Over the past two weeks, gold stocks have surged more than 20% as the awful jobs report forced the bears to capitulate. That strong of a move in a brief amount of time will naturally slow or correct. Furthermore, gold stocks touched resistance Friday morning which led to a bearish reversal. While the bullish trend remains intact, the odds favor lower prices in the days ahead.

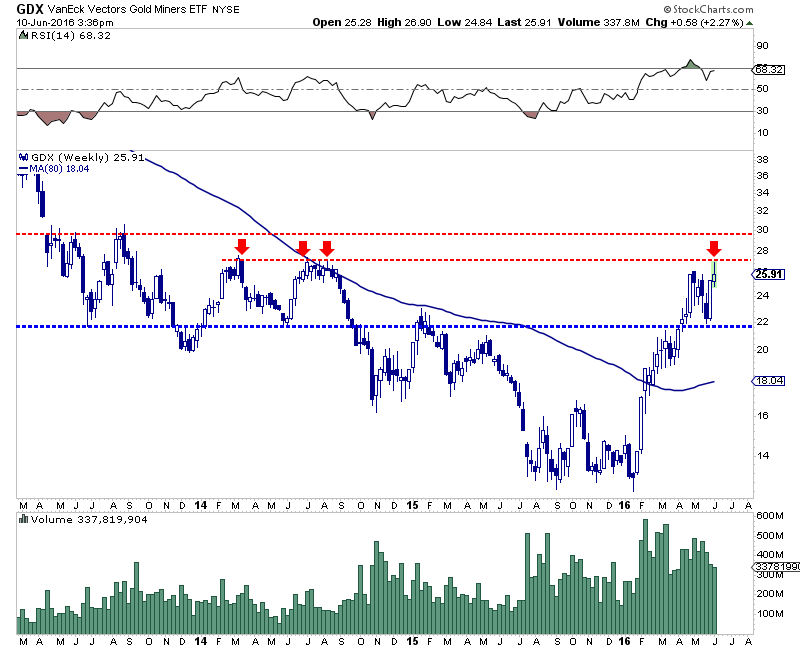

The weekly chart below shows that VanEck Vectors Gold Miners (NYSE:GDX) ticked resistance near $27 yet closed off the highs of the week. That is not a surprise considering the market tested resistance amid a very overbought condition. It was unlikely to crack resistance on the first try.

GDX Weekly

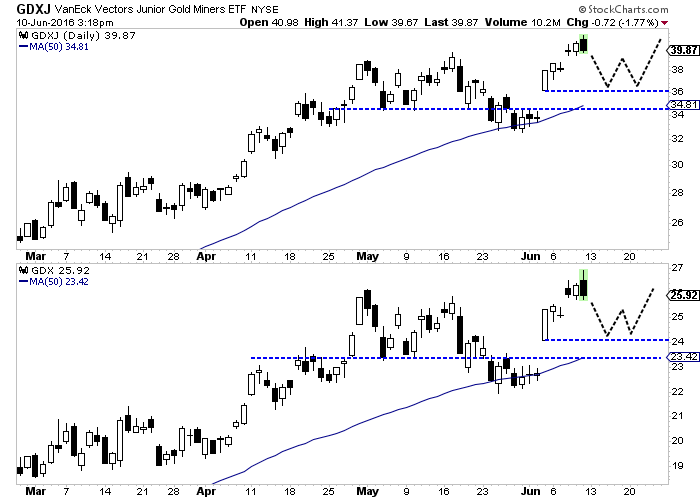

We zoom in on the short term by looking at daily candle charts for both GDX (bottom) and VanEck Vectors Junior Gold Miners (NYSE:GDXJ). The miners pushed to higher highs but formed a bearish reversal on Friday. I expect Wednesday’s gap to fill and the miners to potentially test last Friday’s opening prices (GDXJ $36 and GDX $24). We sketch how the correction could evolve with the presumption of a bullish outcome.

GDXJ, GDX Daily Candles

Buying opportunities within this sector have been few and far between and that could remain the case for the time being. However, if the miners correct here as expected, then we should get a minor buying opportunity in the days ahead. If GDXJ tests $37 that would mark a 10% decline.

Buying +10% weakness has been a profitable, lower risk strategy and we think that will continue to be the case.