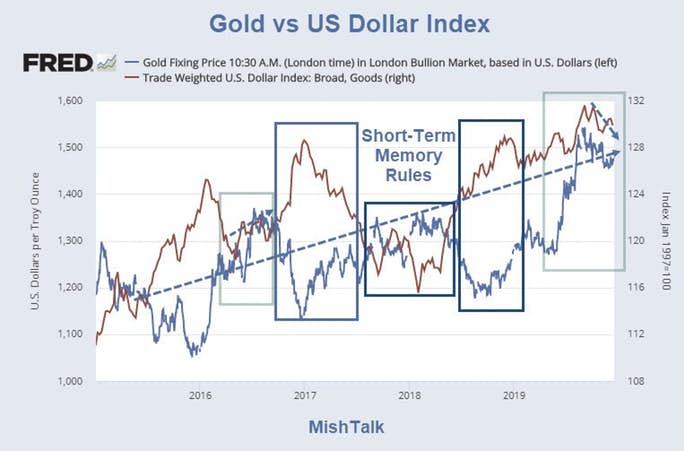

Since 2015, gold has been correlated to the U.S. dollar. What's next?

Most of the time, gold is inversely correlated to the U.S. dollar.

The problem with such analysis is that frequency does not mean amplitude.

The above chart proves that point.

Tweet Inspiration

Gold Eagle

That Gold Eagle Tweet inspired this post.

My chart seems contradictory. And I set out disagree.

Ironically, upon further investigation, I believe Gold Eagle is correct, for now.

I am working on some additional charts and fundamentals to explain why.

For now, let's just say it's important to understand that movements in the dollar do not explain movements in gold.

If dollar movements explained gold, the gold would not be at $1480.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.