After surging sharply in August and early September, gold stocks have been consolidating sideways ever since. Naturally this loss of momentum has sapped the nascent trader enthusiasm for this sector. But stalling out temporarily certainly doesn’t negate gold stocks’ dazzling fundamentals. They remain deeply undervalued relative to gold, the metal that drives their profits and hence ultimately their stock prices.

While sentiment (greed and fear) dominates short-term stock-price swings, over the long run stock prices are nearly exclusively determined by fundamentals. Investors buy stocks to own fractional stakes in the underlying companies’ profit streams. The bigger those profits grow, the higher the stocks are bid of the companies earning them. And for gold stocks, the gold price controls the vast majority of profitability.

Unlike most other companies, gold miners effectively have infinite demand for their product. They can easily sell every single ounce of gold they manage to produce. They never have to discount, the market price is what they get. And with mining costs largely fixed, higher gold prices flow directly into bottom-line profits. And because of these fixed costs, profits rise much faster than the underlying gains in gold.

This profits leverage is easy to understand. Imagine a miner selling gold today for $1700 that it produced for $700. Its profit is $1000 per ounce. But if gold rises 25% to $2125, profits would surge to $1425 since production costs are essentially fixed as mines are planned and built. That’s a 43% increase in profits driven by a 25% gold rally! This profits-leverage growth is more exponential than linear as gold climbs.

But the great opportunities in gold stocks today are not due to this future potential, but a colossal past disconnect. Thanks to the incredible damage 2008’s epic stock panic wreaked on sentiment, gold stocks have been heavily neglected in recent years. Thus they are trading as if gold was far lower than today’s prevailing prices. But this glaring fundamental anomaly won’t last forever, stock prices will reflect profits.

The flagship gold-stock index these days is the NYSE Arca Gold BUGS Index, better known by its symbol HUI (“huey”). This past week with gold near $1775, the HUI was trading near 500. The first time the HUI hit 500 was back in March 2008, when gold had just achieved $985 for the first time ever. Even though prevailing gold prices are 80% higher now, the gold stocks are trading as if gold was still under $1000. This is madness.

Not surprisingly, gold-stock valuations reflect this. Back in late June I updated my decade-long thread on gold-stock valuations. The elite component stocks of the HUI, the lion’s share of the world’s gold miners, were trading at their lowest valuations of their entire secular bull. At 12.0x earnings, they were far cheaper than the benchmark S&P 500’s 17.8x. Gold stocks have somehow become value investments.

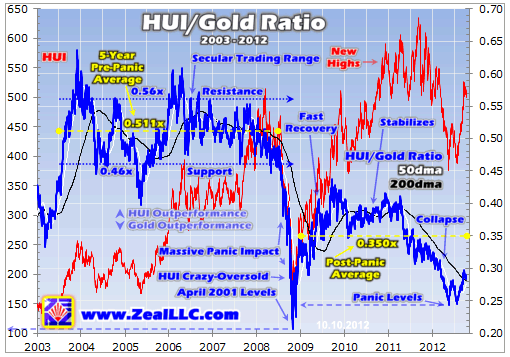

But my favorite way to illustrate this fundamental disconnect is with the venerable HUI/Gold Ratio. The HGR is exactly what it sounds like, the daily HUI close divided by the daily gold close. When charted over time, this ratio reveals the relative performance of gold stocks compared to the metal that drives their profits and hence ultimately their stock prices. The HGR is rendered in these charts in blue.

Prior to that epic discontinuity sparked by 2008’s once-in-a-century stock panic, the HGR spent 5 years meandering in a tight secular trading range. This ran from roughly 0.46x on the low side to 0.56x on the high side. This range is the baseline normal relationship for gold-stock prices relative to gold in the absence of the brutal psychological aftermath of the panic. Without that event, these levels would have persisted.

Because the HUI is the numerator of this ratio, a rising HGR indicates the gold stocks are outperforming gold. Usually this means gold stocks are rising faster during a major gold rally. Occasionally traders got so excited about gold stocks that they greedily bid them above the HGR’s 0.56x resistance for a brief spell. This last happened in early 2006, a euphoric time when gold stocks were just rocketing higher.

And the opposite is also true, a falling HGR indicates gold is outperforming the gold stocks. Prior to the panic, this typically meant the gold stocks were falling faster than gold during major gold corrections. Only once in those pre-panic years did gold stocks slump so deeply out of favor that the HGR’s 0.46x support was temporarily broken. Provocatively that was just before that massive 2006 HUI upleg.

On average during those 5 pre-panic years ending in mid-2008, the HGR ran 0.511x. In other words, the HUI tended to trade at just above half the level of the gold price. A 5-year span is a long time, absolutely secular. This encompassed nearly all possible sentiment environments, from rampant greed late in major uplegs to crippling fear late in major corrections. 0.511x is the long-term normal baseline HGR.

But of course the crazy stock panic changed everything. That insane fear superstorm drove gigantic and unprecedented demand for the US dollar as a global safe haven. Thus the US Dollar Index soared in its biggest and fastest rally ever. So naturally gold took a big hit, plunging 27.2% at worst between July and November 2008. But the gold stocks fared far worse, the HUI plummeting 67.7% over a similar span.

With gold stocks dropping far faster than gold, the HGR entered a sickening free fall. By the time fear peaked and it finally bottomed, it was trading at April 2001 levels. That was when this secular gold bull was born, so gold stocks were acting as if gold’s bull never even existed. Though most traders were blinded by fear, this anomaly was an incredible buying opportunity. So we aggressively bought then.

And indeed the HGR started surging dramatically after the panic, the beaten-down and left-for-dead gold stocks were rallying far faster than gold. But as I’ll dig into in the next chart, this recovery soon stalled. The gold stocks were still rallying, but merely pacing gold. And since late 2011, the HGR has again collapsed. Incredibly, gold stocks were recently back at panic levels relative to gold this past summer.

The stark contrast between pre-panic and post-panic gold-stock valuations compared to the metal that drives their profits is amazing. Before the panic, the HUI averaged 0.511x the price of gold for 5 years running. Since the panic, this average HGR has plunged to 0.350x. So gold stocks have been nearly a third less valuable relative to gold in this post-panic era than they were in the normal times before it.

The critical question for speculators and investors to consider is why did this happen? Since gold stocks’ conventional valuations based on profitability were recently as cheap as they’ve been in this entire secular bull, the answer has to be psychology. The stock panic was so scary that it frightened a sizable fraction of pre-panic gold-stock investors into abandoning this sector and never coming back.

Being in the newsletter business, I received countless capitulation e-mails in late 2008 and early 2009. Speculators and investors were foolishly extrapolating the extreme anomaly of the stock panic forward indefinitely, so they sold near the panic lows to safeguard the dwindling remnant of their capital. And after selling at the worst-possible point in this entire secular bull, they are too demoralized to ever return.

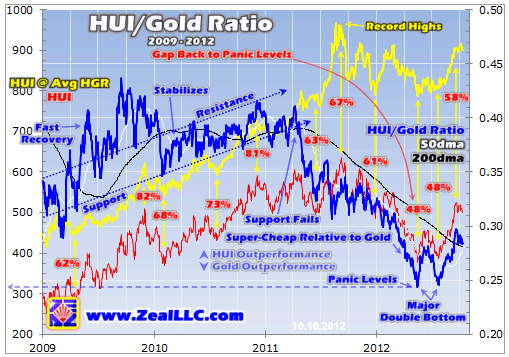

This next chart zooms in to the result of this wholesale abandonment of gold stocks, the dark post-panic era. In addition to the HGR in blue and the HUI itself in red, a third series is shown in yellow. It is where the HUI would hypothetically be trading if it returned to its pre-panic average of 0.511x the price of gold. The massive gap between these normal HGR levels and today’s is the huge opportunity in gold stocks.

In the first year or so after the stock panic, the gold stocks’ recovery relative to gold was indeed fast as expected. But it stalled out and stabilized between late 2009 and early 2011. Though gold stocks continued to rally nicely, they merely paced the gains in gold. Still, much lost ground was made up. The actual HUI recovered to 81% of where it would have been at a 0.511x HGR, compared to just 41% in the depths of the panic.

But in mid-2011, an unfortunate chain of events began that ultimately led us into today’s morass. After achieving new all-time highs in early April 2011, the HUI started consolidating. But gold kept on advancing, powering 8.7% higher that month to the HUI’s 3.4%. This gold outperformance broke the HGR below its post-panic uptrend’s support line, and really started to damage gold-stock psychology again.

With gold stocks failing to follow gold to new all-time highs, traders began to wonder if they were broken. There was all kinds of talk, even on CNBC, of gold being a way superior investment to the far-riskier gold stocks. And if gold stocks can’t leverage gold’s gains, that idea would certainly be correct. But everyone was forgetting the HUI had just rallied 300% since the panic lows compared to gold’s own 120% advance.

And with these gold-stocks-are-dead ideas fresh in everyone’s minds, the 2011 summer doldrums arrived right on schedule. So gold, silver, and the HUI drifted sideways to lower as usual. But then in July, an extraordinary event transpired. With mere weeks to go until the US Treasury’s deadline, it looked like Obama and the Congress weren’t going to reach a deal on raising the US’s statutory debt ceiling in time.

With the risk of the first-ever US default on its sovereign debt looming large, gold demand soared. No one knew what would happen, and how it would impact the usual safe havens of the US dollar and US Treasuries. So gold blasted 8.3% higher in July 2011, something utterly unprecedented in this bull. And the HUI only gained 4.2%, as gold stocks will never be as safe as gold. So the gold-stock hate ballooned.

A crappy weak compromise deal narrowly averted the US debt default, but it resulted in Standard & Poor’s downgrading Washington’s debt for the first time in history. So the stock markets plunged in early August 2011, igniting even more safe-haven gold demand. So gold soared another 16.5% in the first few weeks of that month, and again the gold stocks couldn’t keep pace as evidenced by the HUI’s parallel 11.3% gain.

So the HGR drifted lower and lower on these extraordinary events. But unfortunately euphoria was creeping into gold, its unprecedented summer rally catapulting it to very-overbought levels. So it soon corrected, dragging the gold stocks down with it. Even though they didn’t really participate in its US-debt-default-scare rally, they were still sold off in the aftermath. Gold stocks fell ever more deeply out of favor.

The remaining pre-panic speculators and investors had had enough, they started exiting en masse. Whenever CNBC talked about gold, the focus was usually on how terrible gold stocks were and how stupid it was to buy them instead of gold itself. All this negative sentiment fed on itself in early 2012, ultimately culminating in a stunning gold-stock capitulation in mid-May. It was an utter bloodbath.

Such extreme pessimistic, bearish, and fearful sentiment forced the HGR back to panic levels! The HUI was only trading at 48% of where it ought to be compared to the pre-panic average HGR. Relative to gold, the gold stocks were nearly as loathed as they were during 2008’s crazy stock panic. And relative to their conventional valuations (P/E ratios), gold stocks became considerably cheaper than during the panic.

Of course bottoming in May just before the summer doldrums wasn’t a great time, as gold, silver, and their miners tend to merely grind sideways through June, July, and August. So the HGR slumped to a secondary low in late July. Hardly anyone wanted anything to do with gold stocks, despite their incredible cheapness. I wrote about this extensively this past summer, and we loaded up on cheap gold stocks.

And indeed since then the gold stocks have amplified the gains in gold’s young new upleg. After carving a major double-bottom in May and July, the HGR surged back above its 200dma last month for the first time since early 2011. Although they remain dirt-cheap relative to gold, gold stocks are slowly starting to return to favor again. Even the discussions on CNBC finally recently began extolling their virtues!

The odds are overwhelming that the huge HGR slump greatly exacerbated by the US-debt-default scare was an anomaly, an unsustainable sentiment extreme. It was a perfect storm to breed incredible fear and pessimism in this sector. And after the only two other comparable episodes, mid-2005 and late 2008, the HUI soared dramatically in its biggest uplegs of its entire secular bull. Extreme fear sparks extreme rallies.

Fundamentals always trump psychology in the long run. The gold miners are making profits hand over fist at recent gold levels, driving this sector deep into value-investment territory. Eventually new investors inevitably take notice of extreme values in any sector, and then capital floods in to buy the cheap profit streams. This bids the stocks higher, forcing the irrational fear suffered at the lows to rapidly abate.

And this very process is already underway. Between late July and mid-September, the HGR surged from 0.245x to 0.297x. This is the strongest HGR rally seen since mid-2009 just after the panic. And the HGR’s last major breakout above a sharply-downward-sloping 200dma was also last witnessed in that same timeframe. Remember that was early in the post-panic gold-stock recovery that led the HUI to quadruple!

Though I really doubt the HUI will quadruple again in this new upleg, its potential gains are still massive even from this week’s 500 levels. Even if you are a raging gold-stock pessimist, it isn’t a stretch to think gold stocks will return to their post-panic-average HGR of 0.350x. Assuming gold merely stays flat, this implies we are due for a gold-stock rally approaching 25% in the coming months. That’s not bad at all.

Maybe you are a little less fatalistic on this ridiculously cheap sector with fantastic fundamentals. What if gold stocks rally so strongly that they regain enough favor to challenge their best post-panic levels relative to gold? At late 2009’s 0.430x HGR, the HUI would have to surge over 50% from this week’s levels. And once again this is assuming gold itself doesn’t rally during its usual strong season.

Personally I have no doubt the pre-panic-average HGR of 0.511x will eventually be regained. Silver was once in a similar situation, hopelessly below its pre-panic-average levels compared to gold. And traders gave up on it too. Yet in late 2010 and early 2011 it greatly returned to favor, and so much capital flooded in that it temporarily surged way above even its best pre-panic levels! Mean reversions often wildly overshoot.

At a flat gold price and a 0.511x HGR, the HUI would need to power over 80% above this week’s levels. It would not surprise me at all if this happens by next spring, as we are still early in the strongest season of the year for gold, silver, and the PM stocks. And the assumption that gold will merely stay flat throughout it is pretty darned silly. On the Fed’s new open-ended QE3 campaign alone, a 25% gold rally is likely.

If gold rallies 25% between now and its usual spring peak, obviously the HUI’s upside targets at various HGR levels grow considerably. That would take gold near $2200, meaning a post-panic-average HGR of 0.350x would imply coming gold-stock gains around 55%. And returning to the pre-panic-average HGR of 0.511x takes the target upleg above 125% gains! Gold stocks’ potential from here is simply vast.

And the same is true of silver and the silver stocks, since they too key off of gold’s performance. We’ve been buying silver stocks too. The bottom line is gold stocks remain anomalously cheap relative to gold. A perfect storm of adverse psychology drove gold stocks back down to panic levels compared to the metal they mine. But after that unsustainable fear extreme this past summer, gold stocks are already starting to return to favor. Sentiment is reversing as they’ve rapidly regained ground relative to the product which drives their profits.

But this long-overdue period of gold-stock outperformance is just getting started. Similar fear extremes earlier in this secular bull ignited its biggest and most-exciting uplegs. Couple this with the highly favorable seasonals between now and spring, and the Fed’s new unlimited inflation campaign, and gold stocks ought to soar in the months ahead. Join us and get deployed now before the next surge higher.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Stocks Remain Cheap Relative To Gold

Published 10/14/2012, 03:45 AM

Updated 07/09/2023, 06:31 AM

Gold Stocks Remain Cheap Relative To Gold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.