Is it really a bull era for gold?

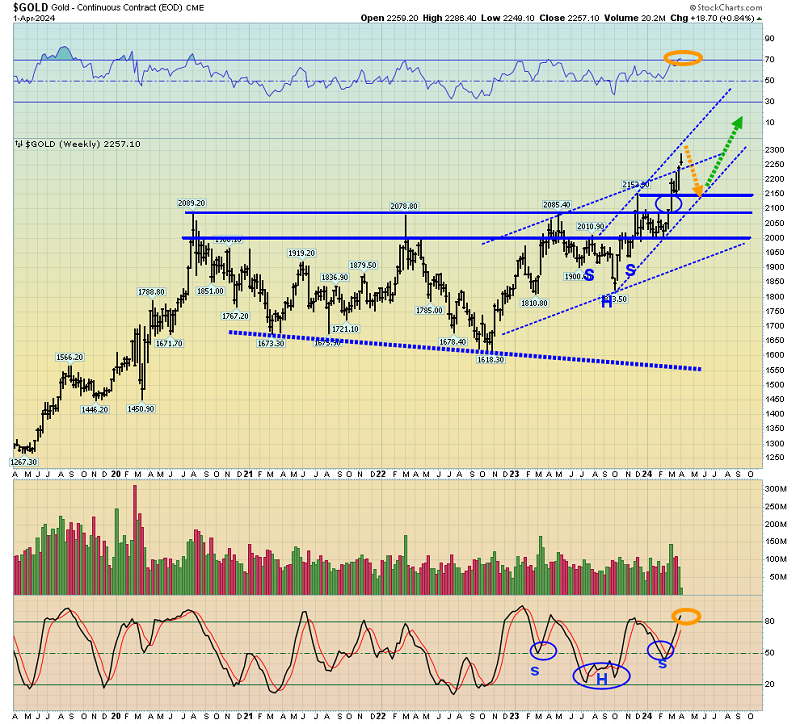

The key weekly gold price chart. The breakout over $2100 has been fuelled by global central bank and aggressive Chinese citizen buying, as well as commercial traders working on the COMEX and LBMA.

The “rocket ride” to $2265 has defined $2150 as a new buy zone for investors.

Ray Dalio is a man who possesses great insight and common sense.

Flashy headlines like, “We’ll hold China down with tariff taxes!” and “Taiwan is about freedom and we’re ready for war!” while these feel-good mantras can convince fiat and debt-oriented Americans who failed to serve that there is no gold bull era

The stark truth is that the gold bull era is only modestly related by the rise to “empire status” of Chinese and Indian governments. It’s mainly about the economic rise of the average gold-oriented citizen in China and India.

Modest exposure to the undervalued Chinese stock market is something for Western gold bugs to consider, but most bugs are focused on gold and silver mining stocks rather than any of the world’s stock markets.

Over the next few years, as the gold stocks stage a dramatic outperformance against gold (and against everything), gold bugs will be proven wise with their bold decision.

The good news is that Chinese citizens buy gold in fear when their stock market falls (as it has in recent years), and they buy even more gold when it rises as it’s seemingly poised to do right now.

The FXI (The Chinese equivalent of the Dow in America) has a huge base pattern on the weekly chart. The $20 lows could be tested (with gold pulling back to $2150), but a move over $25 likely ends the bearish trend and a new bull begins.

It’s a sweet spot for Chinese stock market investors and for Western mining stock enthusiasts too.

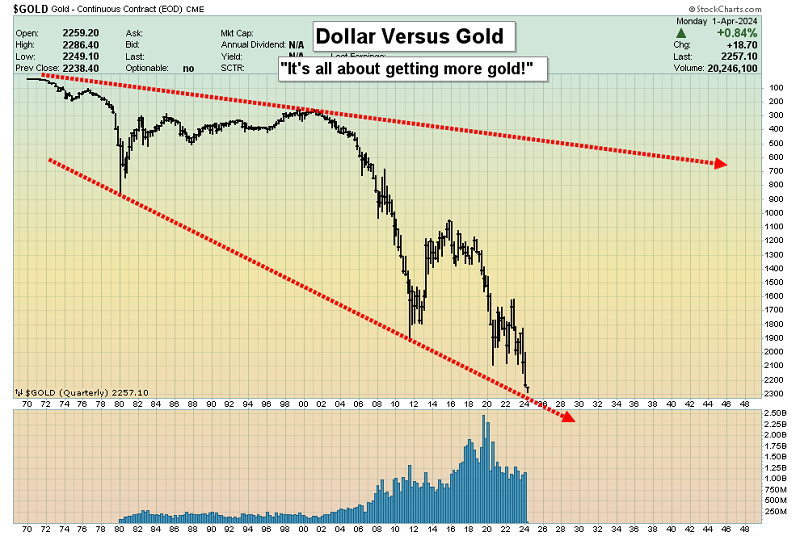

Many investors in the West have mistakenly spent their investing careers trying to get more fiat instead of more gold. This chart shows their folly with stunning clarity.

As the collapse of US fiat versus gold intensifies in the coming decade, millions of Americans will realize the gravity of their error, and begin to focus on gold.

To get more gold, an investor needs to get more fiat first. There are a number of tools available to do that, and to view one of them

As the gold bull era intensifies, a lot of copper is going to be required, and copper stocks can be a long-term hold in addition to functioning as a medium-term tool to get more fiat to use to buy more gold.

The XLE oil stocks ETF chart. A massive bull triangle breakout is in play. As with the copper stocks, there is an opportunity for both long-term investors and those simply seeking a short-term profit that can be parlayed into more gold.

The key round number of $100 sits just above the current XLE price area, and for oil itself the previous highs of $93 could put a short-term cap on the oil investing fun.

The summer driving season (and the time when wars can be launched or intensified) lies just ahead. Given the enormity of the bull triangle, any pullback should be mild and function as a spectacular buying opportunity.

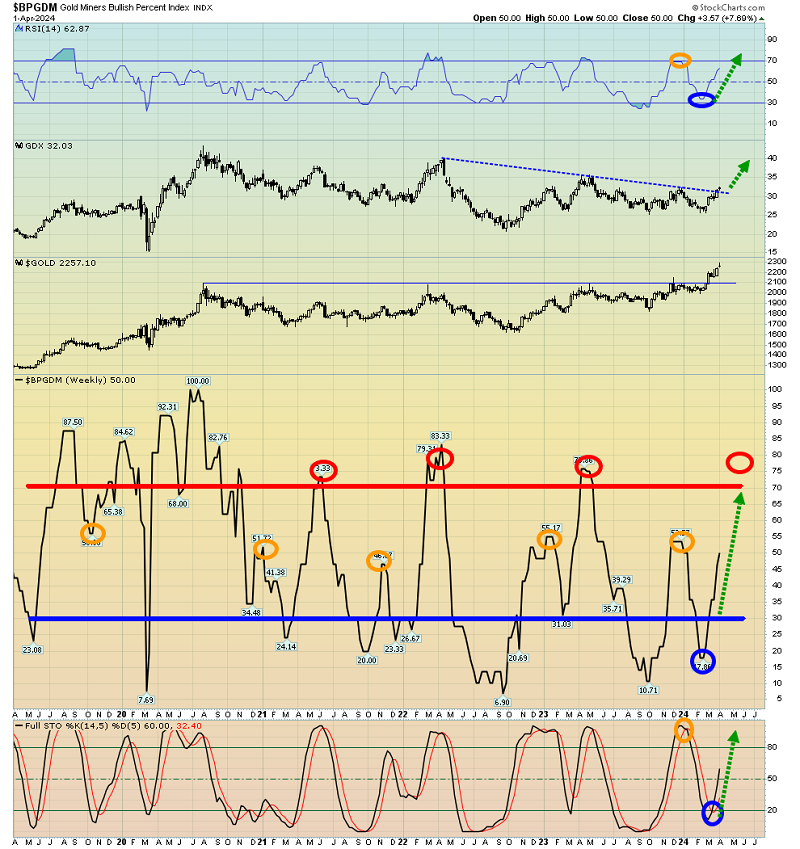

What about gold stocks? Well, words alone can barely describe the awesomeness of the current action. Opera music may be required to do full justice to the charts.

The GDX versus gold chart. It’s obviously one of the most spectacular base patterns in the history of markets. Note the stunning Stochastics buy signal in play at what is likely the right shoulder low.

Most of the emails I’m getting right now are “emails of concern”. Gold stock investors are stunned by the upside action and they are worried it could end. Their sentiment is one of the reasons the rally isn’t set to end and is likely to intensify!

Note that while the BPGDM has peaked in the 50 zone in the past, that typically only happens when my 14,5,5 weekly chart Stochastics oscillator is overbought. It’s on a fabulous buy signal right now.

A pause is normal after a barnburner rally like this one, but the miners are only in the basing zone of what should be several years of truly dramatic outperformance versus everything!