oz) would result in a higher close this week, above $1,721.75/oz. This would be a good indicator that the recent dip is over and it is time to get into position for November, which is one of gold’s strongest months and the November to March rally which is one of gold's strongest periods. A lower close this week could see further falls next week and in early November.

As ever it will be nigh impossible to pinpoint the exact price lows.

The low of $1,699.65/oz seen two days ago on Wednesday may mark the intermediate low however gold could continue falling until October 31st (next Wednesday) as month ends often mark intermediate lows or could even continue falling until the US election or soon after.

There are now 6 trading days left until the US Presidential election on November 6th. The US election has many investors on the sidelines.

Gold will be supported by and likely see gains into yearend due to the coming uncertainty surrounding the US “fiscal cliff.” Tax increases and spending cuts are expected which would sink the US economy into a deep recession or Depression. If US Congress cannot agree on a deal by the end of the year it could have deleterious effects on the dollar and on capital markets.

The US elections themselves are unlikely to have a significant impact on currencies and wider markets in the short term but we expect the recent calm may recede and the stormy volatility of recent years may again be seen soon after the election when the reality of the appalling US fiscal and monetary situation is realised.

November is traditionally one of gold's strongest months (see gold seasonal charts).

Given the extremely bullish fundamentals due to negative fiscal outlooks, ultra loose monetary policies, negative real interest rates and global currency debasement, we expect this November and year end to be very positive for gold and particularly still undervalued silver.

Prudent buyers should now be buying this dip by cost averaging or getting into a position to do so. While gold may correct by another 2% or 3% from here, there is a greater likelihood of gold beginning to rise sharply and quickly recovering the 5.5% loss seen this month in November.

NEWSWIRE

(Bloomberg) -- Eclectica’s Hendry Says Owning Gold Stocks Almost ‘Insanity’

Hugh Hendry, founder of London-based hedge fund Eclectica Asset Management LLP, said buying shares of gold-mining companies is “as close as you get to insanity.”

Hendry said he owns gold and also has a short position on gold-mining stocks, meaning that he’s sold shares he’s borrowed with the expectation of buying them back at a lower price. Mining stocks are likely to fall because the companies are at greater risk as the price of gold rises, he said.

“More precarious societies across the world are more envious of your gold assets at $3,000 than at $300” an ounce, Hendry said today at the Economist magazine’s annual Buttonwood Gathering in New York. “There is no valuation argument that protects you against the risk of confiscation.”

The NYSE Arca Gold Bugs Index has risen about 0.6 percent this year, including reinvested dividends, while bullion climbed 9.2 percent.

“There is no rationale for owning a gold-mining equity,” Hendry said. “Think about it, if you were bullish on gold why didn’t you just buy a gold ETF, gold futures or gold bullion?”

Hendry started Eclectica in 2005 and the firm has $1.1 billion under management, according to its website.

(Bloomberg) -- LBMA Says Gold Trading Surged 26% in September as Silver Rose

Gold trading jumped 26 percent to an average of 22.4 million ounces a day in September compared with a month earlier, the London Bullion Market Association said today in an e-mailed report.

That was the highest average since August 2011, the LBMA said. Silver trading rose 4 percent to a daily average of 124.3 million ounces, the LBMA said.

GoldCore Special Offer - Perth Mint Gold Bars (1 oz) At Just 3.8% - ENDS TODAY!

We are offering increasingly popular Perth Mint gold bars (1 ounce) at an extremely low 3.8% premium finishing today, the 26th of October. The bars are LBMA approved and each bar is individually sealed in a tamper proof assay card featuring a unique serial number. The minimum order is 5 ounces and terms and conditions apply.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold To Rally Strongly In November After Expected October Correction

Published 10/26/2012, 07:36 AM

Updated 07/09/2023, 06:31 AM

Gold To Rally Strongly In November After Expected October Correction

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.