After nearly reaching an all-time high, Gold is correcting and consolidating. It needs some time to digest the recent surge before attempting to break to a new all-time high.

Since Gold is correcting and declined more than $150/oz, we can assume the miners, juniors, and silver stocks are lagging as they typically do.

Wrong!

The gold stocks (and silver stocks) are outperforming Gold during this correction.

There is quite a lot of evidence.

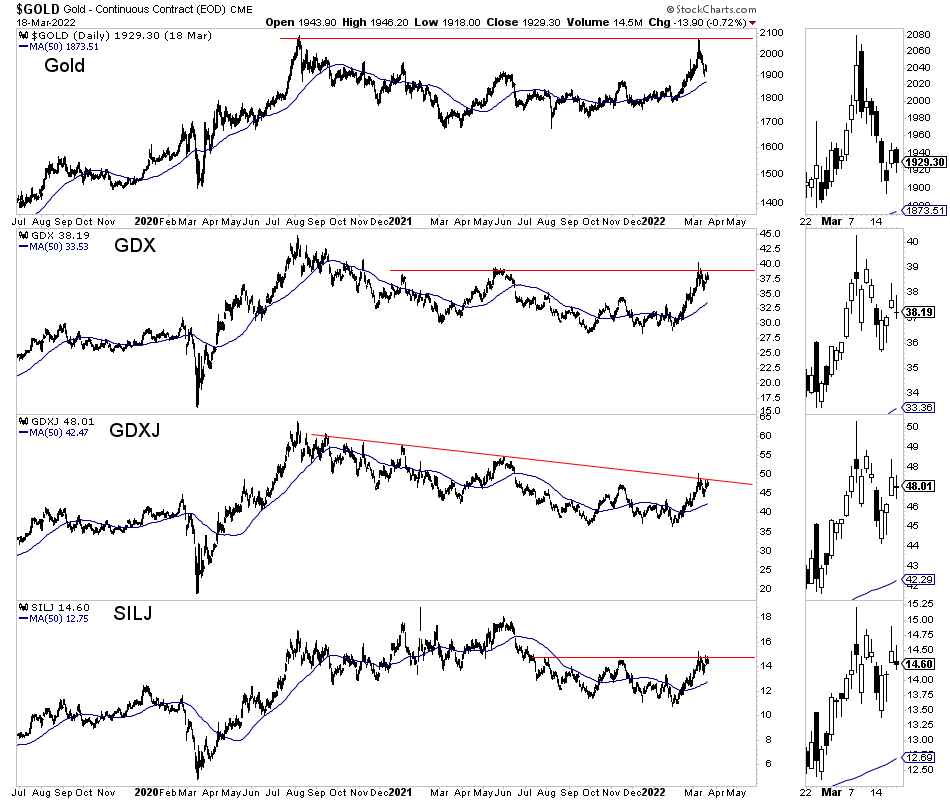

First, Gold filled its gap from March 1, when it declined below $1908. The VanEck Gold Miners ETF (NYSE:GDX), VanEck Junior Gold Miners ETF (NYSE:GDXJ), and the ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ) did not fill their respective gaps from March 1.

Second, take a look at the individual daily candles over the past eight days. Gold has six days with black candles (which can signal distribution), while the miners only have two.

Finally, Gold has retraced 62% of the surge from the January low. The miners only retraced 38%.

As I explained last week, Gold is in a very bullish setup with the potential to explode higher after the current correction.

Given that potential, one should not be surprised to see relative strength in the miners. They are sniffing out what is to come over the months ahead.

If you have followed my work, you understand that I prefer to be conservative, reasonable, and contrarian against many that promote Gold and Silver with fanaticism.

Now is not the time for any of that.

A super bullish setup is in place, and this market could go vertical after this correction.