The German government is in the news, and the news is macabre. This looks like something out of an Orwell novel.

Debt reform… is now defined as taking on even more debt than the ludicrous amounts that governments already have.

The obvious question for all citizens of the world: Got gold?

Income and tariff taxes are a form of piracy, with government pirates targeting citizen and corporate booty. On April 2, the world’s consumers and corporations likely get pounded with another huge round of tariff taxes from America’s most exciting pirate, “Captain Redbeard”, creating more inflation, more consumer concern, and more earnings downgrades for a myriad of companies, both domestically and around the world.

US stock markets have taken a big hit as the piracy intensifies. Basis the CAPE ratio for the SP500, the US stock market is still more overvalued than at the 1929 peak… even after the latest swoon.

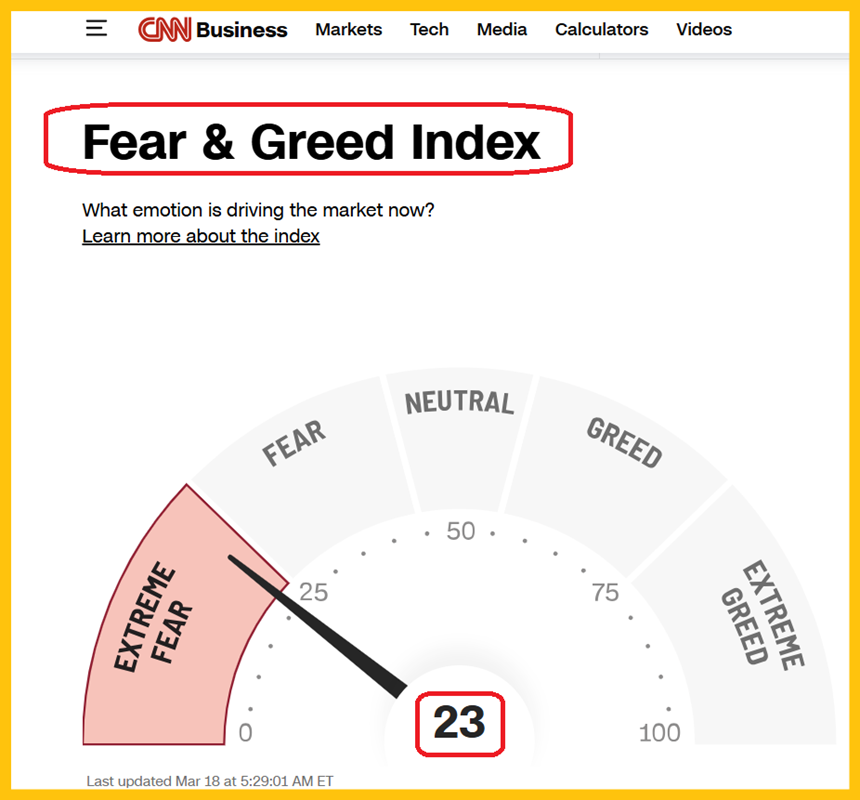

The average investor is terrified but… is the market really going to crash? Likely yes, but incredibly, it may not happen until after a rally to new all-time highs.

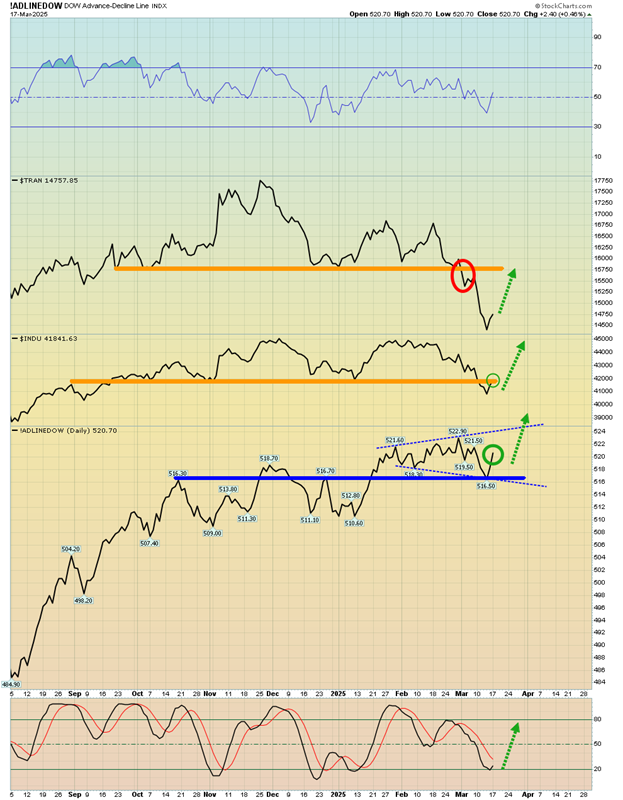

The key advance/decline (A/D) chart for the Dow. It’s bouncing from support and seems set to surge to a new high while the Dow itself has recovered and moved back above the 42,000 “line in the sand” that it broke.

Note the broadening action of the A/D. This type of action occurs when a market is out of control. Clearly, investors don’t care if stagflation is imminent or if earnings are going into the tank. All they care about is buying every new stock market high, and they are doing it with huge gobs of their net worth.

They believe the Fed will cut rates, so stagflation and recession don’t matter. They may be in for a very nasty surprise, as Jay Powell begins to look more like Paul Volker, and it could happen as early as May. This is becoming a situation like 1929 on steroids.

The fantastic iShares China Large-Cap ETF (NYSE:FXI) Chart. I’ve urged stock market investors to focus here rather than on the bloated US market but…

Many gold bugs have no interest in any stock market, regardless of the valuation. For them, it’s still a good idea to watch the Chinese stock market because a fall in that market triggers massive Chinese gambler buying of gold futures.

A rise in Chinese stocks triggers enormous amounts of celebratory buying of physical gold. The bottom line: All dramatic Chinese stock market action is win-win for gold bugs.

The number of reasons that gold is the world’s greatest asset is essentially infinite. All investors should be obsessed with getting as much gold as they can, but what about the miners and silver?

Note the caption about gold stocks. For the past several months, I’ve suggested that most gold bugs may be underestimating the amount of institutional money that could pour into the miners as the world gets carpet bombed with tariff taxes.

In the 1970s, American stock markets tumbled. Gold stocks soared as that occurred, because money managers sold traditional stocks and invested in the miners. They did that because of stagflation.

The awesome VanEck Junior Gold Miners ETF (NYSE:GDXJ) chart. The inverse H&S target is at least $85, and arguably $100.

Note the fabulous action of the key TRIX indicator at the bottom of the chart. The most bullish chart action occurs when Stochastics and RSI are overbought, and the TRIX flashes a signal to buy, and that’s exactly what’s happening now.

The CDNX is also poised for a significant upside breakout. The bottom line: The US stock market is poised for at least a repeat of the 1970s, and it could be ready for a crash with breadlines that are worse than what happened in 1929. Gold stocks are poised to get an ongoing institutional tidal wave of capital… and should stage veritable moon shots as the stagflation-themed stock market meltdown and ensuing gulag occurs.

The GDX (NYSE:GDX) daily chart. The inverse H&S action can be viewed in a number of ways… all of them bullish.

A look at the truly spectacular weekly chart. I urged all gold stock investors to make careful note of the rare and ultra-bullish inside-the-cup handle on this epic C&H pattern.

I asked gamblers to buy aggressively and many did.

What about silver? There was some H&S top risk, but I predicted that would be overwhelmed, and that has occurred. There’s now a beautiful ascending triangle in play, targeting a nice price of $44.

A look at the miners, the stunning Amplify Junior Silver Miners ETF (NYSE:SILJ) chart. Silver was quiet yesterday, while silver stocks staged fabulous breakouts. This is happening because most US money managers can’t buy bullion.

They can only buy equities, and as their outrageously overvalued mainstream stocks get carpet bombed with President Redbeard’s tariff taxes, the only question silver stock investors need to be asking themselves is, can they handle $30 SILJ? I’ll suggest they can, but only if they have their space helmets on.