The bulk of the price discovery process for gold relates to savvy Western commercial traders keying off physical market demand versus mine and scrap supply.

Another big factor is real interest rates. What about Western economic reports like jobs and inflation? Well, they produce lots of short-term volatility but have little big picture importance.

Chinese and Indian players want more say in the process, but to get it, they need to entice Western commercial traders to focus less on London and New York and more on the markets in China and India.

Work is underway to do that now, but it’s likely going to take 10 more years to fully accomplish in China, and probably another 20 for India.

The weekly close chart. While supreme currency gold is overbought technically (basis Stochastics and RSI), falling real rates, central bank purchases, the Chinese fear trade, and the massive Indian import tax cut are all big fundamentals in play.

The bottom line is that these oscillators will eventually become oversold, and gold will see a significant pullback in the price. Whether that happens now or from above $3000 is unknown…

It’s clear that these outrageously bullish fundamentals favour significantly higher prices first.

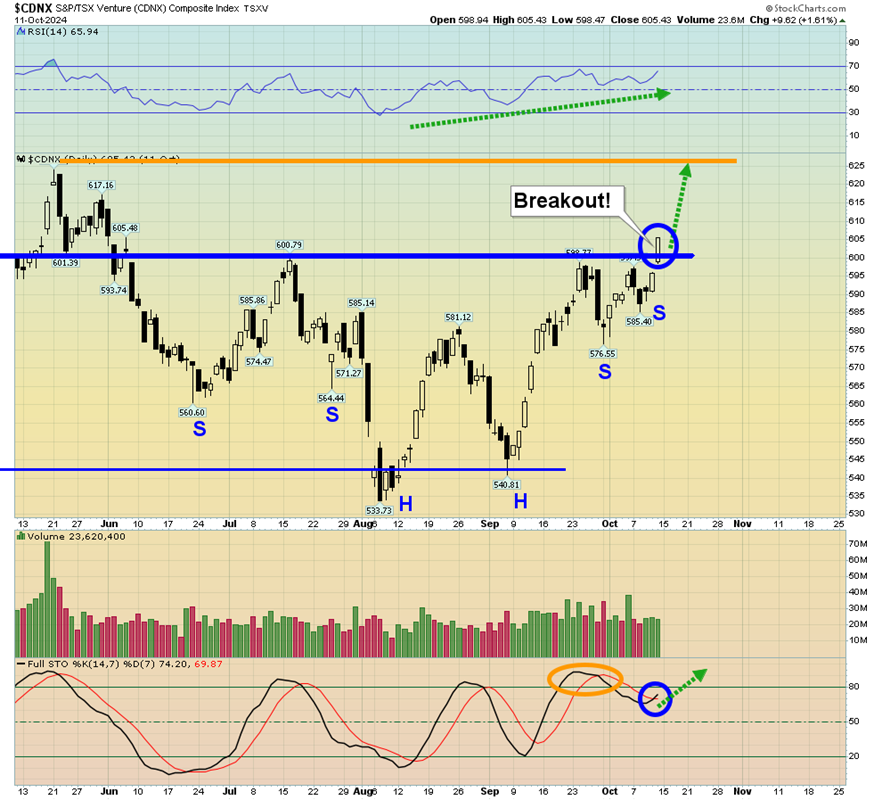

The daily chart is in perfect sync with these fundamentals. The price is breaking upside from of a bullish rectangular drift. Stochastics and RSI are both at the 50 zone… which is the momentum launchpad zone.

Some analysts are claiming that most Western gold bugs sold out of their holdings in the area of my buy zone of $1810 in October 2023, and they have missed the entire move higher in gold. Is that true?

I’ll suggest the answer is a very firm… No! For some insight on what has actually transpired for many Western gold bugs since October 2023. The simple fact is that many Western gold bugs are Americans with a bit of “cowboy” spirit, which means they have an affinity to the adventure of junior mine stock investing.

Junior miners have not participated to the degree that the seniors have in this big move up for gold… but these investors need to be given a lot more credit for their mental toughness than they are getting.

My interaction with many of them has made it crystal clear to me that most of them didn’t sell out. They took a mental hit and withstood it. They are just waiting for their time in the sun… and the good news is that it’s starting now!

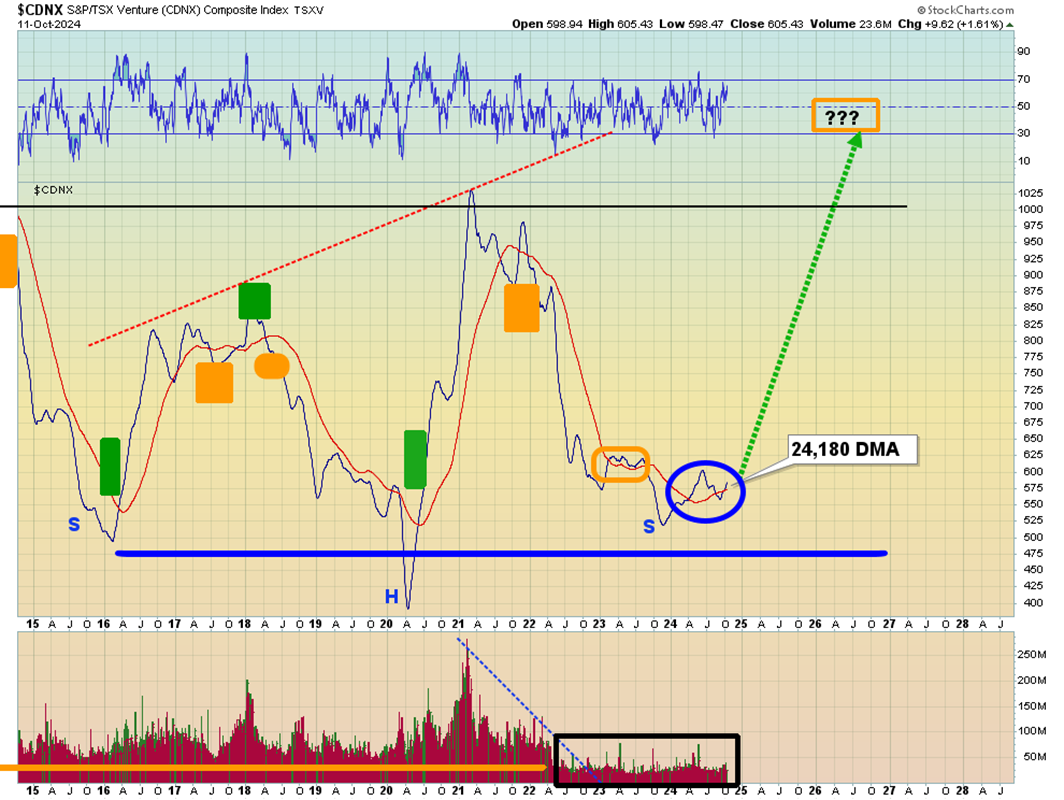

My 24,180 DMA is now flashing a “confirming” crossover buy signal for the CDNX, and doing it in the latter part (right shoulder) of a huge inverse H&S bottom pattern.

This medium-term chart looks spectacular, and what’s particularly exciting is that it confirms the action of the moving averages and big right shoulder on the long-term charts!

Many gold bugs have no interest in junior mine stock investing, but they should note that a massive bull run (starting now?) for CDNX stocks would almost certainly be accompanied with an equally fabulous bull run for the seniors, for silver, and a continued run for gold itself.

The wildly bullish launchpad for junior mining stocks may also be in sync with an Elliott C wave rally for senior mining stocks.

That C wave rally that has barely started and could continue into the year 2027 and maybe into 2028.

The flag-like drifting rectangle for bitcoin is likely ending and a glorious rally is about to begin. It’s highly unlikely that bitcoin roars higher while real rates fall… and gold falls or oozes sideways against fiat. The bottom line:

No gold bug needs to own crypto, but all should note that it’s another confirming indicator for the bullish action of junior, intermediate, and senior mining stocks.

The weekly GDX chart. The loose inverse H&S action targets the 2011 highs of about $60.

The C&H pattern also targets $60, and the handle formation could take some time… or it could be sharp, short, and almost finished now!

The daily GDX versus gold chart. A bullish symmetrical triangle is in play. The positive technical news for gold and silver mining stocks seems almost limitless. Can there be any more?

A look at GDX versus US fiat money on a daily chart. The current upturn on Stochastics (14,7,7 series) looks like it was sculpted by Michelangelo. It hints that a surge through the $40-$43 zone of importance is about to occur. In a nutshell, this is an obvious time of glory, for gold, silver, and mine stock bugs of the world!