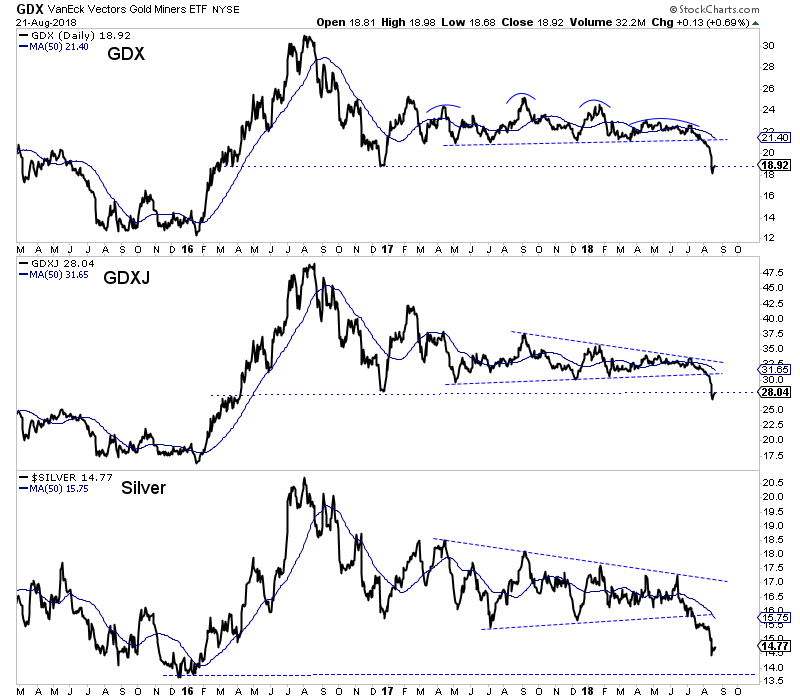

Last week the VanEck Vectors Gold Miners ETF (NYSE:GDX) and the VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) were down almost 12% at their lows on Thursday. Since then, they’ve recovered but only a tiny fraction of recent losses.

The crash did result in the miners reaching an extreme oversold condition while trading around long-term support at their December 2016 lows. It was the perfect setup for shorts to cover. That combination often results in at least a relief rally.

While a rally is underway, where it goes from here remains to be seen. One thing to keep in mind, the recent decline was the result of a technical breakdown that followed months and months of consolidation. It’s extremely unlikely to immediately reverse course.

With that said, let’s keep in mind the measured downside targets. For GDX, the downside target is $16.50-$17.00. For GDXJ, it’s $23-$24 and for silver it is $12.70-$13.10.

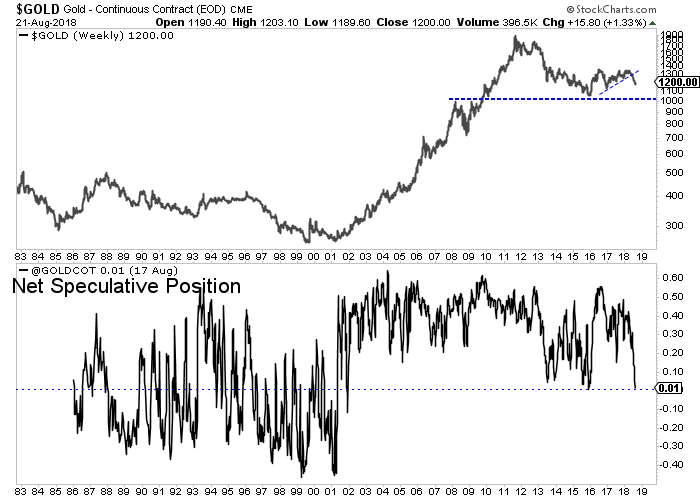

On the sentiment front we should note that gold’s net speculative position reached 1.5% of open interest. That is the second lowest reading in the past 17 years. Does that mean this is December 2015 or 2001 for gold?

Do note that sentiment was at a similar level twice in 2013 and gold trended lower after a rebound. Moreover, look at what happened in the 1980s and 1990s:

With the net speculative position already down to 1.5%, it figures to go negative if gold is going to test its low at $1040/oz or even $1000/oz. If you think sentiment cannot get worse, think again.

Ultimately, its not sentiment or technicals that will decide a major bottom but rather fundamentals. After studying decades of history as well as the current market environment, we became convinced that precious metals will not begin a bull market until the Federal Reserve is done hiking rates.

Consider the following.

Over the past 60 years, in 10 of the last 12 rate hike cycles gold stocks saw an average gain of 185% with a minimum gain of 54%. The advance began on average one month and a median of two months after the Fed Funds rate peaked.

The precious metals sector is currently extremely oversold and a relief rally is underway. It should last at least a few more weeks and maybe a few months. However, the primary trend is down and there are downside targets that are even lower. Our plan is to let the rally run its course and when the time is right, go short again.