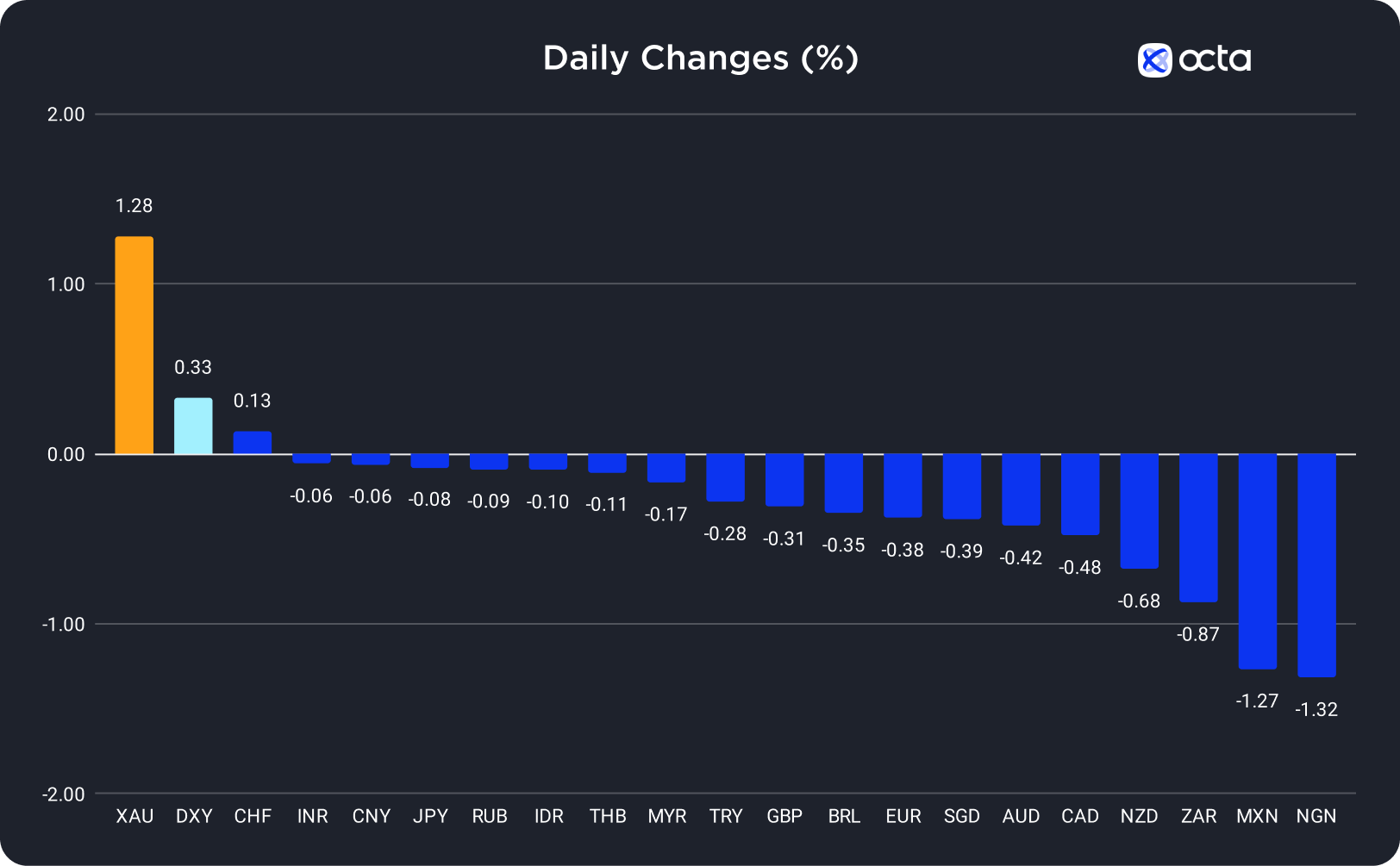

On Wednesday, the US dollar was the best-performing currency among the 20 global currencies we track, while the Nigerian naira (NGN) showed the weakest results. The Indian rupee (INR) was the leader among emerging markets, while the New Zealand dollar (NZD) underperformed among majors.

Gold Reached a 2.5-Month High

The gold price surged by over 1.2% and reached a multi-month high on Wednesday, as rising tensions in the Middle East made the safe-haven metal more appealing to traders.

The gold price rose above 1,950 after the summit with Arab leaders and the U.S. President in Jordan was canceled after a Gaza hospital blast.

"Gold could breach 2,000 in the near term if there is an escalation of geopolitical conflict. Additionally, having the Fed pause rate increases or hint at a lower probability of increases in the future would be viewed positively," said Ryan McIntyre, the senior portfolio manager at Sprott Asset Management.

However, XAU/USD will almost certainly fall sharply if the Middle East tensions ease. Also, the U.S. Treasury yield has reached a 16-year high, putting more bearish pressure on the precious metal.

XAU/USD was rising slightly during the Asian and early European trading sessions. Today, it's important to monitor the speech of the Federal Reserve (Fed) Chair Jerome Powell at 4:00 p.m. UTC. He may clarify the U.S. interest rate trajectory following recent dovish statements from multiple Fed representatives. It will negatively affect gold prices if Powell says they're ready to continue hiking rates or leave the base rate elevated for longer. However, statements downplaying inflation risks will bolster the gold price.

"Spot gold is expected to retest a resistance of 1,964 USD per ounce, a break above which could lead to a gain into the 1,972–1,985 range," said Reuters analyst Wang Tao.

The Euro Remains in a Downtrend

The euro (EUR) lost 0.38% on Wednesday as the difference between 2-year German bonds and U.S. Treasury yields reached the most negative rate since August, while safe-haven flows boosted the US dollar.

Growing Middle East tensions and concerns about high U.S. bond yields have pushed markets into a strong risk-off sentiment. The potential escalation of the Israel-Hamas conflict and its impact on energy supplies is a significant concern for eurozone countries as they rely more heavily on energy imports than the U.S. However, the divergence between the eurozone and the U.S. monetary policies may not last long as the Federal Reserve (Fed) policymakers have been signaling a pause in rate hikes.

EUR/USD was essentially unchanged during the Asian and early European sessions. Today, traders should focus on two events: the U.S. Jobless Claims at 12:30 p.m. UTC and the Fed Chair Jerome Powell's speech at 4:00 p.m. UTC. Higher-than-expected Jobless Claims figures may push the EUR/USD price above 1.05600. However, the bearish trend in the pair will deepen if the figures come out lower than expected. Meanwhile, Powell could offer more clues on the U.S. interest rate outlook.