The key event of this week is the huge rally in gold that took it to new all-time highs.

New All-Time Highs

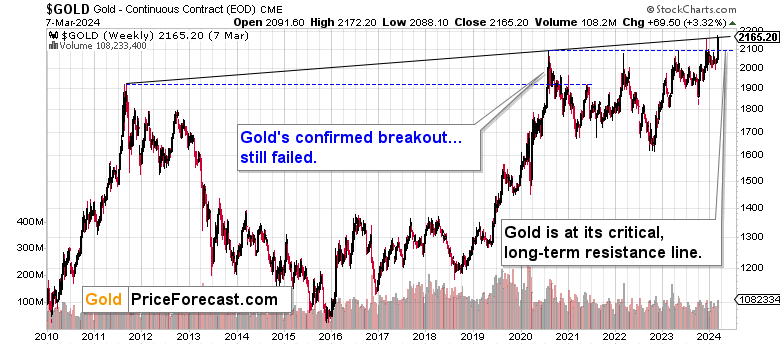

I’ll start with the long-term gold price chart.

Gold price is moving to new all-time highs after breaking above the 2020 high and confirming this breakout in terms of the daily closing prices. And yet, there’s something that still puts a huge question mark behind the “breakout”. It’s the realization of what happened when gold previously broke above its all-time high.

It was back in 2020 – gold was after a sharp upswing. It jumped visibly above its previous all-time high – the 2011 top. I marked it with a blue, dashed line. As you can see, back then gold moved more above its previous high than it did this week, it clearly confirmed this breakout in terms of the daily closing prices – rallying for nine trading days straight.

And then gold topped like nothing happened and started a decline that ended about 7 months later and over $400 lower.

Today is the sixth day after the breakout above the previous highs in terms of the closing prices – well within the analogy to the breakout above the 2011 top that was still followed by a huge decline.

This means that while we saw a confirmed breakout and this could be a game-changer for the medium-term outlook, the emphasis is still on “could”. The medium-term trend did not become bullish in my view just yet, especially because multiple other charts don’t support much higher gold prices.

Moreover, please note that gold moved to the rising, long-term resistance line based on the 2011 and 2020 tops. This could trigger a reversal without us having to wait for another four trading days for the top to form. Yes, gold moved above this line (and it’s even flirting with $2,200 at the moment of writing these words), but the move above this line is definitely not confirmed yet.

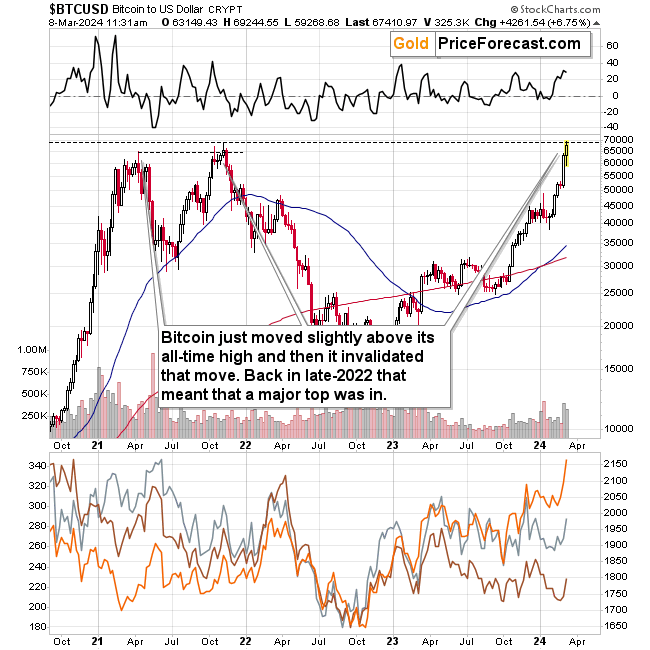

Another important thing that happened this week was a move to new highs in bitcoin and The subsequent invalidation of the breakout.

At times, cryptocurrencies like Bitcoin and Ethereum and the precious metals sector moved together. The 2022 tops were aligned, so it could be the case that gold reaching its rising long-term resistance line and bitcoin invalidating its breakout are connected on an emotional level as both anti-dollar assets are topping at the same time.

Will Gold Hold Its Highs?

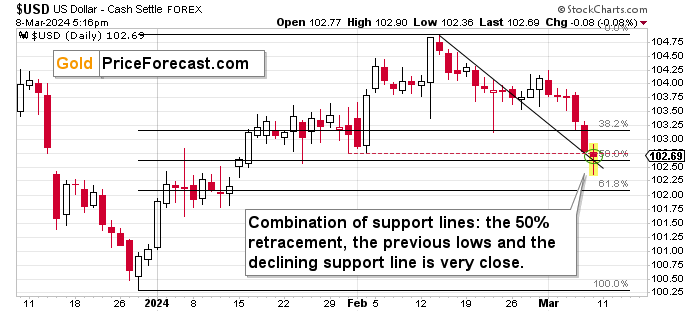

Speaking of the US dollar, it appears to have just bottomed slightly below the downside target.

Quoting my yesterday’s intraday Gold Trading Alert:

As the USD Index just moved below its late-Feb. low it can now decline even lower – how low? Quite likely to the 102.5 – 102.8 area. That’s where we have the following:

- the 50% Fibonacci retracement,

- the previous lows,

- and the declining support line that was broken in the final days of February.

Before anyone says that the rates might fall in the U.S. and this would make dollar decline, please note that the same thing is the case globally – the ECB just provided the same no-rate-cut-yet-but-sometime-in-the-future narrative. The USD Index is an index that is based on several currency exchange rates, so it’s value is driven by how well the U.S. currency does relative (!) to other currencies. If the situation is bad for the USD but it’s worse for other currencies, the USD Index would be likely to rally, because in relative terms, the USD would be a better choice.

Technically speaking, the USD Index has floor just below today’s lows, so its downside is likely limited. And it’s bottom and the subsequent rally might be the trigger that takes gold lower and that takes our short positions in junior mining stocks to their profit-take levels.

The USD Index just moved even slightly below my target area and now it’s back in it. It seems quite likely that the bottom for the USD Index was just formed.

Therefore, it could be the case that the gold price (that just moved slightly above $2,200) just as mining stocks just formed their local tops, especially that miners are clearly underperforming gold today. The euro is likely topping here as well.