- As the banking storm wreaked havoc in March, even Warren Buffett's company suffered losses, with six of Buffett's 15 biggest losses being in the financial sector

- Gold and gold stocks are attractive investment options during this time of economic uncertainty and inflation

- In addition to gold, Franco-Nevada Corporation and Royal Gold are two gold-related stocks worth considering as potential investments

The current banking crisis has hit even the biggest names in finance, with Warren Buffett's company bearing losses of $12.5 billion. Six of Buffett's 15 biggest losses this year are in the financial sector. In a period of 10 days, from March 6 to 15, the market capitalization of banks fell by 11.5%.

In this challenging situation, it's essential to remain calm and consider potentially exciting markets. Gold and gold stocks are definitely an option, considering the yellow metal's appeal as safe haven amid the banking crisis in Europe and the US.

There are several reasons gold could continue to shine this year:

- In times of economic uncertainty, investors tend to shift from buying stocks to buying gold as a safe haven asset.

- With inflation higher than usual, investors may also buy gold to protect their capital and minimize the consequent loss of purchasing power due to the rising cost of living.

- Gold benefits when the dollar weakens due to the inverse relationship between the two assets. If the dollar strengthens, the price of gold tends to suffer, and vice versa.

- China is the world's largest buyer of gold. As the country's economy recovers, demand for gold will likely increase, potentially driving up its price.

On January 12, when I first discussed the potential benefits of investing in gold, gold futures opened at $1,879.70. Since then, prices have risen to $2,014.90 and climbed above $2,000 for the first time in over a year, increasing by 6.5% in the past week.

However, while you can definitely profit by investing in the yellow metal, there are other ways you can profit from rising gold prices; by investing in gold stocks. Here are two gold-related stocks worth considering:

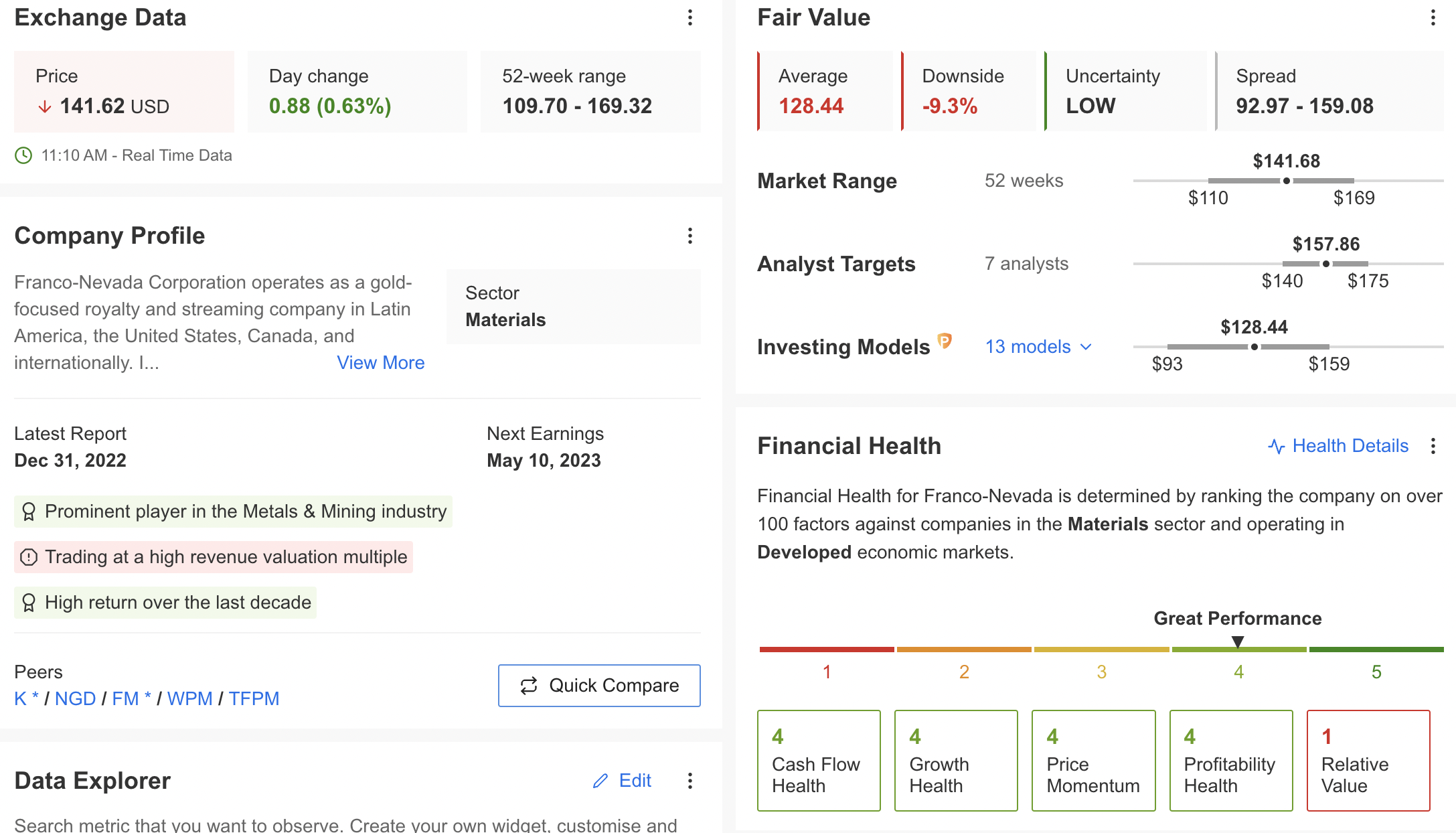

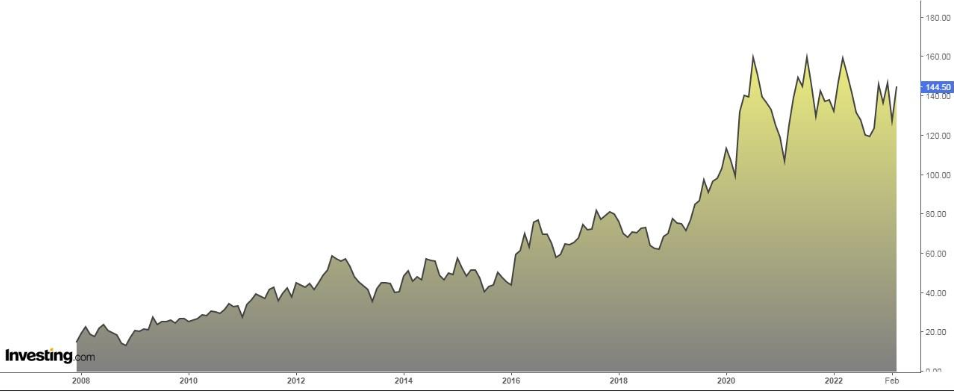

1. Franco-Nevada Corporation

Franco-Nevada Corporation (NYSE:FNV) was founded by a Canadian who discovered that the best way to make money was through mining royalties, i.e., the right to receive a percentage of a gold mine's production.

Source: Investing Pro

It is listed on the New York and the Canadian Stock Exchange under the symbol FNV. Over the past 20 years, it has outperformed almost all other investments.

Its quarterly results are due on May 10, and earnings per share are expected to be $0.84 per share. A break above $150.92 would imply continued bullish strength.

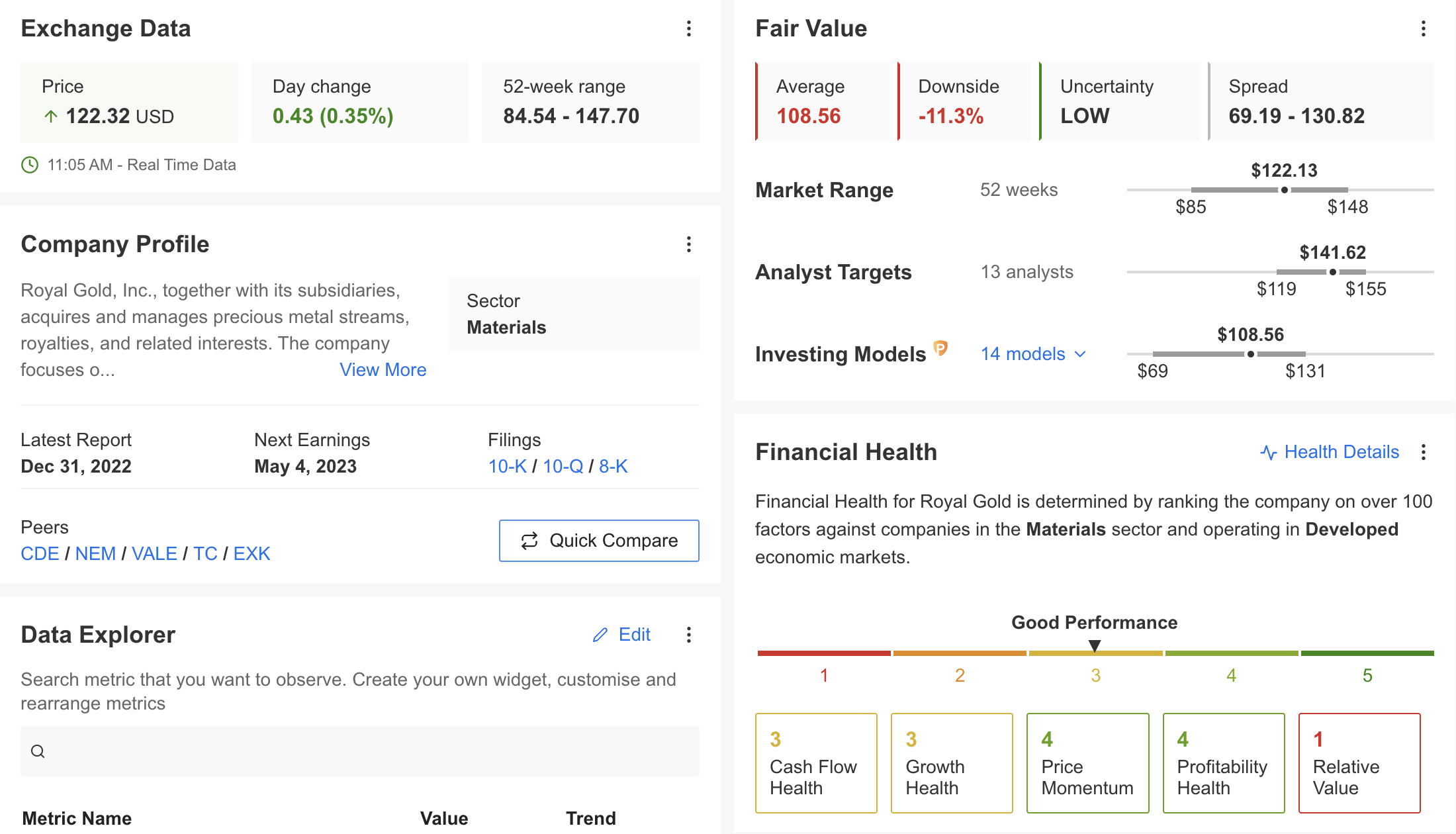

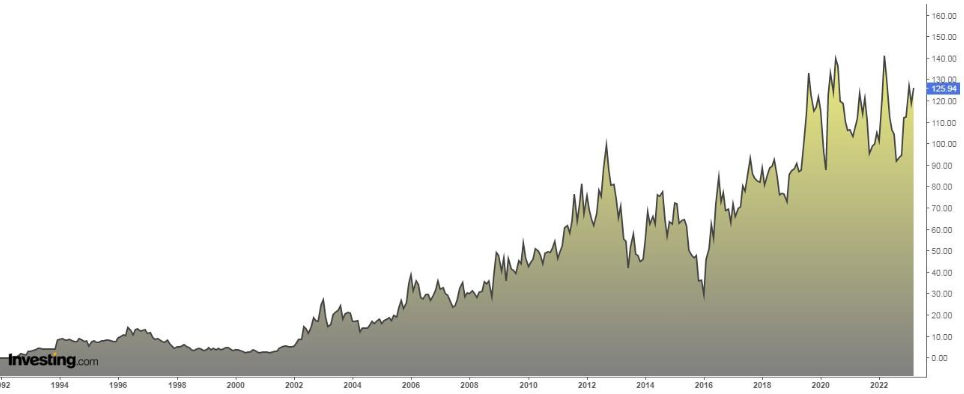

2. Royal Gold

Based in Denver, Royal Gold (NASDAQ:RGLD) was established in 1986 and started as an oil and gas exploration company. In 1987, the company shifted its focus to gold royalties, and it was then that investors started to make large profits.

Source: Investing Pro

It is listed on the Nasdaq with the ticker RGLD. It pays a dividend on April 21. And to be entitled to receive it, you must own shares before April 5. It will pay out $0.3750 per share.

On May 4, it will report its quarterly results and expected earnings per share of $0.89 per share. A break above $131.43 would imply continued bullish strength.

Gold's next target would be at $2060-2076, coinciding with significant resistance in that price area. Remember to keep an eye on the gold market in the coming weeks and months, as it may continue to offer opportunities to jump on the bandwagon.

***

Disclosure: The author does not own any of the securities mentioned.