Welcome to the dog days of summer. The low volatility in precious metals continues. Janet Yellen or some other Fed heads said something Friday. Precious Metals sold off but quickly recovered. It appears that not much has transpired in recent weeks as precious metals have been grinding higher, albeit slowly. However, while it may be a fledgling development, the miners appear to be leading gold now.

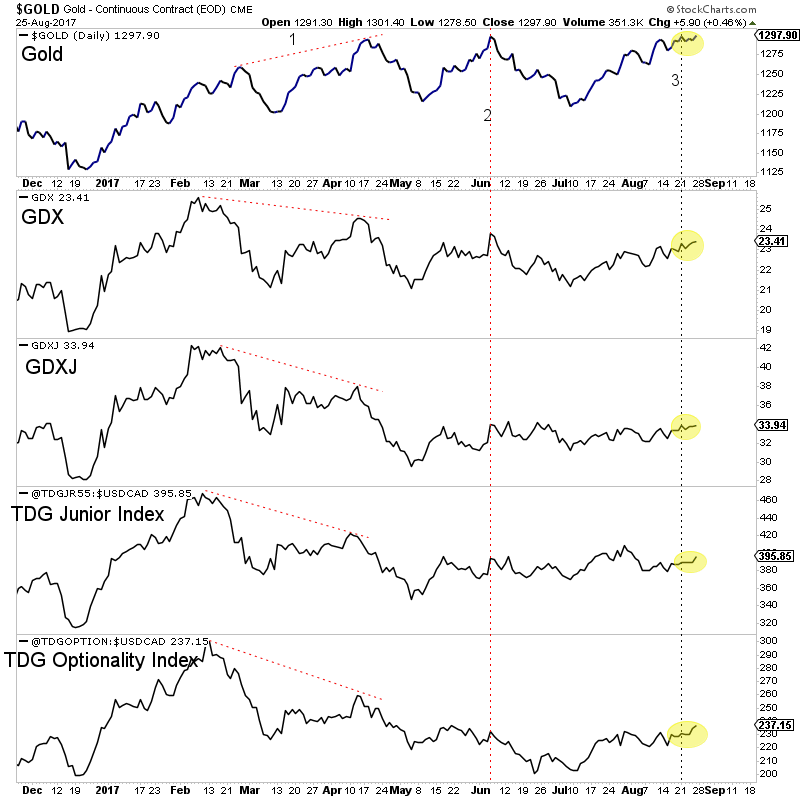

In the chart below we plot a number of markets including gold, VanEck Vectors gold Miners ETF (NYSE:GDX), VanEck Vectors Junior gold Miners (NYSE:GDXJ), our 55-stock junior index and our optionality index. We marked three points that help inform our analysis.

From point 1 to point 3, the gold stocks went from underperforming gold to slightly leading gold. The gold stocks began to underperform in late winter. They peaked in February and did not even come close to reaching those highs in March while gold made a higher high. Gold retested that high at point 2 in June while miners made another lower high. However, there has been a change from then to point 3. Gold is at the same level at point 3 as point 2 but so are the miners! Furthermore, in recent days (since point 3) the gold stocks have made higher highs while gold has not.

The most important recent development in precious metals could be the renewed relative strength in the gold stocks. Volatility has been very low and gold has yet to break $1300/oz but the gold stocks have managed to reverse their previous underperformance. They were lagging badly from late winter through spring.

Ratio charts (not shown) show that the underperformance ended in May and the outperformance began only days ago. If that holds up into September and gold breaks above $1300/oz then the gold stocks could enjoy strong gains over the weeks ahead.