- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gold Takes The Plunge

If any market was the talk overnight, it was certainly Gold markets. The pennant pattern finally broke and when it did as predicted in previous articles, it plummeted lower. With an easing of global tensions – especially in the Ukraine – there has been more much risk appetite out there, and risk aversion is certainly not on the lips of any traders and investors as of late.

Certainly the recent gold prices going higher, where in part led by unrest in the Ukraine, especially as Russia looked to contest parts of the Ukraine and annexation of Crimea – long seen as a sore point for Russia’s political elite. With the election of a new Ukrainian president, stability is now seeming assured for the struggling country, as well as its place in the EU in the future. As the current president is Euro leaning, and the majority of voters are as well.

The main driver for gold overnight was the release of US data, which saw massive positive movements in the US dollar. US durable goods showed a positive increase of 0.8%, compared to forecasts of -0.6%. Needless to say the market reaction was optimistic as a result. Consumer confidence also received a boost, which bodes well for the American economy in the lead up to Summer.

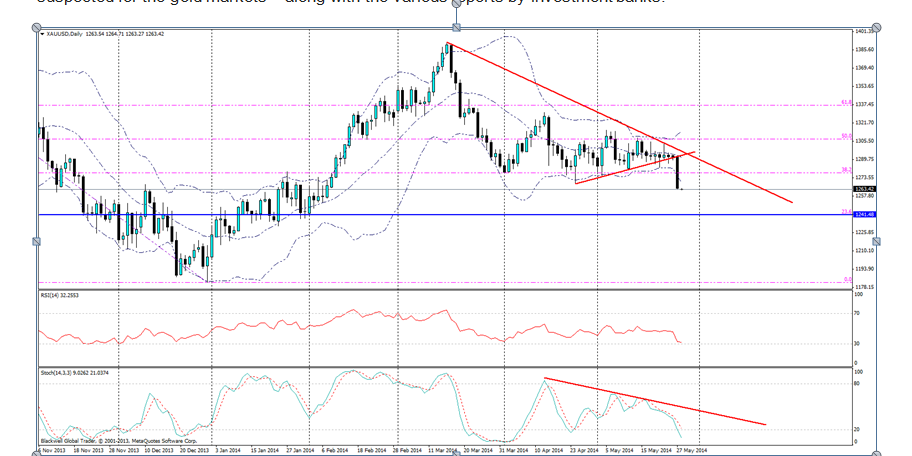

Technically speaking, it was ripe for some serious action, a tightening of Bollinger bands pointed to a big play by the markets, coupled with a strong pennant pattern and markets looking to test the lower boundary of the pattern. The stoch had also been in a downward trend for some time, and todays fall only confirmed what we already suspected for the gold markets – along with the various reports by investment banks.

What we can expect from gold in this case is some sort of minor pullback which almost looks certain after pushing out the Bollinger bands, market participants may indeed try and push it back up slightly in the short term. However, long term is all downhill, and markets would be folly to think otherwise in the current global climate.

I support this by pointing to the current breakout on the charts as well as the stoch slope which I have drawn, which shows that selling pressure and momentum are currently there and well supported for further movements lower. Additionally, GDP and jobless data are due out on Thursday, and we expect this to be relatively positive for US markets.

When target lows that are attainable in the medium term, certainly, the 23.6 fib level looks very attractive as a level of support. The price target of 1242.00 is a fair distance from the current fall, and markets have used this level as support on a number of occasions. Any further falls lower may be a little hard to crack and be rather far off in the current market climate.

Certainly, gold is looking extremely attractive as the bears take hold. While many still believe in gold for fundamental reasons (which can be questionable), you can’t argue with the technical and they are all pointing to the bears taking hold and pushing this lower. The US economy has arguably improved as well and markets are well poised to take advantage of this. The only concern I have over gold falling is volatility in equity markets and the VIX rising, but this may just be a hangover effect from the end of tapering.

Related Articles

President Trump has had success bringing down oil prices by sheer force of will and keeping traders off balance. Perhaps the biggest success has a lot to do with not only...

Will WTI crude oil hit 67.00 key level? MACD and stochastics indicate further losses WTI crude oil futures dived below the long-term descending trend line again, meeting the...

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.